The Australian benchmark index S&P/ASX200 was trading at 6571, down by 19.3 points (as on 13 August 2019, AEST 3:54 PM).

In this article, we would discuss the recently declared FY 19 results of HiTech Group, annual report of Korvest, Kelly Partners Groupâs revised forecasts for FY 19 period, LogiCamms acquisition of OSD Pty Limited and Namoi Cottonâs appointment of a new CEO along with the FY 19 performance.

Letâs have a look at the five ASX listed stocks and their recent updates:

HiTech Group Australia Limited

Strong Performance in FY 19:

HiTech Group Australia Limited (ASX: HIT) released FY2019 report for the period ended 30 June 2019 on 12 August 2019. For the FY 19 period it has reported 13% growth in the NPAT to $2,898,316 over the previous corresponding period (pcp). Further, during the time frame it has delivered 15% growth in the operating revenue to $30,284,662, 9% rise in the gross profit to $5,777,819 and an 10% increase in EBITDA to $4,089,810 over pcp. During FY 19, there has been 1% increase in the cash & cash equivalents to $5,927,690 compared to FY 18. The company has also declared a fully franked final dividend of 4 cents per share, which it would pay on 12 September 2019. For fiscal year 2020, the companyâs performance would depend upon demand & supply for ICT talent and services, which the company is currently receiving good demand.

Source: Companyâs Report

On 13 August 2019, HITâs stock was trading at A$1.195, down by 0.417 percent (at AEST 2:39 PM).

Korvest Limited

Suspended the Dividend Reinvestment Plan (DRP) for the final dividend:

On 30 June 2019, Korvest Limited (ASX: KOV) had released annual report for the period ended 30 June 2019, on 26 July 2019 and has reported the net profit after tax of $2.9m versus $1.4m in FY 19, which means that the companyâs profit has more than doubled during FY 19 period. The company has posted 6.8% increase in the revenue of the company in FY 19 to $60.8 million. The increase in the profit & revenue of KOV in the period was on the back of increase in the volume and margin in number of markets. Further, the company for FY 19 had declared the fully franked final dividend of 13 cents per share versus the final dividend of 7 cents per share in FY 18, which would be payable by 6 September 2019. The company has suspended the Dividend Reinvestment Plan (DRP) for the final dividend.

On the outlook front, since the company had experienced a strong momentum in the infrastructure sector from the past two years, it now intends to capitalise this opportunity driven by multiple major road and rail projects that is planned to be constructed over the next few years. Therefore, the company plans to invest in enhancing the manufacturing capability and capacity significantly in fiscal 2020.

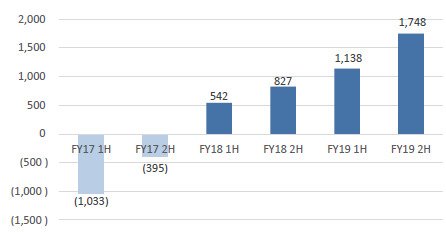

Profit After Tax Performance (Source: Companyâs Report)

On 13 August 2019, KOVâs stock was trading at A$3.520, down by 0.283 percent (at AEST 2:56 PM).

Kelly Partners Group Holdings Limited

FY 19 Forecast & Strategic Steps:

As announced on 14 June 2019, Kelly Partners Group Holdings Limited (ASX:KPG) for period ending 30 June 2019 had declared a fully franked dividend of AU1.1 cent per share.

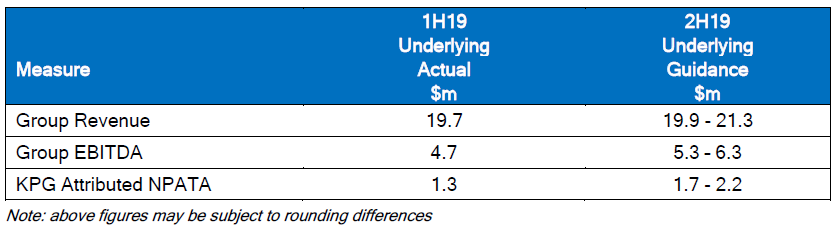

Further, as per the trading update on 29 May 2019, for FY 19 period, the company has revised the forecast downwards for both topline & bottom line. For FY 19, the company now expects the Group Revenue to be in the range of $39.6 million to $41.5 million compared to the previous guidance expected to be of $41.2 million. The company now expects the Attributed NPATA to be in the range of $3.0 million to $3.5 million, down compared to the previous guidance of $4.3 million. The company anticipates 2019 Group EBITDA to be in the range of $10 million to $11 million. Moreover, KPG has integrated four accounting firms that the company has recently acquired in North Sydney, Inner West, Northern Beaches and Oran Park. The company has integrated the full management of Sydney CBD business after the two year earn-out period that had ended at 31 December 2018. The company has implemented the newly configured IT platform and has suspended the proposed increase in the remuneration for all Directors.

FY 19 Guidance (Source: Companyâs Report)

On 13 August 2019, KPGâs stock was trading flat at A$0.9 (at AEST 3:35 PM).

LogiCamms Limited

Acquired OSD Pty Limited:

On 28 June 2019, LogiCamms Limited (ASX: LCM) has concluded the acquisition of OSD Pty Limited, which as per the Pro forma forecast for FY19 would result in the revenue of ~$120m, Normalised EBITDAI of $6.7m and the company, as at January 2019 had work-in-hand of $57m.

The company, in the Investor Presentation, released on 23 May 2019 had stated that the integration plan, was projected to reduce the corporate and local operations costs of approximately $3 million per annum within one year of completion of acquisition by leveraging the shared service functions. Further, as per the companyâs integration plan the company intends to secure long-term financing facilities that have lower Debt/EBITDA ratios. The company plans to identify and promotes cross-selling of the products to each companyâs existing client base. It will now pursue to secure larger contracts on the back of stronger balance sheet and with the expansion of engineering capability. The company plans to consolidate both the companyâs resources and to improve its utilization and the implementation of key OSD management systems for the replacement of outdated LCM systems.

LCMâs stock last traded on 12 August 2019, at a price of A$0.19.

Namoi Cotton Ltd

Appointment of CEO & Weak Performance in FY 19:

Namoi Cotton Ltd (ASX: NAM) has recently notified on 30 July 2019 that it had hired Mr Michael Renehan as NAMâs new CEO. He would begin his duty on 1 September 2019.

Also, on 26 July 2019, the company in FY 19 results had reported the consolidated net loss after tax from continuing operations of $556,000 compared to a net profit of $6,769,000 in FY 18. Namoi Cotton has posted the 2019 consolidated net profit before tax of $124,000 compared to $9,674,000 in FY 18. However, the company has generated the positive cash flows from operating activities to $21,029,000 versus $17,317,000 in 2018.

As a result, the company has decided not to pay a final dividend for the full year 2019. Moreover, the companyâs joint venture Namoi Cotton Alliance (NCA) has posted the operating losses in the lint business to $443,000 and packing business to $639,000, on the back of delays in the lint shipping that resulted in rise in finance costs and also due to low packing volumes driven adverse seasonal conditions.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.