Australia is one of the few regions which has abundant resources of Rare Earth elements, both heavy and light, with a number of ASX companies listed on the Australian Securities Exchange engaged in the development of massive and rich deposits that account for approximately one third of the world's known rare earth resources. Many of these companies have been front running the worldâs major Rare Earth Elements demand. Thus, developing and enhancing the rare earths supply chain in Australia could be a massive boon to the economy.

The following four rare earth companies have been performing extremely well, with their respective stocks generating positive return yields since the last six months.

Greenland Minerals Limited

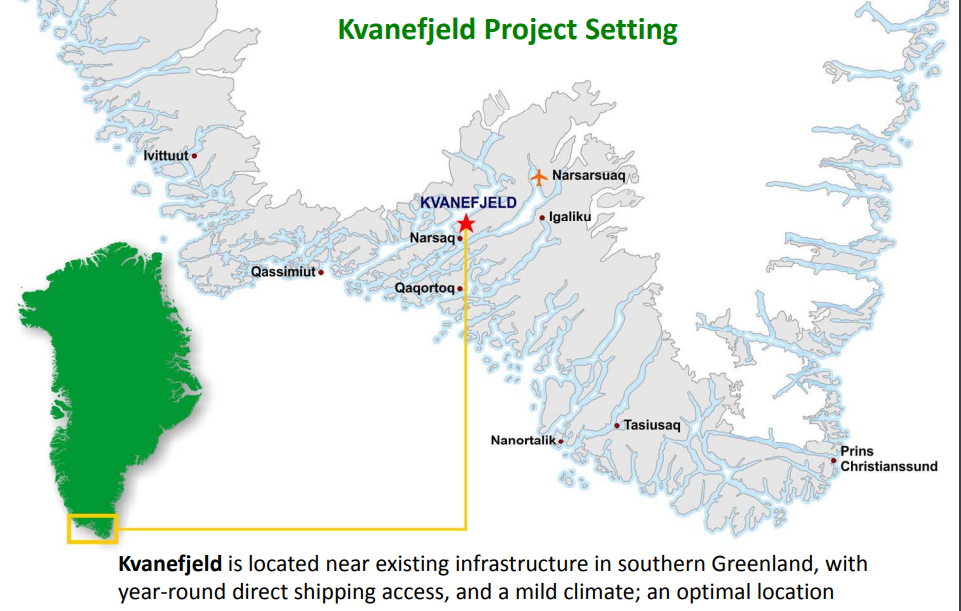

Greenland Minerals Limited (ASX:GGG), based in Subiaco, Western Australia, is a mineral exploration company engaged in the development of high-quality projects in Australia. Greenland Mineralsâ flagship asset is the Kvanefjeld Rare Earth Project, prospective for rare earth elements, uranium, and zinc, for which a pre-feasibility study (PFS) was completed in 2012, and thereafter in 2015, a comprehensive feasibility study (FS) was conducted, followed by pilot plant operations in 2016.

Source: AGM Presentation

Source: AGM Presentation

With a market capitalisation of AUD 158.57 million and around 1.13 billion shares outstanding, the GGG stock was trading today (28 June 2019, AEST 03:06 PM) flat at AUD 0.140, with approximately 1,888,735 shares traded.

In addition, GGG stock has generated impressive return yields of 133.33% for the last six months and 105.88% YTD.

Recently on 15 May 2019, Greenland Minerals updated the stakeholders on the performance of the optimised rare earth refinery circuit, introduced in early 2018, for its flagship Project, and also briefed on the improved economic outlook for the same.

As a background, Greenland Minerals undertook an extensive metallurgical optimisation program during 2017-2018 with its major shareholder Shenghe Resources Holding Co Ltd, which develops, produces, and supplies rare earth (RE) resource and related products in China and worldwide.

Subsequently, in the beginning of 2018, the company updated on the development of an enhanced leaching method designed for the simplification of the refinery circuit.

Lately, the continued work at the refinery circuit has resulted in an 8% increase in the rare earth recoveries to 94%, compared to the FS 2016.

Now, the company has mentioned that the improved recoveries will facilitate production of 32,000 tpa rare earth oxide (REO) and ~USD 31 million per annum increase in revenue at the going RE prices. The metallurgical improvements also flow through to the annual operating cost which have now been revised to a value that is 40% lower (< USD 4/kg REO) compared to FS.

Thus, Kvanefjeld is well-positioned to be a significant contributor to global rare earth supply for an initial 37-year period, based on a 108Mt ore reserve (11% of the projectâs mineral resource estimate).

Source: AGM Presentation

Source: AGM Presentation

Northern Minerals Limited

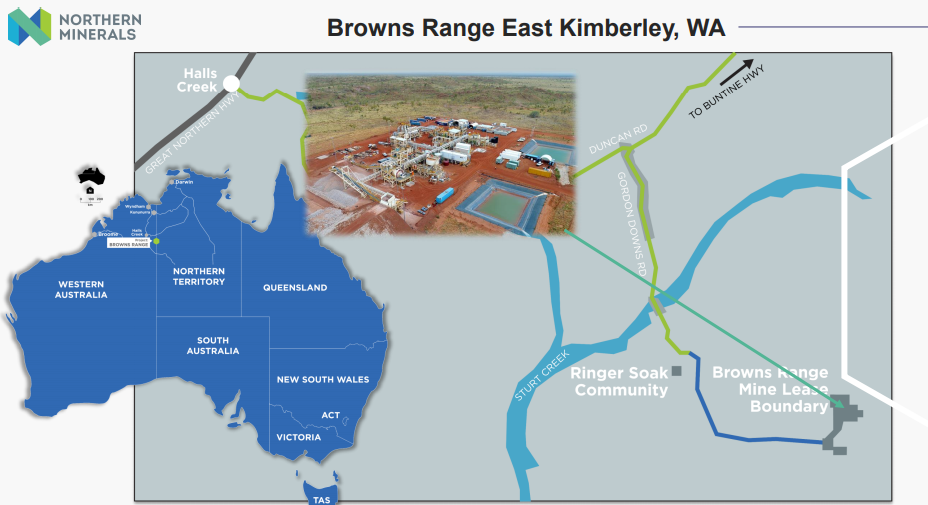

Northern Minerals Limited (ASX: NTU), established in 2006 and based in West Perth, Australia, is engaged in the exploration and evaluation of rare earth element mineral deposits in Australia. The companyâs interest lies in exploring for lutetium, dysprosium, and terbium deposits. Its flagship property is the Browns Range Project (100%-owned) situated to the south east of Halls Creek, Western Australia.

Source: NTU Corporate Presentation - Asian Metal Rare Earth Summit

Source: NTU Corporate Presentation - Asian Metal Rare Earth Summit

The company has completed the practical completion of the Browns Range Heavy Rare Earth Pilot Plant Project and commenced production of heavy rare earth carbonate.

The three-year Pilot Plant Project would continue to assist the company evaluate the economic and technical feasibility of mining at Browns Range and will also provide the opportunity for obtaining production experience and assurance regarding supply to the companyâs offtake partner.

With a market capitalisation of AUD 159.16 million and around 2.07 billion shares outstanding, the NTU stock was trading today (28 June 2019, AEST 03:18 PM) at AUD 0.075, down 2.597% by AUD 0.002 with approximately 1,054, 837 shares traded in total. In addition, the stock has generated positive return yields of 49.88% for the last six months and 44.43% YTD.

Recently on 24 June 2019, Australian heavy rare earths producer, Northern Minerals announced to have received the final $ 5 million instalment for the $ 7.5 million convertible debt agreement, announced as part of a combined $ 15 million placement and convertible debt issue on 23 April 2019.

The $ 7.5-million Convertible Debt was undertaken with sophisticated and professional investors as pursuant to s708 of the Corporations Act. The Convertible Debt has the following terms and conditions:

- An Interest rate of 10% per annum.

- Term: Repayable or convertible by 30 June 2020.

- Conversion price: $ 0.10 per share.

- Conversion conditions: At debt holdersâ election, the debt can be converted into Ordinary shares, subject to the Company either having sufficient authority to issue the shares or shareholder approval, whichever is applicable.

An arrangerâs fee of 10% of the value of the Convertible Note would have to be paid in either cash or shares (at $0.05 per share), at the arrangersâ discretion, at the completion of the transaction. The proceeds of the Convertible Debt would be directed towards progressing initiatives at Browns Range, including ore sorting and product separation and also help in bolstering the balance sheet.

Lynas Corporation Limited

Lynas Corporation Limited (ASX:LYC), incorporated in 1983 and is headquartered in Kuantan, Malaysia, is engaged in the exploration, development, and processing of rare earth minerals across Australia and Malaysia. In addition, it also produces and supplies neodymium-praseodymium material and offers corporate services.

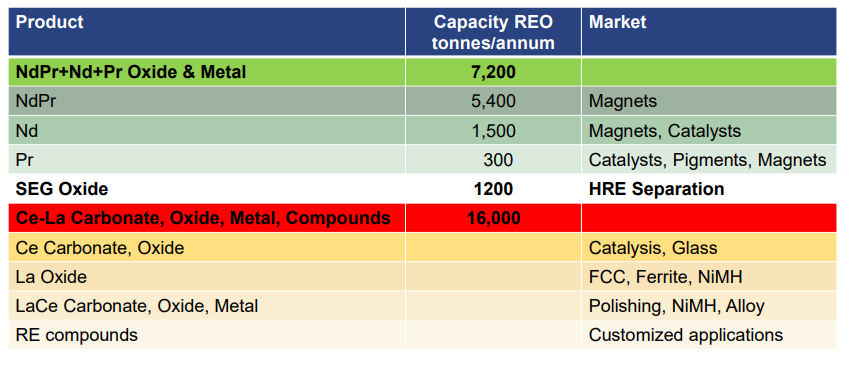

Lynas product Offerings; Source: Argus Specialty Metals Conference Presentation

Lynas product Offerings; Source: Argus Specialty Metals Conference Presentation

The company holds interest in the Mount Weld Project in Western Australia; owns and operates the Lynas advanced materials plant in Kuantan, Malaysia; and Mount Weld concentration plant in WA.

Lynas Corporation has a market cap of AUD 1.74 billion and ~ 667.8 million shares outstanding. Today on 28 June 2018 at AEST 03:28 PM, the LYC stock is trading at AUD 2.570, down 1.533% In addition, the stock has generated positive return yields of 66.24% over the last six months and 70.03% YTD.

JARE loan facility- Recently on 27 June 2019, the company pleasingly announced the signing of a documentation whereby the JARE loan facility has been extended by a period of 10 years. JARE is a special purpose company established by Japan Oil, Gas and Metals National Corporation (JOGMEC) and Sojitz Corporation. As part of this loan facility extension, Lynas has reaffirmed its commitment to priority supply to Japanese industry.

The new agreement would support the continued strengthening of Lynasâ position as the worldâs second largest producer of Rare Earths products reduces principal repayments to nominal levels up to 2025, allowing Lynas to accumulate substantial cash flow from operations. This would be utilised to fund the significant capital investment required for the execution of the Lynas 2025 Project.

MoU in the United States- In May 2019, Lynas Corporation signed a Memorandum of Understanding (MoU) with Texas, US-based Blue Line Corporation, engaged in processing of Rare Earth products, for a joint venture to develop Rare Earths separation capacity in the United States. The MoU would help in making up for the absence of Rare Earths separation capacity in the US.

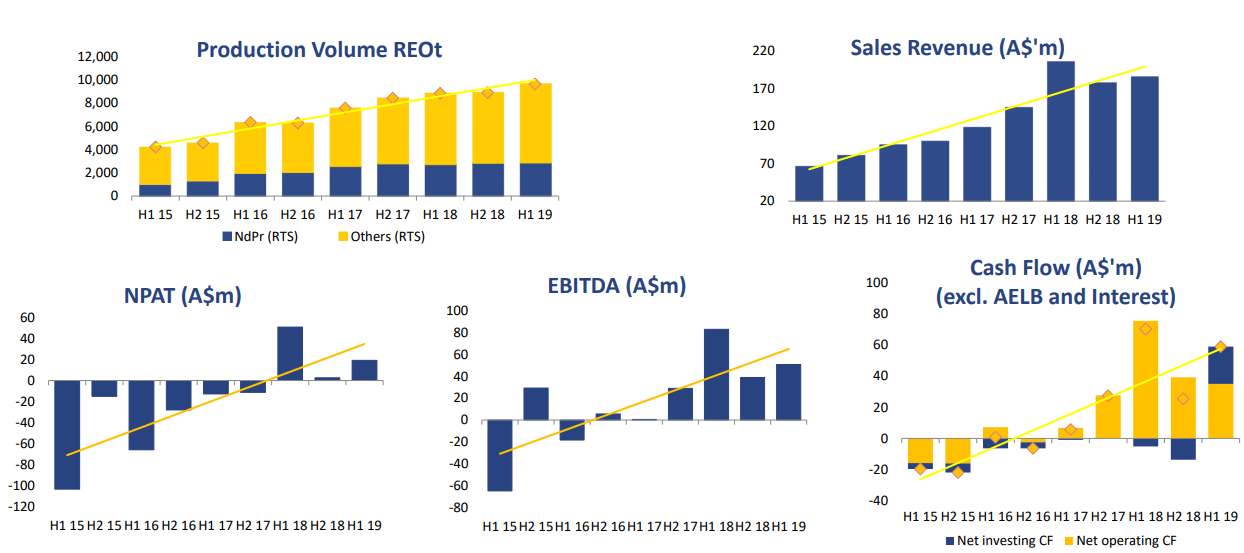

March 2019 Quarterly Results- The company disclosed its performance for the three months to 31 March 2019, where its Invoiced sales revenue stood at AUD 101.3 million, up 26.8% on the prior quarter. Although, the Loan repayment of USD 3.1 million in early January 2019 reduced JARE loan to USD 146.9 million, the cash balance was ~AUD 67.1 million at quarter end.

There was new record quarterly production and the company sold the 1st separated Pr produced during the quarter. The REO sales volume were also high at 5,030 tonnes while the weakness in the published NdPr price sustained during the quarter. However, the companyâs track record underpins its confidence in the future prospects.

Lynas product Offerings; Source: Argus Specialty Metals Conference Presentation

Lynas product Offerings; Source: Argus Specialty Metals Conference Presentation

Hastings Technology Metals Ltd

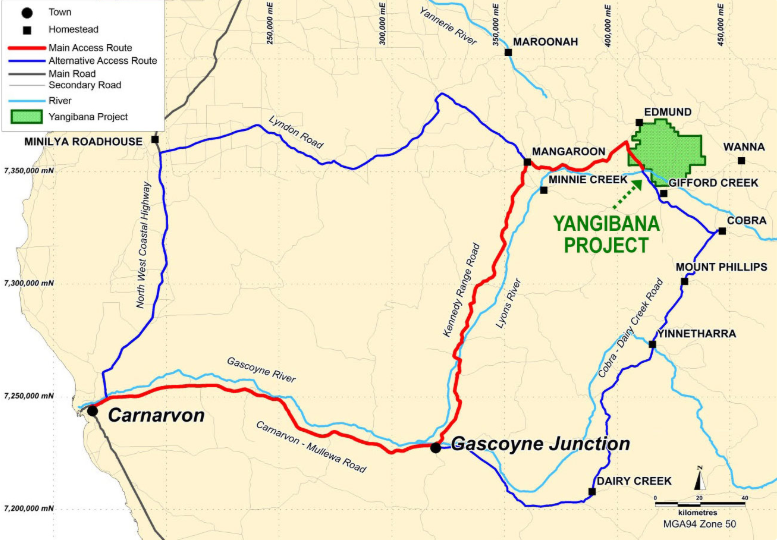

Hastings Technology Metals Ltd (ASX:HAS), based in Sydney, Australia, operates as a mining company exploring for technology metals for the manufacture of a range of new consumer and industrial technologies for customers in Australia. Currently, the company is advancing its Yangibana Rare Earths Project in the Upper Gascoyne Region of Western Australia towards production.

Besides, the company is also progressing a mining lease application for the Brockman Rare Earths and Rare Metals Project, near Halls Creek in Western Australia.

With a market capitalisation of AUD 142.12 million and around 916.9 million shares outstanding, the HAS stock is trading today (28 June 2019, AEST 03:38 PM) flat at AUD 0.155 with ~ 38.451 shares traded.

In addition, the stock has delivered positive return yield of 10.71% over the last six months and 6.90% YTD.

Recently on 27 June 2019, Hastings Technology Metals informed the market that the EPA (Environmental Protection Authority) had disclosed the Yangibana Rare Earths Project report to the general public and it is open for public appeal for the period of two weeks, before it is forwarded to gain the final approval from the Minister for Environment.

Source: Companyâs Website

Source: Companyâs Website

The EPA, its report, has mentioned that the production impacts on water and human health were not observed to be so considerable and the company could easily manage those liabilities under Part V of the Environmental Protection Act 1986, the Radiation Safety Act 1975, the Rights in Water and Irrigation Act 1914, the Mines Safety and Inspection Act 1994 and the Mining Act 1978.

Besides, the EPA has also recommended for the company to conduct further surveys of the surrounding flora and vegetation, additional modelling of the ground water and small sensitive calcrete areas in the vicinity, and ensure that the limited calcrete areas must be protected from clearing and mining activities by the company.

Yangibana has extensively undertaken the environmental impact assessment to satisfy all the stakeholders involved and proceed without any hurdles.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.