The S&P/ASX 200 Index was trading at 6,512.7 on 20 August 2019 (AEST 11:45 AM), moving up 0.7% by 45.3 points from the last close of 6,467.4. The S&P/ASX 200 Information Technology Index was trading at 1,288.5 (up by 1.29%) followed by a 1.66% (171.2 points) upward movement in the S&P/ASX 200 Energy Index to 10,334.5 on 20 August 2019 (AEST 11:45 AM). Letâs see how the following four stocks from the energy, metals & mining, IT and healthcare sectors are faring so far.

Metalsearch Limited

Metalsearch Limited (ASX: MSE), based in Australia, is a mineral exploration company with a highly prospective portfolio of precious and base metals projects. The companyâs flagship project is the Kraaipan Gold-Nickel-Copper-PGM Project located in southern Botswana. Metalsearchâs market cap is around AUD 8.2 million to date with ~482.36 million shares outstanding. On 20 August 2019 (AEST 11:49 AM), the MSE stock was trading at AUD 0.018, up 5.882% by AUD 0.001 with ~ 11.21 million shares trading. Besides, MSE has delivered positive returns of 466.67% in the last three months and 142.86% in the last six months.

Response to ASX Query - On the same day, the company reverted to an ASX query regarding the change in the price of MSEâs securities from a low of AUD 0.011 at the close of trading on 15 August 2019 (Thursday) to an intraday high of AUD 0.022 at the time of writing on 19 August 2019. Metalsearch explained that there was no particular reason for the price trend mentioned above and a possible explanation could be the companyâs recent announcements regarding its proposal to acquire the Abercorn High Purity Alumina Project (13 August 2019) and anticipated drill results from the Kraaipan Project (Quarterly Activities Report dated 29 July 2019).

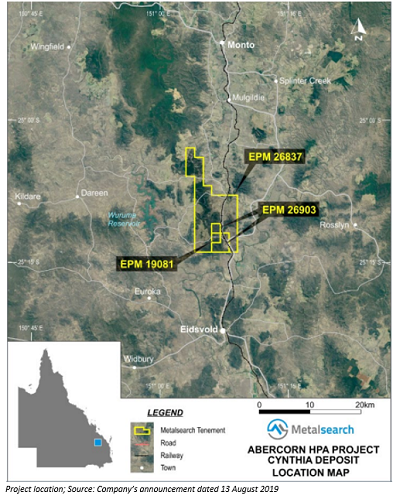

Agreement to Acquire Abercorn HPA Project â On 13 August 2019, Metalsearch announced to have entered into a binding agreement for the acquisition of 100% equity in Abercorn Kaolin Pty Ltd, which owns the Abercorn High Purity Alumina (HPA) Project (comprising three EPMs 26837, 26903 and 19081 spanning 128 km2) located in Queensland, Australia. The Kaolin mineralisation previously identified from drilling at the Cynthia prospect offers an opportunity to produce HPA and marketable volumes of higher-grade feedstock.

Some of the key advantages of the prospect include low cost operation, little to no overburden, no drill/blast required, low impurities, closeness to water ports, presence of an adjacent main sealed highway and many others.

ParaZero Limited

ParaZero Limited (ASX: PRZ), established in 2014 and based in Israel, is engaged in the design, development and provision of best-in-class autonomous drone parachute systems for commercial drone safety and civilian applications across the following industries.

The companyâs market capitalisation stands at around AUD 8.55 million with approximately 117.06 million shares outstanding. The PRZ stock last traded at a price of AUD 0.073 on 19 August 2019.

Investors Update - On 19 August 2019, Parazero released an update on its strategy. The company informed that there has been a significant shift in the global regulation landscape regarding commercial drone operation and the main implication for the company lies in the mandatory dependency created by the regulator between free flight over people and beyond visual line of sight to the need of safety systems. The new move has opened a new source of revenue (licensing) for Parazero while accelerating the OEMâs requirement for safety systems.

Also, upon success in securing the first waivers for operations over people in the US, the company has shifted its business model to a hybrid model of hardware sales together with the licensing of documentation. The licensing model would require a small upfront capital investment to complete the testing and compliance process, while allowing the company to generate high gross margins on both the sale of licenses and subsequent hardware. The license would be sold on a per drone serial number basis and is tied directly to the serial number of an individual SafeAir System.

In addition, ParaZero is also shifting resources and focus to expand its OEM (drone operators) partnerships. The company also added that it had generated more revenue in H1 of 2019, higher than the revenue for the whole year prior to it.

Nanollose Limited

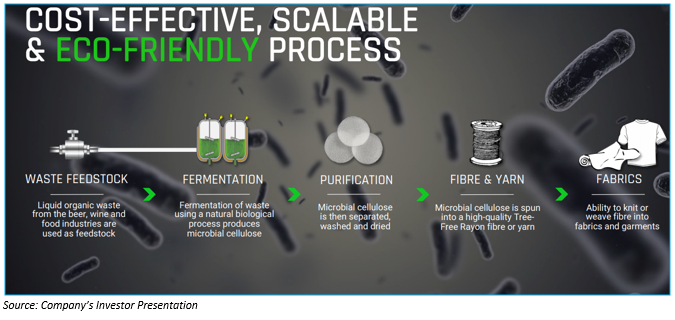

Western Australia-based Nanollose Limited (ASX:NC6) operates as a bio-technology company that is engaged in the development of fibres using an eco-friendly fermentation process that could be an appropriate sustainable substitute to the conventional plant-derived cellulose fibres. The process used by the company produces Plant-Free Cellulose, which forms a large part of everyday items like paper, clothing and hygiene products.

The companyâs market capitalisation stands at around AUD 6.37 million with approximately 75 million shares outstanding. On 20 August 2019 (AEST 11:50 AM), the NC6 stock was trading at a price of AUD 0.090 with approximately 139,833 shares. Moreover, NC6 has generated positive returns of 44.07% in the last three months and 16.44% in the last six months.

The companyâs market capitalisation stands at around AUD 6.37 million with approximately 75 million shares outstanding. On 20 August 2019 (AEST 11:50 AM), the NC6 stock was trading at a price of AUD 0.090 with approximately 139,833 shares. Moreover, NC6 has generated positive returns of 44.07% in the last three months and 16.44% in the last six months.

Cooperation Agreement with Codi Group - On 16 August 2019, Nanollose announced to have reached a Cooperation Agreement with Codi International BV, which is part of the Codi Group, a global leader in the development, manufacturing and marketing of high-quality personal care wipes. The companies have decided to collaboratively manufacture commercially feasible consumer wipe products. As per the agreement, the companies would use Nanolloseâs Tree-Free nonwoven fibre for the product manufacturing.

Codiâs extensive technical and commercial understanding, along with its ability to prototype and test products, will assist Nanollose in commercialising its Tree-Free rayon fibre for this market sector. Nanollose would also be granting a licence to Codi to use the companyâs trademarked Tree-Free branding where reasonably required. The wipes market was estimated to be worth USD 13.2 billion in 2018 and expected to be growing to USD 17.3 billion by 2023. The term of the agreement is three years and upon further testing of Nanolloseâs fibre for the production of wipes, both parties will seek to enter into a formal agreement with the specific intention to form a long-term business relationship.

Sacgasco Limited

Sacgasco Limited (ASX: SGC), based in Perth, Australia, is engaged in the exploration and development clean natural gas in the Sacramento Basin, located in the US state of California. With a market cap of ~AUD 5.6 million to date and 266.86 million outstanding shares, the SGC stock was trading at a price of AUD 0.020 on 20 August 2019 (AEST 11:52 AM), down 4.762% by AUD 0.001. Moreover, the stock has delivered a positive one month return of 26.47%.

Non-Renounceable Rights Issue - On 16 August 2019, the Directors of Sacgasco Limited announced their decision to raise up to AUD 400,290 by way of a non-renounceable rights issue of options. The offer will be on the basis of 1 new option for every 2 shares held at the record date, with the offer price of 0.3 cents per option. The options will be exercisable at 4 cents each on or before 31 December 2021.

As of 16 August 2019, and subject to rounding of fractional entitlements and no existing options being exercised prior to the record date, the offer would comprise 133,429,948 new options at the offer price of 0.3 cents each.

June 2019 Quarterly Update â On 31 July 2019, the company disclosed its Quarterly Activities Report for the period ended 30 June 2019, informing that a location had been chosen for the Borba Prospect Well, less than 2 miles from existing sales gas pipelines, and the location is optimal to test potential for channel fill sand reservoirs for its next drilling target. The application for drilling at the prospect has been submitted. Sacgascoâs priority is to increase gas flows in the short-term through work-overs in wells that have been identified for increased production, with a special focus on the Borba Prospect.

The company closed the quarter with a cash in hand of AUD 590K as of 30 June 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.