Listed on the NASDAQ as MESO and ASX as MSB, Mesoblast Limited (ASX:MSB) is a world leader in developing allogeneic (off-the-shelf) cellular medicine. The company has facilities in Texas, New York, Melbourne and Singapore.

On 31st May 2019, the company released its financial outcomes and operational highlights for the nine months ending 31st March 2019.

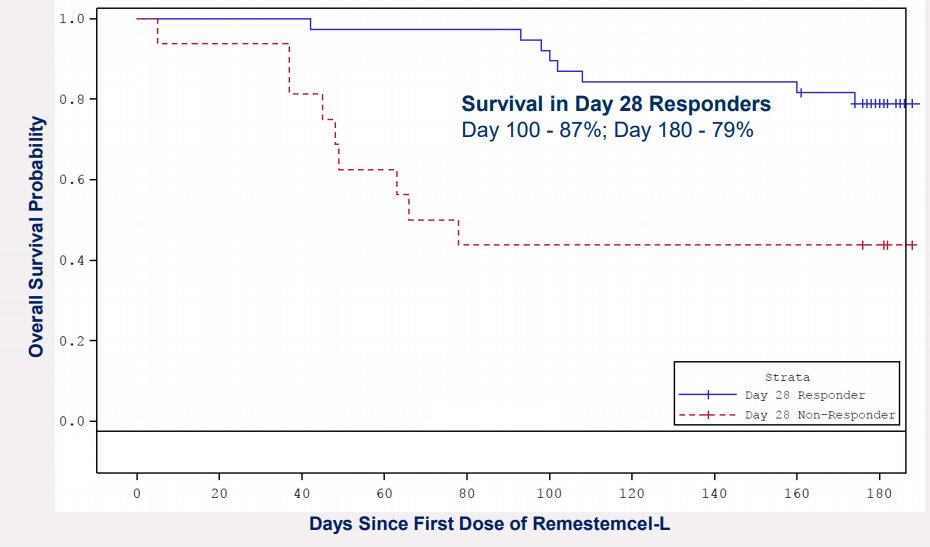

In its recent corporate highlights, the company informed that the US FDA has agreed to a rolling review of Biologics License Application for remestemcel-L, used to cure steroid-refractory acute Graft Versus Host Disease affecting children. The company had commenced the rolling submission of this application to the FDA. This would encourage ongoing communication, and MSB is positive of adequately addressing any substantial matters raised by the FDA.

Remestemcel-L (Source: Companyâs report)

Remestemcel-L (Source: Companyâs report)

The company entered into an MoU with the International Center for Health Outcomes and Innovation Research for conducting a confirmatory clinical trial using Revascor to reduce gastrointestinal bleeding in end-stage heart failure patients, who had been implanted with a left ventricular assist tool.

566 patients were randomized to receive Revascor or placebo under the companyâs Phase 3 trial catering to advanced heart failure, and the trial has finished the patient enrolment. The study would be complete post enough primary endpoint events are accrued. The trial in chronic low back pain too finished its enrolment with 404 patients to receive MPC-06-ID or placebo. All the available patients had finished a follow up of safety and efficacy of at least 12 months.

Besides these on the corporate end, the company had extended its license in Japan with JCR Pharmaceuticals Co., Ltd. towards the use of TEMCELL®. As MSB enters its commercial stage, the board had appointed Joseph R. Swedish as Chairman.

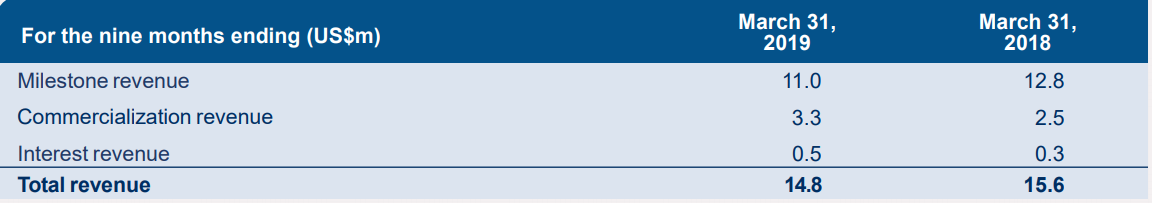

On the financial end, the company reported Cash reserves of $70.4 million as on 31st March 2019. After a nod from few milestones, an extra non-dilutive capital of $35.0 million could be available under present deals with Hercules Capital, Inc. and with NovaQuest Capital Management, LLC. The Royalty income on sales of TEMCELL® for aGVHD in Japan witnessed a 28% increase during the period.

Revenue details (Source: Companyâs report)

Revenue details (Source: Companyâs report)

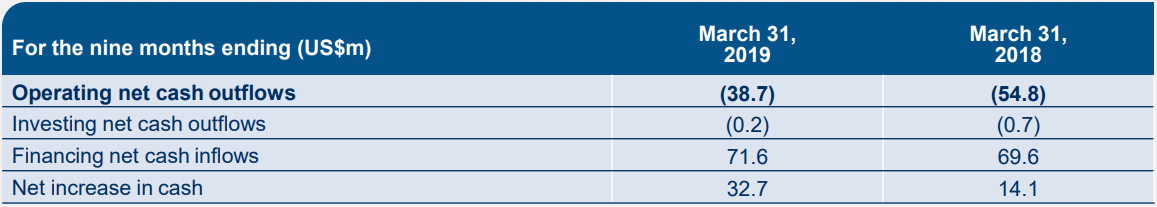

The company reported revenue of $14.7 million, relative to $15.6 million revenue in the nine months of FY2018. There was an increase in investment in commercial manufacturing worth US$9.5 million to aid the possible launch for aGVHD product. The net operating cash outflows were down by 29 per cent to US$38.7 million in the nine months.

MSBâs cash details (Source: Companyâs report)

MSBâs cash details (Source: Companyâs report)

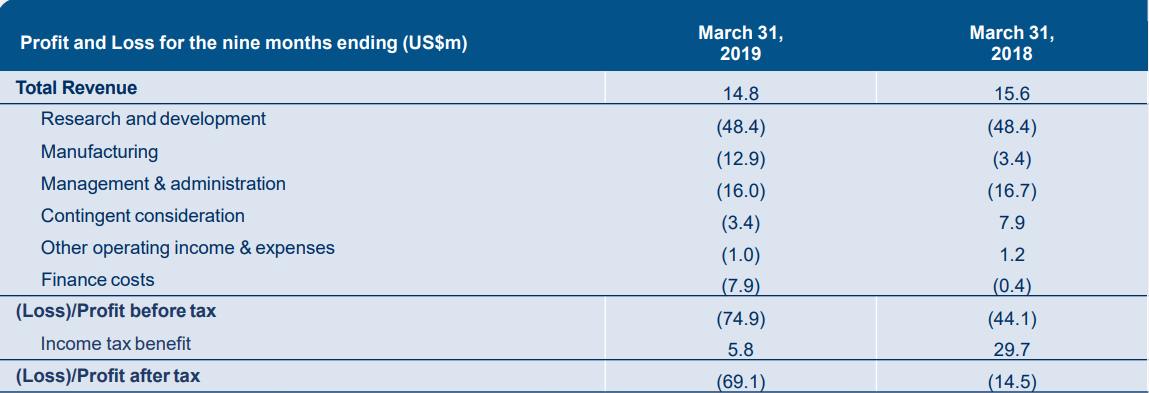

MSBâs R&D expenses were relatively stable in comparison to the prior corresponding period (pcp), amounting to $48.4 million. The manufacturing expenses improved to $12.9 million in nine months of FY19, in comparison to US$3.4 million in pcp. Management and Administration expenses stood at $16.0 million, down by $0.7 million when compared to pcp.

Profit and Loss highlights (Source: Companyâs report)

Profit and Loss highlights (Source: Companyâs report)

Letâs have a look at MSBâs upcoming milestones for CY2019:

- Completion of BLA filing for remestemcel-L to treat steroid-refractory aGVHD in children.

- Completion of Phase 3 trial in advanced heart failure is also expected.

- The company aims to meet the FDA to discuss the approval of Revascor.

- MSBâs partner, Tasly, plans to discuss regulatory approval of Revascor in China with the National Medical Products Administration of China.

Share Price Information:

As on 31st May 2019, the stock closed at A$1.390, down by 2.797% from its previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_06_30_2023_10_37_44_979056.jpg)