Every investor plays a role in the market by way of investment in some stocks which have decent performance metrics. In this article, we will learn about some stocks on which the market has a favorable outlook. These companies are paying decent returns to their shareholders in the form of dividends. Adding to that, the recent increase in holdings by directors has won investorsâ trust. Below are a few stocks having stable financial performance as per their recent earnings releases as well as decent outlook for growth.

Evolution Mining Limited

Evolution Mining Limited (ASX: EVN) is engaged in exploration, mine development, mine operations and the sale of gold as well as gold/copper concentrate in Australia.

Inclusion in the Dow Jones Sustainability Index (DJSI)

- The company recently through a release dated 16th September 2019 announced that in the annual assessment of the Dow Jones Sustainability Index Australia, it has been ranked as the top performer in the Australian mining companies for corporate sustainability

- It was mentioned in the release that the company joins only one other gold company recognised in this category.

- The company further stated that since 1999 DJSI has been tracking the performance of companies, which are leaders in corporate sustainability with respect to their industries and have since identified as a leader for sustainability on the back of RobecoSAMâs analysis of financially material Environmental, Economic and Social criteria.

Key Takeaways from Denver Gold Forum Presentation

The company in the presentation communicated about its performance as well as provided guidance in relation to its mining assets.

- Evolution Mining Limited stated that it has disciplined capital investment in order to ensure all assets generate adequate returns

- The average annual returns under its ownership stood in the range of 12% â 23% throughout the portfolio

- It added that currently, Cowal is truly a cornerstone Tier 1 asset

- The company further stated that it is among the lowest cost / highest margin producers under the top 10 gold miners in the Van Eck Gold Miners Index (GDX).

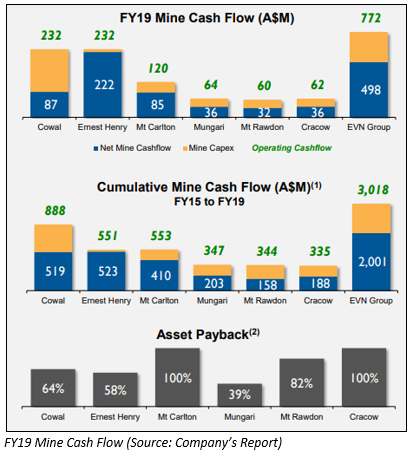

Cash Flow of Mine

- The company possesses the quality portfolio with more than A$3 billion of operating and A$2 billion of net mine cash flow between the time period of FY15 to FY19.

- It achieved a 5-year average gold price of A$1,640 per ounce.

Dividend

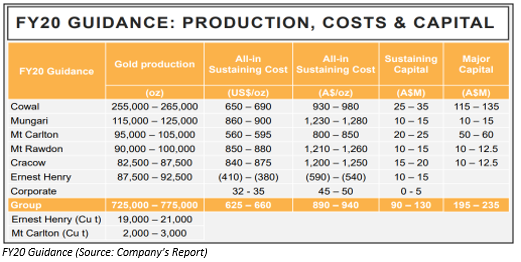

In FY19 earnings release, it was mentioned that the company has declared fully franked final dividend amounting to 6 cents per share, totaling to A$101.8 million on the back of its new dividend policy of a payout ratio targeting 50% of free cash flows. The dividend yield of the company stands at 2.09%. The company will be paying the dividend on 27th September 2019. The following picture provides an idea of guidance for FY20:

When it comes to the price performance of stock, Evolution Mining Limited was last traded at a price of A$4.730 per share with a rise of 4.185% on 16th September 2019. It witnessed a rise of 15.23% and 24.38% in the time span of three months and six months, respectively.

Transurban Group

Transurban Group (ASX: TCL) is in operation and building of toll roads in Sydney, Melbourne and Brisbane as well as in North America. The company also operates in the Greater Washington Area in the United States and Montreal in Canada.

Change in Directors Holding

The company recently on 10th September 2019, released a series of announcements, wherein it communicated about recent changes in holding made by directors.

- The company stated that Louis Scott Charlton has made a change to his holdings in the company by acquiring 1,025 Stapled Securities at the price of $14.64 per security on 6th September 2019.

- Robert John Edgar has made a change to his holdings in the company by acquiring 1,025 Stapled Securities at the price of $14.64 per security on 6th September 2019.

- Accordingly, Peter Brooke Scott has made a change to his holdings in the company by acquiring 1,025 Stapled Securities at the price of $14.64 per security on 6th September 2019.

- Also, Neil Gregory Chatfield has made a change to his holdings in the company by acquiring 1,025 Stapled Securities at the price of $14.64 per security on 6th September 2019.

Notice of Annual General Meeting

The company via a release announced that it will be conducting its Annual General Meeting 2019 on 10th October 2019.

Glimpses from Capital Raising

- Recently, the company through a release dated 4th September 2019 updated the market that it has completed its Security Purchase Plan, which was announced by the company on 7th August 2019. However, the closing date for SPP was 30th August 2019.

- The company has raised fund amounting to $312 million from Security Purchase Plan. issued 21.3 million SPP securities at $14.64 per security.

- The company has issued securities in relation to SPP on 6th September 2019.

- As per the release dated 8th August 2019, the company announced that it has successfully wrapped up its pro-rata institutional placement amounting to $500 million.

- The company further stated that pro-rata institutional placement was strongly supported by its current security holders as well as with new investors was oversubscribed at the announced price of $14.70 per new stapled security, reflected a discount of 3.48% to its closing price of $15.23 on 6th August 2019.

- When it comes to the use of proceeds raised under the institutional placement and security purchase plan. The funding would be used to finance its acquisition of the remaining 34.62% interest in M5 West for $468 million as well as for general corporate purposes.

Dividend

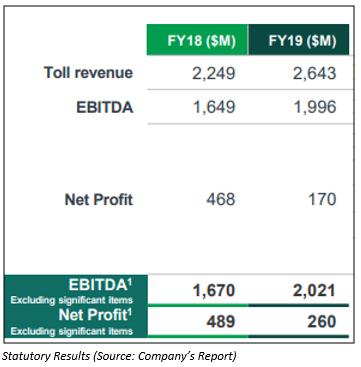

As per a release, for the six months ended 30 June 2019, a distribution of 30.0 cents per share has been paid on 9 August 2019. The following picture provides an idea of statutory results for FY19:

When it comes to the price performance of stock, Transurban Group was last traded at a price of A$14.180 per share with a fall of 2.342% on 16th September 2019. It witnessed a rise of 16.44% in the time span of six months.

Telstra Corporation Limited

Telstra Corporation Limited (ASX: TLS) provides telecommunications and information services for domestic as well as international customers. The company recently announced that Roy H Chestnutt has made a change to his holding in the company by purchasing 27,000 ordinary shares at the consideration of $97,051.50 on 5th September 2019.

Updates FY20 guidance for NBN Coâs Corporate Plan 2020

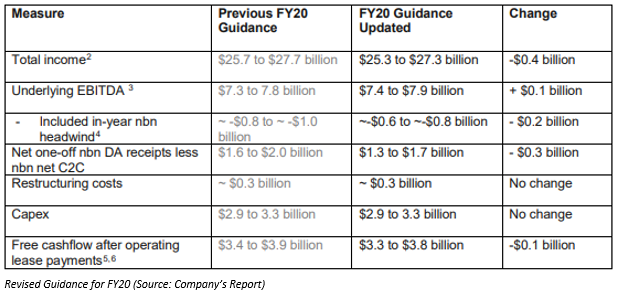

- The company has provided guidance for FY20 to the market on 15 August 2019. It was assumed that nbn launch and migration in the next year would be according to the plan for 2019.

- The company expects total EBITDA in the range of $25.3 billion to $27.3 billion as compared to previous guidance of $25.7 billion to $27.7 billion.

- There was no change in guidance for capital expenditure of $2.9 billion to 3.3 billion.

Dividend

The Board of the company has declared a total fully franked final dividend amounting to 8 cents per share, which comprises a final ordinary dividend amounting to 5 cents per share and a final special dividend of 3 cents per share, which brings the full year dividend to 16 cents per share.

When it comes to the price performance of stock, Telstra Corporation Limited was last traded at a price of A$3.570 per share with a fall of 1.108% on 16th September 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.