About Retirement

Retirement is defined as a phase of life when individuals withdraw from their occupation or from active working life. The concept of retirement did not exist about a hundred years ago; it became more common with the rise in life expectancy.

The age at which a person is anticipated or required to stop working is the retirement age. People can also retire when they are eligible to get superannuation or other government benefits. People usually decide to retire when they become eligible for the Age Pension. In Australia, there is no definitive retirement age and itâs up to the individuals to decide when they are ready to retire. However, the Pension age is 65½, and it is likely to rise gradually to 67 years by July 2023.

How to Sustain Retirement?

To sustain retirement life, individuals need to start saving in their young age. Some analysts believe that they need to save at least 10 per cent of their income each year as later age (40âs and 50âs) requires a large portion of income to be saved, approximately 50 per cent a year. An individual can also go for part-time retirement where people find work that they enjoy, even if they are paid less for it. In this case, individuals get time to let their retirement money grow before using it for income.

Retirement Planning

The procedure of identifying retirement income goals and the decisions required to achieve those goals is termed as Retirement planning. Such planning incorporates implementing a savings program, identifying sources of income, managing assets and estimating expenses. The retirement planning makes a person financially and emotionally prepared for retirement.

Why Australians Invest?

As per the ASX Australian Investor Study released in 2017, the Australians usually invest for the long term, particularly for retirement and wealth accumulation. Minimum $370,000 investment, returning 7% p.a. is required for a single person seeking a âmodestâ lifestyle in retirement, mentioned the study report. However, for couples, this amount is at least $400,000.

The compulsory superannuation will not always be sufficient for the people to maintain their lifestyle expectations in retirement, raising the need for investment. Early investment for wealth accumulation would help the individuals to distinguish between a modest and a comfortable retirement in the future.

Where to Invest Hard-Earned Retirement Money?

There are different investment options available to the Australians to be considered while investing their money:

- Cash Investments

- Fixed Interest or Fixed Income Investments

- Shares

- SMSFs

- Exchange traded funds (ETFs)

- Investment Bonds

- Annuities

- Listed investment companies (LICs)

- Real estate investment trusts (REITs)

- Peer-to-peer lending (P2P)

- Cryptocurrency

- Gold

The ASX Australian Investor Study revealed that the shares, along with other instruments traded on the Australian Securities Exchange (ASX) have been the most popular investment choices among Aussies. Self-managed superannuation funds (SMSFs) were also found to be a popular option for investors in the study as 30 per cent of the investors that were not using an SMSF at that time intended to set one up in the future. A superannuation trust structure that delivers benefits to its members at the time of retirement is termed as Self-managed superannuation fund.

What is the Best Time to Invest in for Retirement?

Individuals in their 20s do not think much about saving for their retirement. However, early decision to start investing for retirement is a brilliant financial move, enabling individuals to earn an interest year-after-year. Different investments are best suited for a different investing time frame and carry varying degrees of risk and return. So, individuals should make their investment decisions based on the time duration for which they plan to keep their money in the market.

Are Stocks Good for Retirement?

A stock is a type of security that represents proportionate ownership in the issuing corporation, entitling the shareholder to that proportion of the companyâs assets and earnings. As the stocks have produced bigger long-term gains in the past than any other asset class, they are an essential part of a good retirement portfolio. Large stocks have delivered an average return of 10 per cent per year since 1926, as per market estimation.

How Much of the Retirement Should Be in Stocks?

The old rule of thumb (as suggested by various analysts/studies) shall be applied to decide the amount of retirement money to be invested in stocks, as per which one should subtract his age from 100 and that gives him the percentage of the portfolio to be kept in stocks. As an example, if you are 40, 60 per cent of your portfolio should be in stocks. However, with a growing life expectancy, many financial planners are now suggesting that the rule should be modified to 110 or 120 minus the age of the individual.

Are Dividend Stocks A Good Investment?

Dividene is a payout made by some companies to their shareholders that reflects the company's earnings. Regardless of what happens to the stock price, dividends give stockholders a steady return. In order to build long-term wealth, investment in a dividend-paying stock is a great option for investors. However, dividends are not guaranteed, and the company can stop dividend payments at any time. So, the investors should reinvest the dividends rather than spending them when they receive it.

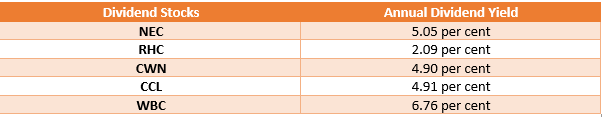

Let us look at some of the major dividend-paying stocks trading on the Australian Securities Exchange:

Nine Entertainment Co. Holdings Limited

An Australian media company, Nine Entertainment Co. Holdings Limited (ASX: NEC) announced an ordinary fully paid dividend of AUD 0.050 in February this year. The dividend related to a period of six months was to be paid on 18th April 2019. The declared dividend was 100 per cent franked on which 30 per cent corporate tax was applicable for franking credit.

Ramsay Health Care Limited

A global hospital group, Ramsay Health Care Limited (ASX: RHC) operates a broad range of healthcare facilities throughout Australia and other countries like Indonesia, Malaysia, UK and France. The company released an update on dividend distribution recently in which an ordinary dividend of AUD 2.2931 relating to a period of six months was announced.

Crown Resorts Limited

Headquartered in Australia, Crown Resorts Limited (ASX: CWN) is indulged into the gaming and entertainment sector. The companyâs ordinary fully paid dividend amounting to AUD 0.30 was announced in February this year. Relating to a period of six months, the dividend was to be paid on 4th April 2019 with record date and ex-date of 21st March 2019 and 20th March 2019, respectively.

Coca-Cola Amatil Limited

Incorporated in 1927, Coca-Cola Amatil Limited (ASX: CCL) is engaged in manufacturing, distribution and marketing of beverages. On 10th April 2019, the company informed about the payment of a final dividend of 26.0 cents per share, franked to 50 per cent, representing an underlying pay-out ratio of 87.6 per cent for the full year.

Westpac Banking Corporation

One of the major banks of Australia, Westpac Banking Corporation (ASX: WBC) provides banking, financial and other related services to the Australian market. On 5th June 2019, the bank provided DRP (Dividend reinvestment plan) details in an update on its dividend announcement notification released on 6th May 2019.

An ordinary fully paid dividend of AUD 0.94 related to a period of six months was declared with a payment date of 24th June 2019. The dividend declared was fully franked with 30 per cent applicable corporate tax rate for franking credit. The bank also informed about the DRP price of AUD 27.36 that would be applicable on the dividend at 1.5 per cent discount rate.

Let us have a look at the current annual dividend yields, as per ASX, as on 7th June 2019, of the companies mentioned above:

Is It Better to Invest in Stocks or Bonds?

A fixed income instrument that depicts a loan made by an investor to a debtor is a bond. An entity issuing bond issues debt with the agreement to pay interest for the use of the money. The stocks are better than bonds in having the potential to deliver higher returns than bonds. However, bonds outperform stocks in providing fairly reliable returns through coupon payments. The bonds are less risky than stocks and are best suited for risk-averse investors. The best option for investors is to diversify their portfolio with a combination of stocks and bonds as diversification helps in mitigating the risk.

What Are The Safest Investments For Retirement?

As the economic climate is unpredictable and there are a variety of options available in the market, it is difficult to identify any single investment which is clearly safest. However, some of the investments are safer than others like a fixed annuity, bank savings, etc.

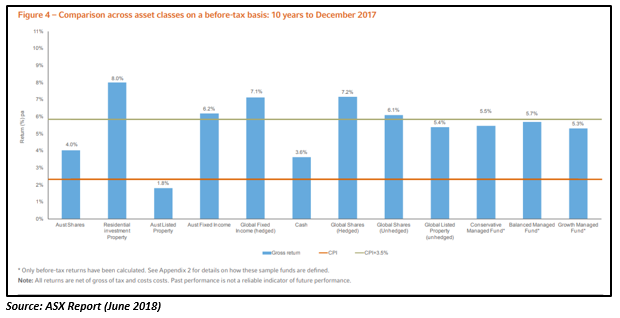

The ASX/Russell Investments 2018 Long-term Investing Report that investors use to rank the best performing asset class for the last 10 and 20 years indicated that Australian residential property outperformed all asset classes for the 10 and 20 years to 31 December 2017. For the ten years on a gross of tax and fees basis, the residential property got the top spot, succeeded by global shares (hedged) and global fixed income (hedged). However, given the recent property meltdown, investors may want to be cautious while making investment decisions.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)