A companyâs growth is measured organically as well as inorganically. Organic growth refers to the growth of the company by improving its output and sales. On the other hand, inorganic growth refers to the growth of the company through merger and acquisition.

In this article, we would review the growth of companies from the point of view of acquisition, product and asset enhancement.

Sequoia Financial Group Ltd

Company Overview: Sequoia Financial Group Ltd (ASX:SEQ) is an integrated financial services company which offers products and services like investment and superannuation products, corporate advisory and capital markets expertise, wealth management and advisory services, retail, wholesale and institutional trading platforms, market data and financial news services to self-directed retail as well wholesale customers and to third-party professional service firms.

Recent Update:

Libertas Acquisition: Recently on 7 August 2019, Sequoia Financial Group Limited announced the acquisition of successful financial advice dealer group, Libertas Financial Planning Pty Ltd (Libertas). Libertas has around 70 designated representatives.

With the acquisition of Libertas, the company would be provided with additional scale in the advice marketplace. Also, Sequoia has become one of the largest non-bank owned financial adviser groups in the country as per one of the surveys undertaken by Money Management dealer group. The acquisition would help in boosting the annual revenues by $6 million and EBIT by $600k. The funding for the acquisition would be done through the existing cash reserves on an EBIT multiple of ~ 4. Half of the cash consideration would be paid up-front and the remaining in a duration of 12 months. As a part of the consideration, the company would also be issuing 1.5 million fully paid ordinary shares to the seller at 20 cents per share.

Stock Information: On 13 August 2019, shares of SEQ were trading at A$0.185 on ASX, down by 5% (as at AEST: 11:35 AM). SEQ has a market cap of A$23.24 million with 119.19 million outstanding shares, an annual dividend yield of 2.56% and a PE ratio of 33.05x.

De.mem Limited

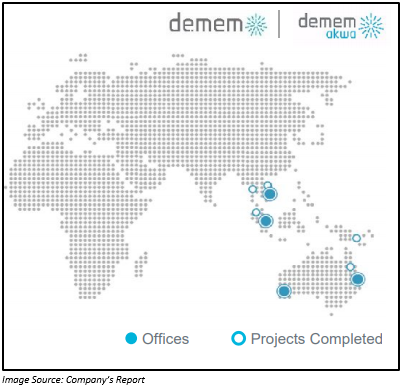

Company Overview: De.mem Limited (ASX: DEM) is a decentralized Singaporean-Australian company that is into the business of water and waste-water treatment. The company is engaged in designing, building as well as operating turn-key water as well as waste water treatment systems for its clients.

Recent Update:

Pumptechâs Acquisition: Further to the announcement on 29 July 2019 related to the binding share purchase agreement to acquire Pumptech Tasmania Pty Ltd fully, De.mem Limited (ASX:DEM) on 7 August 2019 announced the completion of the acquisition process of Pumptech Tasmania Pty Ltd.

As per the binding share purchase agreement, DEM made a cash payment of A$450,000 and has issued around 906,582 fully paid ordinary shares (voluntarily restricted for 12 months) at an issue price of $0.165. Further, the company would be making three deferred payment of A$150k in each 12, 24 and 36 months respectively from the date of completion of the transaction.

Stock Information: On 13 August 2019, shares of DEM were trading A$0.200 on ASX, down 2.44% as compared to its previous closing price. DEM has a market cap of A$28.7 million and 140 million outstanding shares. Around 60,000 shares of DEM have traded on ASX (as at AEST:11:36 AM).

Novita Healthcare Limited

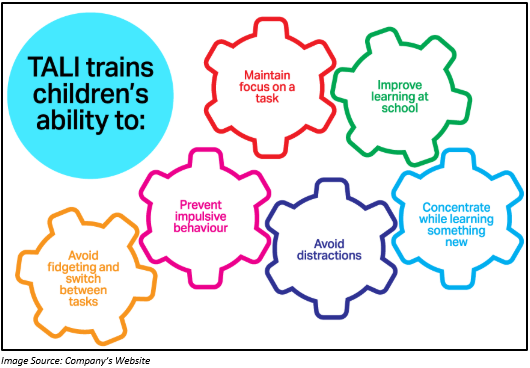

Company Overview: Novita Healthcare Limited (ASX: NHL) is an emerging health care technology company which focuses on captivating attention of children through its advanced technology known as TALI. Through TALI, children are able to maintain focus on the task, enhance learning at school, prevent impulsive behaviour, avoid distraction, improve concentration etc.

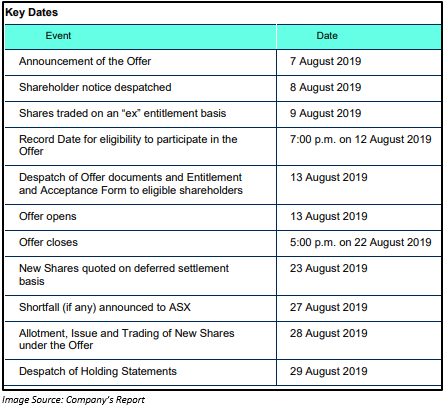

Recent Update/s: On 7 August 2019, Novita Healthcare Limited announced a 5 for 11 pro-rata non-renounceable entitlement offer of fully paid ordinary shares to raise an amount to $2 million at an offer price of $0.01 per share. The offer price made by the company represents a discount of 10% on the last traded price of the company on 6 August 2019 and 18.9% to the 15-day VWAP. The funds generated would support the company in funding Tali Detect and Tali Train business models of the company including associated capital expenses, operating costs and working capital.

Under the Offer, the eligible shareholders who are holding 11 shares of the company at 7:00 p.m. (Melbourne time) on 12 August 2019 would be able to subscribe for additional five fully-paid ordinary shares.

Also, the entitlements are non-renounceable. The shareholders need to take up their entitlements in order to receive any value in respect to those entitlements which would otherwise lapse.

Apart from that, the eligible shareholders can also apply for additional new shares over and above of their entitlement that are not subscribed by other eligible shareholders as per the offer at the offer. The shareholders would also be provided with the information letter along with the Offer Booklet, which includes personalised entitlement and acceptance form providing additional details to participate in the offer. A letter would also be provided to those shareholders who are holding options of the company.

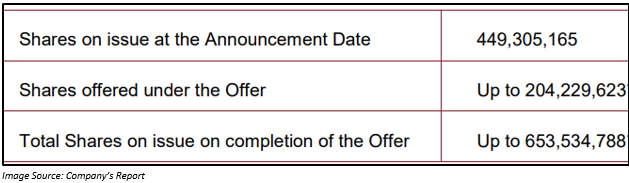

Important Information Related to the Offer:

- A maximum new share issued under the Offer would be 204,229,623.

- The new shares would be of equal rank from the date of allotment.

- Each share will cost A$0.01

- In case the shares are fully subscribed, the total number of shares quoted on ASX would be up to 653,534,788. Below is the breakdow.

- The company has unquoted 34,777,766 Options on issue.

- The shares under the offer would be having the same dividend entitlements as prevailing shares on issue.

Stock Information: On 13 August 2019 the shares of NHL were trading at A$0.010 on ASX, down by 9.09% as compared to its previous closing price. NHL has a market cap of A$4.94 million and 449.31 million outstanding shares. Around 195,000 shares of NHL have traded on ASX (as at AEST: 11:43 AM).

Twenty Seven Co. Limited

Company Overview: Twenty Seven Co. Limited (ASX:TSC) is an Australian exploration company which focuses on creating shareholders wealth through the discovery of mineral resources like cobalt.

Recent Update:

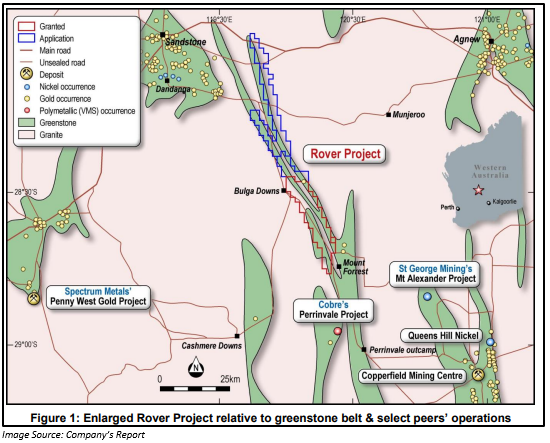

Rover Project Extension: On 12 August 2019, Twenty Seven Co. Limited announced that it has secured comprehensive aeromagnetic data from a geophysics contractor which includes a major portion of the enlarged Rover Project in WAâs goldfields and nearby regions. This region would help the company explore for Archean Au and VMS (volcanic massive sulphide) mineralisation prospects along the Cook Wells greenstone and Maynard Hill belts.

The data was derived from a low flying airplane with fifty-meter line spacing, which would provide better clarity of the geological understandings along the greenstone belts. The key effort of the company would be on building a thorough geological reading, especially in zones of VMS targets in the southern part of the granted area.

In order to expedite the Rover Project exploration campaign of the company, the geology team members are collecting additional soil & rock-chip samples around the Creasy 2 prospect as well as along the 12km prospective gold strike.

Background: As announced by the company on 1 August 2019, the company provided an encouraging result from the companyâs wholly-owned Rover Project, which is situated in WAâs goldfields, post the mapping and sampling program. The assay confirmed the presence of VMS style geology within the boundaries and extended gold anomalism of the project between the Creasy 1 & 2 prospects.

Apart from this, the assay results of the company confirm the extension of substantial gold anomalism by 1.4 kilometres amongst the Creasy 1 and 2 prospects along the 12 kilometres gold strike. At that point, the immediate priority of the company was the field trip to examine the VMS mineralisation potential of the project as well as the gold potential along the 12km strike between Creasy 1 & 2 prospects.

Stock Information: On 13 August 2019 the shares of TSC were trading at A$0.005 on ASX, down by 16.6% as compared to its previous closing price. TSC has a market cap of A$5.99 million and 999.06 million outstanding shares. Around 5,449,100 shares of TSC have traded on ASX (as at AEST: 11:44 AM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.