The following pharmaceutical sector companies have recently disclosed their June 2019 quarterly updates. Let us have a brief glance at how these companies faired in the recent three months.

AVITA Medical Ltd

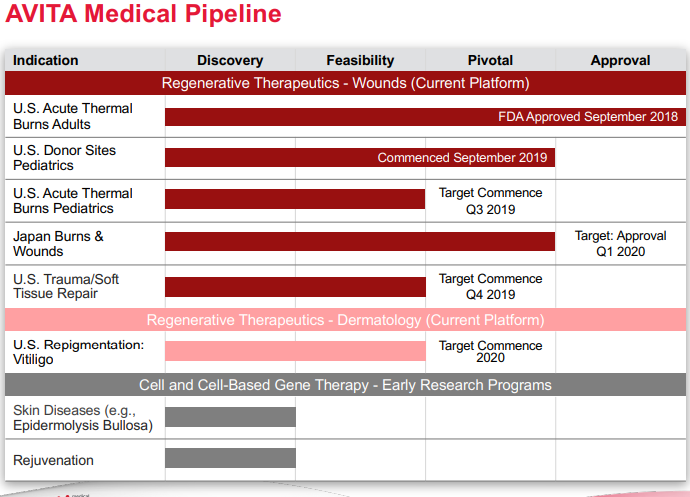

AVITA Medical Ltd (ASX: AVH), a medicine technology company, aiming to meet the medical needs in chronic wounds, burns, and aesthetics indications by manufacturing regenerative medicine and respiratory markets, addressing both medical and aesthetic indication. AVITA Medicalâs market capitalisation stands at around AUD 767.23 million with approximately 1.87 billion shares outstanding. The AVH stock is trading at AUD 0.405, down by 1.22% (as at 1:23 PM AEST, 2 August 2019). In addition, the AVH stock has generated positive and high returns of 418.99% Year-to-date and 215.38% in the last six months.

Source: Companyâs Presentation

Q4 FY19 Financial Results -Recently, the company released its Fourth Quarter Fiscal 2019 Financial Results and Company Update, posting total revenues of AUD 17.0 million for FY19, depicting an increase of 50% year-on-year and U.S. product sales of AUD 6.2 million for fourth quarter, an increase of 32% compared to FY third quarter sales.

AVITA had started to deliver orders for its first product in the US, the RECELL® System, immediately following FDA approval in a pre-launch phase, before the full nationwide launch in January 2019. The sales of the RECELL System generated approximately AUD 2.9 million, depicting sequential quarterly growth of 32%.

Also, on 19 July 2019, AVITA submitted a confidential draft registration statement to the US Securities and Exchange Commission concerning the proposed registration of its American Depositary Shares in the US.

Mesoblast Limited

Mesoblast Limited (ASX:MSB) is engaged in developing allogeneic cellular medicines based on its proprietary technology platform and it has established a portfolio of late-stage product candidates including three candidates in Phase 3 trials. The companyâs market cap stands at around AUD 747.99 million with ~ 498.66 million shares outstanding. MSB is currently trading at AUD 1.500 (as at 1:32 PM AEST, 2 August 2019).

In addition, the stock has delivered positive return of 18.58% on a YTD basis and 28.21% in the last six months.

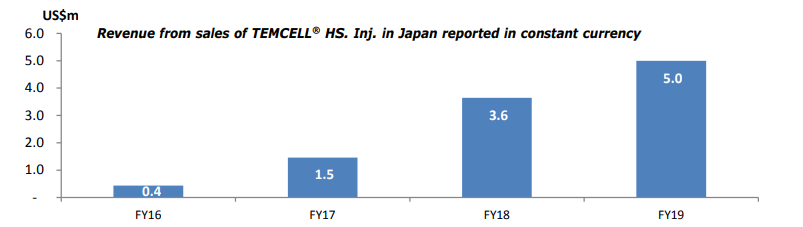

Operational Highlights- Q4 FY19 â On 31 July 2019, the company disclosed its operational highlights and its quarterly cash flows for the fourth quarter and twelve months ended 30 June 2019.

The revenues recorded in the quarter improved by 54% and 37% for the year on sales of TEMCELL® HS. Inj. In Japan steroid-refractory acute graft versus host disease (SR-aGVHD) by Mesoblast licensee JCR Pharmaceuticals Co. Ltd.

Source: Companyâs ASX update

Besides, Mesoblast initiated a rolling Biologics License Application (BLA) with the United States Food and Drug Administration (FDA) for remestemcel-L in the treatment of pediatric aGVHD, while FDA granted Orphan Drug Designation for the use of rexlemestrocel-L (Revascor) for the prevention of post implantation mucosal bleeding in heart failure patients implanted with a left ventricular assist device (LVAD).

As of the quarter end, the cash at hand stood at AUD 71.9 million while the company also mentioned the possible availability of additional capital (USD 35.0 million) under the existing arrangements with Hercules Capital, Inc. and NovaQuest Capital Management, L.L.C.

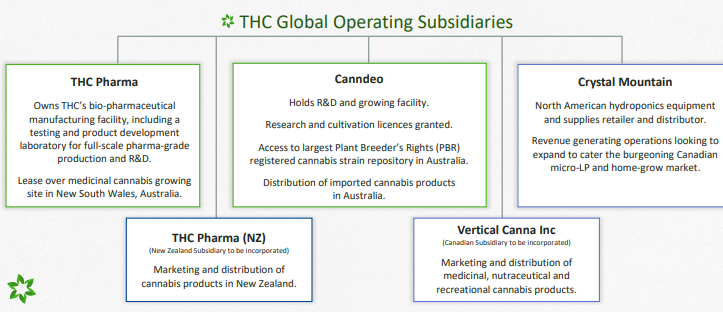

THC Global Group Limited

THC Global Group Limited (ASX:THC) operates under a âFarm to Pharmaâ pharmaceutical model, and now holds all three key cannabis licences including a Cannabis Research Licence, a Medicinal Cannabis Licence (Cultivation), and two Manufacture Licences through its domestic medicinal cannabis subsidiaries THC Pharma and Canndeo. The company has a market capitalisation of around AUD 67.19 million with approximately 135.73 million shares outstanding. On 2 August 2019, the THC stock is trading at AUD 0.480, down 3% (as at 1:32 PM AEST).

Source: Companyâs Presentation

In addition, THC has generated positive returns of 6.45 % in the last six months and 3.3% on YTD basis.

Activities Update Q4FY19 - Recently on 31 July 2019, THC Global provided an update on its quarterly activities for the three months to 30 June 2019. The Australian Office of Drug Control (ODC) granted THC Global two cannabis Manufacture Licences for its Southport Facility, the largest bio-pharmaceutical extraction facility in the Southern Hemisphere, and for its Bundaberg Strain R&D & Cultivation Facility with its own separate manufacturing capability.

THC Globalâs Canadian hydroponics equipment division based in Vancouver, Crystal Mountain reported a maiden unaudited profit for the half-year to 30 June 2019 of over AUD 100,000 and unaudited trading revenue for the half year exceeding AUD 2,000,000. In addition, at THC Globalâs cannabis cultivation facility project in Nova Scotia, Canada, the Company expects to commence initial construction activities in the coming months.

Moreover, THC Global appointed Laura Harvey as Chief Operating Officer of THC Globalâs Canadian operations to support the development of the Companyâs Canadian operations.

The cash in hand as of quarter end stood at AUD 5.69 million.

Auscann Group Holdings Ltd

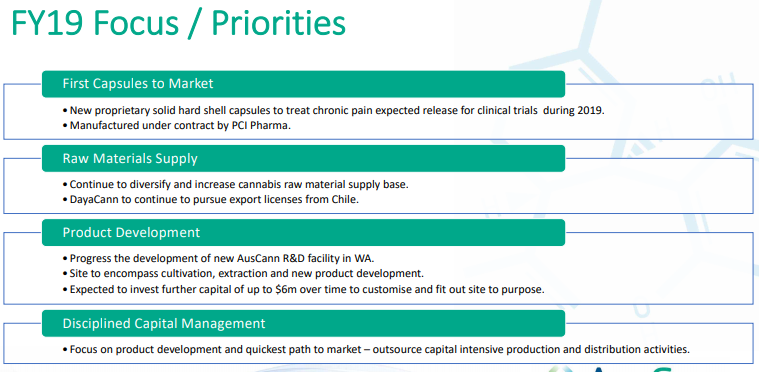

Auscann Group Holdings Ltd (ASX:AC8), based in Victoria, Australia, is a pharmaceutical company that develops and globally commercialises cannabis based medical products for application in anti-convulsion, neuroprotectant, anti-inflammatory, anti-nausea, glaucoma, pain management, and appetite stimulation areas. AC8 has a market capitalisation of around AUD 139.5 million with approximately 317.05 million shares outstanding. On 2 August 2019, the AC8 is trading at AUD 0.435, down 1.14% (as at 1:45 PM AEST).

In addition, the AC8 stock has generated a positive return of 17.33% for the last three months.

Source: Companyâs Presentation

June 2019 Quarter Highlights - On 31 July 2019, Auscann Group Holdings provided provide an overview of its activities for the three months ended 30 June 2019. The key highlights for the three months was the appointment of the Mr Ido Kanyon as AusCannâs new Chief Executive Officer (CEO) on 22 May 2019.

In addition, the company undertook various activities to progress from product development to commercialisation during the quarter.

The first ever international shipment of medical cannabis concentrate from Canada to Australia was completed during the quarter as MediPharm Labs exported the active pharmaceutical ingredient medical cannabis concentrate to AusCann. The imported resin would be used in AusCannâs product development batches and later commercial batches of its hard-shell cannabinoid-based capsules.

Also, Auscann completed a production scale-up of the capsules in a Good Manufacturing Practice (GMP) environment and purchased the in-house 7,300 m2 Research & Development (R&D) site in Perth, Western Australia, for the development of a facility, which is currently under construction. The site will encompass new product development activities including cultivation, extraction formulation and testing.

Clinuvel Pharmaceuticals Limited

Melbourne-based Clinuvel Pharmaceuticals Limited (ASX:CUV) is a biopharmaceutical company engaged in the development of dermatology pharmaceutical products for different UV-related skin issues. The company has a market capitalisation of around AUD 1.54 billion with around 48.96 million shares outstanding. On 2 August 2019, the CUV stock is trading at AUD 31.120, down 0.9% (as at 2:00 PM AEST).

In addition, the CUV stock has delivered positive returns of 74.44% on YTD basis and 47.07% in the last six months.

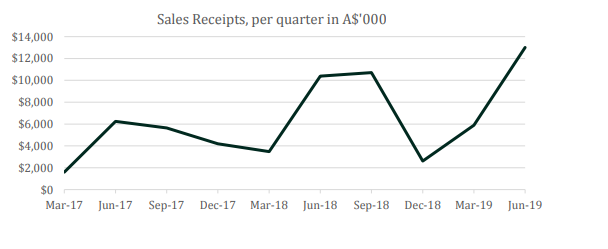

Recently on 31 July 2019, the company disclosed its Quarterly Report for the period 01 April to 30 June 2019. The cash receipts for the quarter totalled $ 13.01 million, up 121% on the previous quarter ended 31 March 2019 ($ 5.89 million) and 25% on the June 2018 quarter ($ 10.38 million), demonstrating a strong seasonal demand for its product. For the entire FY19, the Cash Receipts amounted to ~$ 32.21 million, up 36% relative to FY18.

Source: Appendix 4C- Quarterly Cashflow Report June 2019

Clinuvel Pharmaceuticals generated most of the revenue through the provision of SCENESSE® (afamelanotide 16mg) in the European Union and Switzerland to patients with the rare metabolic disorder, erythropoietic protoporphyria (EPP).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.