We have long heard about the paper-thin, long-lasting and with high energy densities, but do they really exist? I wonder! In fact, these sought-after qualities do not exist in a single battery practically at least for now. One battery could be for the desired size with high energy density but might not be long-lasting and wear out prematurely. Another one might be long-lasting but bulky or with low runtime. As of now, the long-lasting battery with huge runtime per cycle is a myth.

A battery pack is a series of voltaic cells or galvanic cells (converting chemical energy into electrical energy). The selection of battery depends on the suitability of the purpose.

For example: The mobile phone industry gives priority to lightweight, high energy density and low-cost batteries and usually not to longevity.

What is considered while selecting a battery pack for EVs?

For electric vehicles, the battery packs are developed with objectives of high power to weight ratio, specific energy and energy density as the lighter and smaller batteries reduce the size and weight of the vehicle, improving its performance. The high specific energy and energy density allows vehicles to last a longer range per recharge cycle. The charging/discharging cycle time and the cost of the batteries are also taken into consideration.

Electric mobility: Adoption and Reforms: Must Read

The industry, in general, is sanguine about the EV demand, but there is uncertainty over what the actual scenario would be in 2025 or 2030. International organisations such as the IEA estimate that EV sales would reach 44 million units in 2030.

The target seems to be quite taxing, but the support from the government and regulatory bodies providing heavy monetary subsidy benefits or discounted road tax and other privileges such as free parking or charging infrastructure would attract the customers. It will also bring down the lifetime cost of electric vehicles.

Impeding the government reforms and initiatives are the price and supply disruption of the key metals like Cobalt and Nickel, which could thwart the cost declines that have been the bases for the affirmative EV future demand estimates.

Adoption Dynamics

A traditional S-curve is used to describe the growth trajectory for any major technological, successful adoption, the market growth for EV would be slow and then would accelerate rapidly till the point when the market matures and saturates. We are currently in the initial phase of adoption of the EV technology and additional battery manufacturing capacity is essential to prevent shortages in future.

The control over the total cost of ownership (TCO) to compete with the conventional ICE vehicles is essential to rapidly reach the inflection point on the S-curve at which the EV sales will boom. The stable supply of battery materials including Nickel, Cobalt, Lithium, Graphite and others at an attractive cost will keep the OEMs interested in the high-quality long-range and lasting battery packs.

Current Battery Technologies

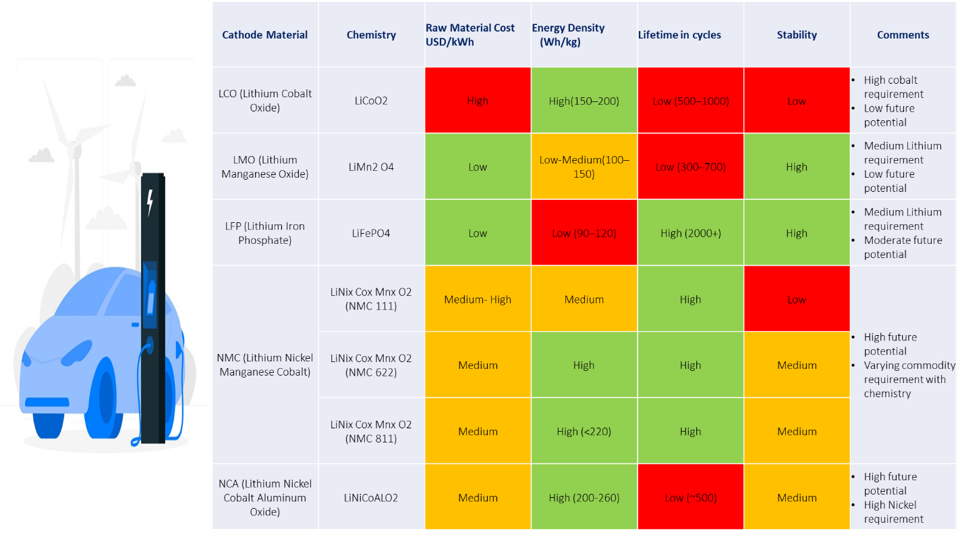

Here is a comparative analysis of the different existing battery technologies and their suitability in future-

Comparative analysis of different EV Cathode technologies Source: Kalkine Research

The future battery technology would require high energy density, long life and low manufacturing cost to keep the OEMs interested in high-quality battery manufacturing. The major risks that could hamper the EV adoption rates in future are posed by the disruption in the supply of the metals.

Cobalt - In order to keep up with the demand, the supply of Cobalt has to increase significantly. Currently, the majority (~50-60%) of the supply of Cobalt comes from the Democratic Republic of Congo (DRC), a country which is prone to civil war situations at times and is difficult to operate in.

Chinese companies own the majority of the Cobalt supply from the Democratic Republic of Congo (DRC), which faces issues socio-political issues and often lead to fluctuations in the Cobalt supply.

A huge supply of Cobalt can't be tracked due to artisanal mining production. Any incident of instability in DRC might affect the global Cobalt supply. These disruptions have led the major car manufacturers to minimise the Cobalt percentage in their battery packs. In fact, Tesla has already brought down the cobalt percentage in its battery packs to close to single digits.

Most of the Cobalt is produced as a by-product of Nickel or Copper, and the market of these primary commodities often make the decisions on behalf of Cobalt. Huge investments in other regions of the world are being made to increase production from stable locations. Example: One such project is the Corazon Mining's Mt Gilmore Copper-Cobalt-Gold Project.

Nickel – Nickel, required for the EV industry has already started fuelling growth in demand with an increase in EV adoption from countries especially the EU, Asia and North America regions. The increase in the Nickel prices to the yearly record value of $18,000 a tonne due to increasing demand for electric vehicles and a probable supply deficit, being enhanced by Indonesia's recent Nickel ore export ban.

Indonesian authorities had allowed export of lower-grade nickel grade (<1.7% Ni) in 2017 at a time when the country lacked infrastructure to process low-grade nickel ores to produce high-quality products, but with commencement of multiple HPAL (high-pressure acid leach) the country now can use its low-grade nickel ores to produce high-grade cathode material for battery. The extra supply would be helpful in developing Nickel-based Cathode for the EV market.

Nickel & Lithium Outlook: Read Here

Lithium

Lithium supply is estimated at 470,000 tonnes in 2019 and is set to increase to 489,000 tonnes in 2021 major due to the expansion in Spodumene concentrate capacity and increased production from hard rock sources. Certain regions of Lithium triangle which consists of portions of Argentina, Bolivia and Chile, have faced protest from the local community on using excessive water for lithium brine assets.

SQM, the world's largest Lithium producer, remains confident and will ramp up its production in future. A few projects from Albemarle are also expected in the years to come. Increased supply from recycled Lithium is set to increase the market outputs in the next 4-5 years.

Favourable reforms, advancement in technology and stable supply of commodities will decide the market dynamics for the Electric Vehicles and entire Mobility in general.