In current times, the world is going through a tough and emotional situation with COVID-19 overshadowing the news every single hour of the day. At present, there is plenty of gloom in the Australian market. Nevertheless, the fact remains that Australia has one of the best healthcare systems across the world and the global mortality rate for COVID-19 is around 6 per cent, which is significantly less than what was seen for MERS (34 per cent) and SARS (10 per cent).

Markets are confident that the fiscal stimulus offered by the government will diminish the fallout, but uncertainty is heightening amongst property investors and housing agents. However, in the previous downturns in the economy, like the recession in 1991 or the Global Financial Disaster of 2007-2008, the Australian property industry indeed coped better than the other sectors.

Read More: Real Estate Market Updates Amid COVID-19

Stock markets are particularly liquid, and therefore, they are very much faster to respond to adverse sentiments than non-liquid resources, like property. Nevertheless, reduced levels of confidence of consumers would sooner or later make a mark on the residential property market.

Moreover, both the Federal Government and the Reserve Bank of Australia (RBA) stated that they would launch additional stimulus if the necessity occurs.

Let us delve deep and discuss few ASX-listed property market stocks- BLD, ABC, BKW

Boral Limited (ASX:BLD) Declares demand substantially declining due to COVID-19 impact

Australia-based building products and construction material group Boral Limited operates through three segments which include Boral Australia, USG Boral and Boral North America.

The Company supplies its customers with high-quality, sustainable building products and construction materials. Boral has 672 operating sites, 154 distribution sites in 17 countries.

Dwindling demand amid COVID-19

Across many jurisdictions, the operations of Boral Limited are deemed to be surrounded by the essential infrastructure and construction regions that are authorised and encouraged to continue as significant businesses. This also comprises Boral’s US Fly Ash business, which offers a vital service to the energy sector.

However, in a few areas, particularly in North America and Asia, more stringent mandates and restrictions have caused temporary closings of numerous processes. Additionally, the requirement is dwindling in most markets. It is projected to continue to decline, particularly in residential construction markets where the pipeline of work is substantially reducing in all geographies.

Crucial actions to cope during the downturn and to maintain a robust balance sheet

Although uncertainty continues around the duration and extent of the impact of coronavirus pandemic, Boral is taking decisive measures to cautiously preserve cash and protect the Company for the long term, by:

- Reducing expenses and discretionary expenditure across the entire business.

- Right-sizing operations, including temporary plant closures to align production with current and expected lower activity levels.

- Rigorously managing cash flow and working capital.

- Reducing non-essential capital expenditure, resulting in ~15-20 per cent lower capital expenditure in the fiscal year 2020. The Company now anticipates capital spending of approximately $330 million in the FY2020.

Moreover, the Company foresees that these actions will bolster its financial position, assisting in maintaining a stable liquidity position as well as a resilient balance sheet.

At the end of March 2020, Boral Limited had approximately $890 million of available cash and undrawn committed assets. Furthermore, the remaining $73 million of $82 million earnings from the sale of Midland Brick is anticipated in the June quarter.

On 16 April 2020, BLD stock was trading at $2.725 (at 01:26 PM AEST), up by 0.184 per cent, with a market cap of approximately 3.19 billion. The Stock has nearly 1.17 billion outstanding shares on the ASX.

Adelaide Brighton Limited (ASX:ABC) is well-positioned with Cash Balance of more than $450 million

A material sector Company, Adelaide Brighton Limited is engaged in manufacturing and distribution of cement, lime, concrete and concrete products. The Company operates in almost every state and territory in Australia and has nearly 1,500 employees.

Earnings guidance withdrawal

According to one ASX announcement dated 02 April 2020, the Company given the uncertainty concerning the duration and impact of the COVID-19 pandemic, it is withdrawing its earnings guidance for the fiscal year 2020 (ending 31 December 2020)

Moreover, it is noteworthy that the balance sheet of the Company stays robust, and it is well-positioned with a surplus of $450 million of cash and committed and undrawn bank facilities.

On 16 April 2020, ABC stock was trading at $2.540 (at 01:26 PM AEST), down by 1.167 per cent, with a market cap of approximately 1.68 billion. The Stock has nearly 652.27 million outstanding shares on the ASX.

Re-commencement of Pennsylvania brick plant of Brickworks Limited (ASX:BKW)

Headquartered in NSW, Australia, Company Brickworks Limited is into the development and distribution of concrete and clay products. BKW is one of the largest and diverse manufactures of building material and has 12 operating brick plant and one manufactured stone plant. The Company employs more than thousands of employees at 26 manufacturing sites.

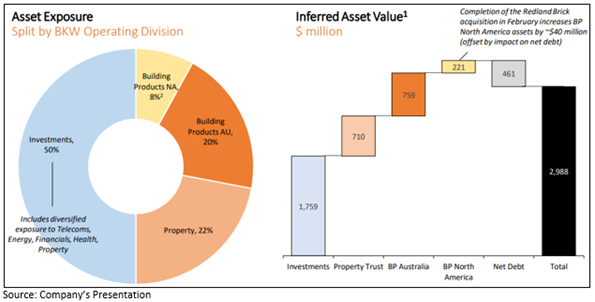

Diversification & Asset Backing

The Company has a diversified portfolio of assets, with an inferred asset value of approximately $3.0 billion.

Pennsylvania brick plants cleared for re-commencement

According to an ASX announcement dated 01 April 2020, Brickworks revealed that after the consultation with the Governor, the Company had been informed that it might recommence its brick plants.

Brickworks mentioned that it would begin a phased process of re-starting services in Pennsylvania, considering the anticipated level of requirement, such as due consideration of the continuing impact of the coronavirus pandemic, and formerly proposed plant rationalisation activities.

Given the rapidly evolving nature of the COVID-19 pandemic, BKW foresees further effects on production as well as in demand across its operations over the forthcoming months and will update the market.

COVID-19 Impact: Expectations and BKW Response

A significant recession is anticipated after this COVID-19 pandemic ends, but Brickworks is acting on the situation and is in a steady position. The Company is taking substantial measures to prepare for a downturn and preserve cash. Moreover, Brickworks withdrew any previous outlook statements and is unable to provide any earnings guidance at this stage.

It is noteworthy that Brickwork is in a strong financial position, with a diversified portfolio of attractive assets and a robust balance sheet.

Outlook: Although the outlook is overshadowed due to the coronavirus pandemic, Brickworks is well placed and has a strong history of outperformance over the long term and across business cycles.

Moreover, the Company is planning to sell 10 hectares at Oakdale East into the Trust in the second half of 2020.

On 16 April 2020, BKW stock was trading at $13.070 (at 01:26 PM AEST), down by 2.681 per cent, with a market cap of approximately 2.01 billion. The Stock has nearly 149.94 million outstanding shares on the ASX.