Perth, Australia-based Sacgasco Limited (ASX:SGC) is an energy company engaged in the appraisal, exploration and production of natural gas in the highly prospective world-class Sacramento Basin, onshore California. The company has an extensive portfolio of gas prospects at both exploration and appraisal stages, including Tcf gas opportunities. Currently, Sacgasco is targeting to supply gas to the local Californian gas market facing a supply deficit and a burgeoning liquefied natural gas (LNG) market in North America.

California is one of the prolific oil and gas producing regions in the world and features a well-established infrastructure and working environment, including a comprehensive regulatory system, for the same. Most mineral rights in the United Sates are held by individuals/companies and not obtained from the government bodies and exploration is conducted on leases grant by Mineral Right owners.

Sacgascoâs strategy is to identify and develop opportunities in the overlooked areas of the Sacramento Basin that are close to under-supplied oil and gas markets with attractive product prices.

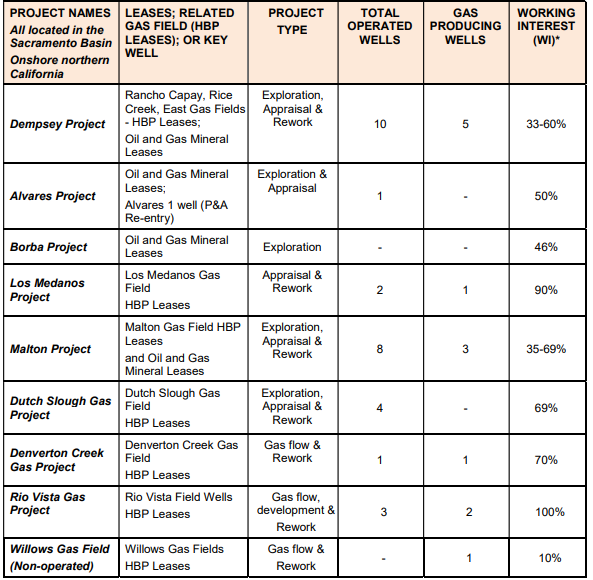

The companyâs latest project portfolio is tabulated below while it also continues to review several potential projects for their strategic fit. Sacgasco is the Operator of all but one of its WI wells-

Source: June 2019 Quarterly Report

June 2019 Quarterly Activity Report

On 31 July 2019, Sacgasco disclosed its Quarterly Activities Report for the three months to 30 June 2019 updating on the following key areas.

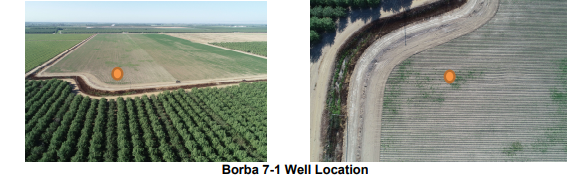

Borba Natural Gas Prospect â The company is gearing up for drilling of the Borba (aka Anzus) Prospect and a preferred location has been chosen for the Well with an application to drill also being prepared as informed in the prior quarter update. It is located less than 2 miles from the existing sales gas pipelines, and the vertically stacked conformance of seismic anomalies is much greater than at the Dempsey 1-15 well, which had over 4,000 feet of gas saturated sediments when drilled by Sacgasco. The surveying of the well location, which was earlier delayed due to wet surface conditions, was completed after the end of the March 2019 quarter.

Also, the company believes that the Borba prospect is in an optimal location to test potential for channel fill sand reservoirs for its next drilling target. The wellâs location is within a 3D seismic data volume. An undrilled amplitude anomaly interpreted to indicate gas filled sands will be intercepted in the shallower Forbes Formation by the Borba 7-1 well. The interpreted individual gas traps range from structural to stratigraphic in nature. The interception of good reservoirs at this location will calibrate more extensive seismic anomalies and gas resource potential in the region.

Source: SGCâs June 2019 Quarterly Activity Report

According to Gary Jeffery, SGCâs Managing Director, Empyrean Energy (LON:EME), Xstate Resources (ASX:XST) and a subsidiary of California Resources Corporation (NYSE:CRC), are the other participants in the Borba Prospect leases. The individual company working interests in the Borba well would be finalised prior to drilling. The company is encouraged by the recognition of Borba Prospectâs potential by other participants.

Alvares Natural Gas Project â It is located around 9 miles from large natural gas pipelines and on trend 35 miles from the similarly structured Sites Anticline on which the 1948 Shell James 1 well flowed gas to surface from reservoirs of similar age to those of interest at Alvares.

Sacgasco already holds the regulatory approval to re-enter Alvares 1 well, and sequentially examine its casing integrity and potentially test the interpreted gas filled reservoirs, and the well work is to be scheduled alongside a program of other drilling and workover activity.

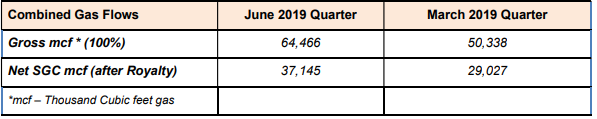

Gas Flow Update- During the quarter, the Gas Flow increased due to the addition of one of the idle wells in Sacgascoâs portfolio comprising 29 operated wells. Meanwhile, the natural gas prices in California continue to be at a premium to the US benchmark Henry Hub natural gas prices.

The company also witnessed an intermittent gas production for the Dempsey 1-15 well, since its completion and connection to sales. Also, to address the water flow issue in the well bore (flowing from a separate wet reservoir) a workover is required and the same is to be scheduled and completed together with other well work.

Source: SGCâs June 2019 Quarterly Activity Report

California- The company continued to maintain leases in the Sacramento Basin during the three monthsâ period. Sacgasco has a working interest (WI) ranging between 10% and 100% in oil and gas leases which cover natural gas prospects ranging in size from 5-20 Bcf to Tcf recoverable prospective resources of natural gas. In addition, to help the company on its growth opportunities, Sacgasco continued its strategic analysis of well histories and seismic. SGC is working towards delivering a drilling and workover program in late 2019.

Near Term Objectives â Sacgasco aims to increase gas flows, on priority, in the near term through work-overs in wells that have been deemed prospective for increased production. Besides, a drilling and workover program is being pursued, focused on the Borba Prospect.

Cashflow- During the three months, there were around AUD 395K of cash outflows (March 2019 Quarter: cash inflow of AUD 118K) from the operating activities including production, staff costs and other administration & corporates expenses. The financing activities also generated ~AUD 18K (March 2019 Quarter: AUD 73K) of cash outflows, with AUD 18k of cash payment accounted for repayment of borrowings. As of 30 June 2019, the company had AUD 590K in cash and cash equivalents (March 2019 Quarter: AUD 991K ). In the next quarter, the net cash outflows are projected to be around AUD 340K.

Natural Gas â Positive Future Outlook

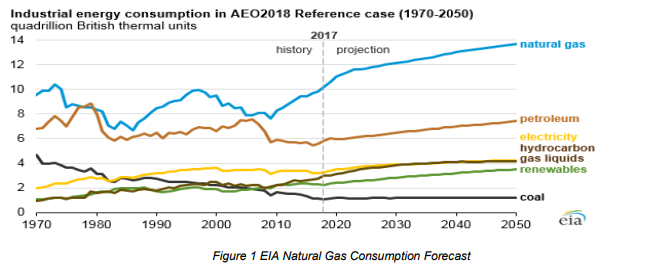

Market experts across the world continue to forecast that the global energy demand, particularly natural gas, will grow significantly over the next two decades. The US Energy Information Administration (EIA) also projects United Statesâ natural gas consumption to rise by around 40% between now and 2050 (as depicted below).

Source: SGCâs Annual Report 2018

Natural gas constitutes a key component of Californiaâs energy system, making up for around one-third of the stateâs primary energy demand. As California transitions to adopting clean energy alternatives and moves away from fossil fuels to meet its climate goals, natural gas-fired electricity is expected to play a crucial role in integrating increasing amounts of renewables into the electricity grid.

Since, California currently receives ~90 percent of its natural gas from basins outside the state, through the integrated North American natural gas market, it is to be noted that a local source of natural gas has its advantages.

Stock Performance

Sacgasco has a market capitalisation of around AUD 4.27 million with approximately 266.86 million shares outstanding. On 7 August 2019, SGC closed at a price of AUD 0.018, zooming up 12.5% by AUD 0.002. Around 58,000 shares were traded.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.