Earnings Season

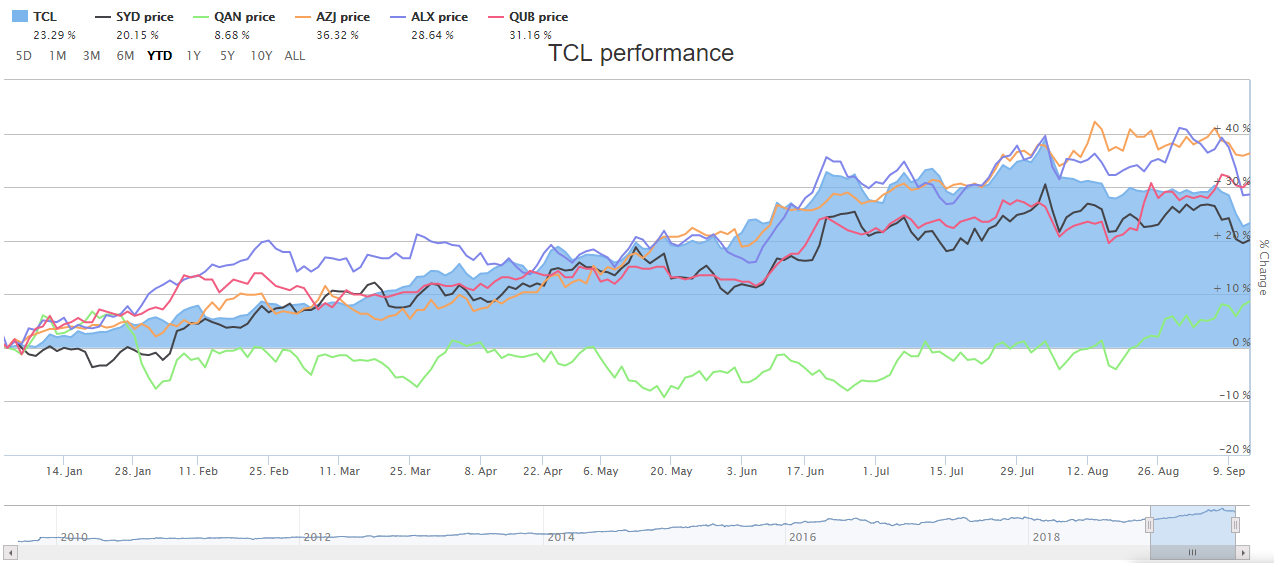

Transportation stocks are categorised under the Industrial sectors, and this article incorporates six of the transportation stocks from the ASX/S&P 200 index, ASX/S&P 200 Industrial index. The index has returned 17.56% over the year-to-date period. In the same period, it closed at higher at 7.087.7 on 2 August 2019 from 5,671.74 at the year end 2018.

| Stock | Period Close | Ticker | Latest EPS | EPS (PCP) | One Month Return | Three Month Return |

| Transurban Group | FY2019 | TCL | 6.6 | 22.7 | -6.01% | -2.13% |

| Qantas Airways | FY2019 | QAN | 54.6 | 54.4 | 8.87% | 10.02% |

| Aurizon Holdings | FY2019 | AZJ | 23.9 | 24 | -1.37% | 8.04% |

| Atlas Arteria | HY2019 | ALX | -12.8 | -2.3 | -4.78% | 3.46% |

| Qube Holdings | FY2019 | QUB | 12.3 | 12.5 | 6.15% | 12.33% |

(EPS in Cents/Security, Returns from ASX)

The companies in the transportation space have disclosed earnings for the period ending 30 June 2019. Among the six stocks, four had full-year close, and only Qantas Airways saw its EPS grew slightly in the FY2019.

Impairment caused Atlas Arteriaâs (ASX: ALX) loss to widen. Transurban Group (ASX: TCL) suffered a major decrease in the earnings caused by escalated expenses on acquisition, integration, finance costs, and D&A on new assets.

At the outset, the earnings have been broadly in line with the previous year, and five of the six stocks have positive returns in the last three month period. In the past one month period, only two stocks out of six have positive returns, being QAN & QUB.

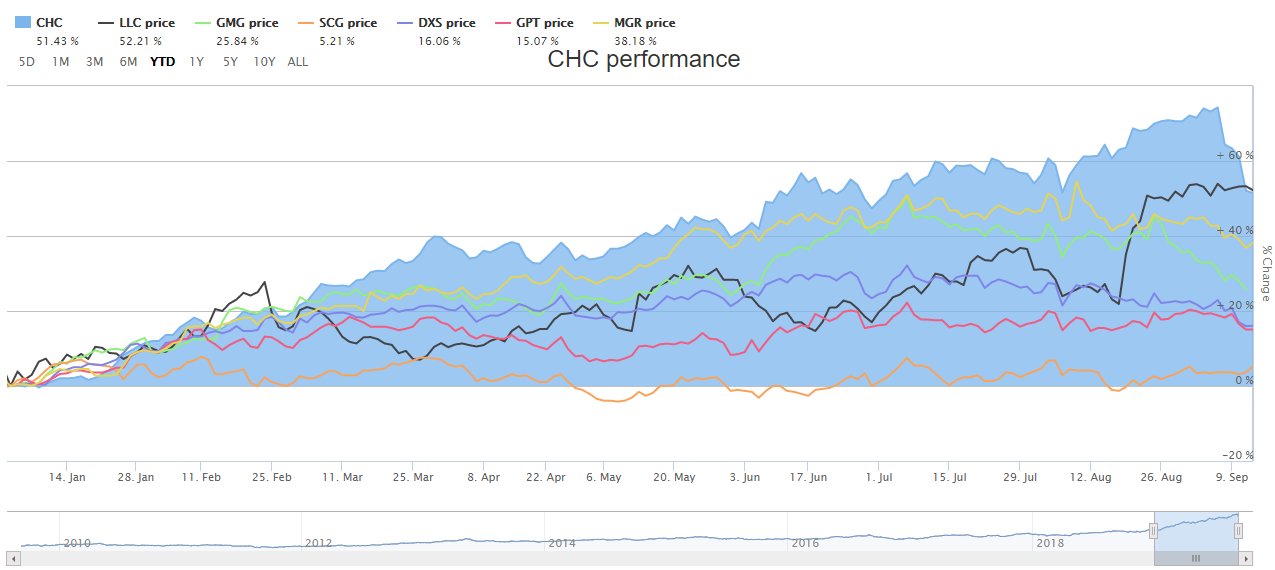

S&P/ASX 200 A-REIT is an index for REIT in Australia, the index hosts six of the seven stocks being discussed in this article under Real Estate stocks. On 13 September 2019, the index closed at 1,599.86 from 1,375.25 at the year end 2018, within this period, it reached a high of 1712.43 in early July 2019.

| Stock | Period Close | Ticker | Latest EPS | EPS (PCP) | One Month Return | Three Month Return |

| Charter Hall | FY2019 | CHC | 50.5 | 53.7 | -6.08% | 0.45% |

| Lendlease Group | FY2019 | LLC | 82.9 | 137 | 20.53% | 27.33% |

| Goodman Group | FY2019 | GMG | 89.9 | 61.1 | -10.93% | -6.86% |

| Scentre Group | HY2019 | SCG | 13.95 | 27.54 | 1.00% | 6.60% |

| Dexus | FY2019 | DXS | 124.54 | 169.95 | -8.88% | -9.02% |

| GPT Group | HY2019 | GPT | 19.5 | 40.3 | 0.33% | 0.66% |

| Mirvac Group | FY2019 | MGR | 27.6 | 29.4 | -6.75% | -3.49% |

(EPS in Cents/Security, Returns from ASX)

These seven stocks have mostly recorded decline in earnings in this reporting season, except for Goodman Group (ASX: GMG), which posted an increase in net profit of 48.2%, despite this, the stock has eroded investors wealth in the past one and three month period.

In a similar period, Lendlease (ASX: LLC) has returned positively despite falling profits. However, LLC has announced on market purchase of approx. 2.6 million securities, as well as, the company had sustained decent FUM growth.

Most of the REITs discussed here were adversely impacted by the relatively lower property revaluation gains in reporting while comparing property revaluation gains from the previous year. Similarly, the gains/profits were also lower from the equity accounted investments.

On the performance side, Lendlease outperformed all the seven stocks in the one month, and three-month period. GPT Group (ASX: GPT) has sustained a very low positive return in the last one month.

Transportation Stocks

In this industry group, the companies are involved in Air Freight & Logistics, Airlines, Marine, Road & Rail, and Transportation Infrastructure. Transportation stocks are categorised under the sector Industrials.

YTD Performance (Source: ASX)

Transurban Group (ASX: TCL) is down by 6.01% over the last one month. In FY2019, the companyâs profit was trimmed to $170 million against a profit of $468 million in the previous year. As a result, the earning per security was down to 6.6 cents compared to 22.7 cents a year ago.

As per FY 2019 investor presentation, the decrease in profits was attributed to acquisition costs, integration costs, increase in Depreciation & Amortisation on new assets, and an increase in net finance costs.

Sydney Airport (ASX: SYD) is a major constituent of the S&P/ASX 200 index and S&P/ASX 200 Industrial (Sector) Index. The group closed its half year end this June. Accordingly, the EBITDA of the group was down 25.4% to 465.1 million compared to 623.4 million in H12018. Besides, the group had expensed indemnities worth $181.7 million, which caused earnings to fall.

Qantas Airways Limited (ASX: QAN) has reported revenue growth of 4.9% in FY 2019 to $17,966 million from $17,128 million a year ago. Statutory NPAT was down 6.5% to $891 million in FY 2019 compared to $953 million in FY 2018. Basic EPS improved slightly to 54.6 cents in FY2019 from 54.4 cents in the previous year.

Aurizon Holdings Limited (ASX: AZJ) is an industrial freight & logistics operator. In FY 2019, the companyâs revenue was down by $207.5 million to 2,905.2 million. Profit after tax from continuing operations was down to $473.3 million from $560.1 million in FY 2018. Basic EPS for the period was 23.9 cents against 24 cents in FY2018.

Atlas Arteria (ASX: ALX) operate and develop toll roads globally. In the half-year ended 2019, the company witnessed decent growth in toll revenue and other revenue, which led to a total revenue of $86.06 million during half year compared to $59.56 million in the previous corresponding period.

In addition, the net loss after tax for the period for $87.5 million for the period compared to a loss of $15.5 million in the previous corresponding period. The increasing loss was majorly attributed to an impairment of $162.9 million.

Qube Holdings Limited (ASX: QUB) is a logistics solutions provider across the spectrum of import-export supply chain. In FY 2019, the company recorded revenue growth of 3.9% to $1,838.9 million in FY2019 compared to revenue of $1.770.1 million in FY2018. Besides, net profit after tax was down by 1.4% to $196.6 million for the period compared to $199.3 million in the previous corresponding period.

Real Estate Stocks

In Australia, there are a lot of ASX-listed REIT funds, and these funds are associated with property management, including acquisition, disposal, rental income from those assets, and fees charged by fund management business.

YTD Performance (Source: ASX)

Charter Hall Group (ASX: CHC) is one of the largest listed REIT operators in the country. In its FY2019 results, the group recorded growth of 31.1% in funds under management (FUM) to $30.4 billion from $23.2 billion in FY2018. CHCâs basic earnings per security were down to 50.5 cents per share or $0.505 in FY2019 compared to basic earnings per security of 53.7 cents in the previous year.

Lendlease Group (ASX: LLC) has more than doubled its FUM since 2014. In FY2019, the FUM grew by 17% to clock $35.2 billion compared to the previous corresponding period. Meanwhile, the basic EPS of Lendlease group was down to 82.9 cents per security from 137 cents per security in the previous corresponding period.

Goodman Group (ASX: GMG) has also reported full-year earnings, and property management income of the group was $469.7 million in FY2018 compared to 316.5 million in the previous corresponding period. Besides, the basic EPS during the period was 89.9 cents compared to an EPS of 61.1 cents in the previous corresponding period.

Scentre Group (ASX: SCG) in its half year disclosure has posted a net after tax of $744 million for the period ended 30 June 2019 compared to a profit of $1467.7 million a year ago. Basic EPS was 13.95 cents in HY2019 against 27.54 cents a year ago.

Predominantly the profit has been impacted by property revaluations, which were +$62.6 million for the period compared to +$883.2 million in HY 2018. In addition, property revaluations were in negative for equity accounted entities.

Dexus (ASX: DXS) has reported revenue of $795.1 million in FY2019 down by 5.4% from $840.6 million in the previous year. Net profit after tax for the period was $1,281 million compared to 1,728.9 million a year ago. Basic EPS was down to 124.54 cents per share compared to 169.95 cents in the previous year.

GPT Group (ASX: GPT) in its half-year results had recorded revenue and other income of $645.2 million, down 31.8% from $946.3 million in HY2018. Revenue was slightly up, but the fair value gain on investment properties, profits from equity accounted investments had dragged other income to lower levels. As a result, net profit after tax was $352.6 million for the half year period compared to $728.5 million in HY2018. Basic EPS was down to 19.5 cents from 40.3 cents in the previous corresponding period.

Mirvac Group (ASX: MGR) in its full-year ended 30 June 2019 recorded revenue & other income of $2,186 million, down 1% from $2,802 million in FY2018. Share of net profit of joint ventures was down to $69 million from $143 million in FY208. Net profit after tax was down by 6% to $1,019 million for the period compared to $1,089 million in the previous corresponding period. Basic EPS was down to 27.6 cents in FY 2019 compared to 29.4 cents in FY 2018.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.