Dividend stocks are the stocks that pay out dividends regularly and are deep-rooted companies that have a track record of giving earnings back to the shareholders. These stocks are ownership shares in a Company that distributes dividends and create a source of regular income for its shareholders. Investing in a dividend stock is one of the better options to build wealth in the long-term.

As coronavirus continues to spread across countries, investors fear the economic fallouts and market volatility that will arise with it. Markets particularly react to real and future risks much more rapidly than a virus can spread.

Global stock markets have gone for a beating, enticing investors to pull their money out of the markets. However, investors must try to build a portfolio for a longer-term and dividend stocks are a perfect bet to ensure a consistent income stream during uncertain times.

Let’s look at some of the stocks with a strong dividend history and whether there have been any changes to the dividend distribution practice given the unpredictable and unforeseen scenario the world is grappling with.

Washington H Soul Pattinson & Company Limited (ASX:SOL)

SOL has a diversified portfolio of uncorrelated investments across listed equities, private equity, loans, property, term deposits and cash. The Company has investments in zinc, copper, coal and gold mining activities, and telecommunications, among others.

The stock price of the Company fell from a high of $23.07 on 20 February 2020 to $16.660 on 13 March 2020 amidst the virus spread. SOL stock closed the day’s trade at $18.090 on 27 March 2020, down 8.312% compared to its previous close.

The directors of SOL announce interim and final dividends based on the Company’s regular cash inflows less regular operating costs. The cash inflows include dividends and interests from its investments, income on interest and gains on property assets.

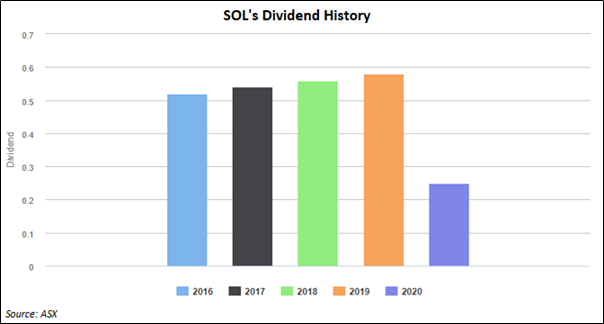

WHSP has a remarkable history of paying dividends to shareholders. It is one of only two companies in the All Ordinaries Index that increases ordinary dividends every year. The compound annual growth rate of WHSP’s ordinary dividends stands at 9% over the last 20 years.

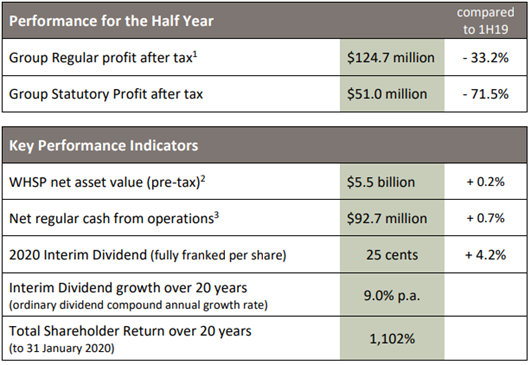

On 26 March 2020, the directors of SOL declared a fully franked interim dividend of 25 cents per share for the half-year ended 31 January 2020, an uptick of 4.2% over last year’s interim dividend of 24 cents per share. The record date for the dividend is 23 April 2020 with payment due on 14 May 2020.

The Company also announced its half-year results with a 0.3% increase in revenue from continuing operations. Net regular cash inflow was at $92.7 million for the period ended 31 January 2020 compared to $0.7 million over the first half of FY 2019. Continuous supply of cash returns enables the Company to provide increasing fully franked dividends to its shareholders.

The net regular cash inflow for FY20 is expected to be in line with last year.

Source: Company’s Half-Year Report

Rural Funds Group (ASX:RFF)

Rural Funds Group is the owner of a diversified portfolio of high-quality agricultural assets of Australia.

The stock price of the Company fell from a high of $2.08 on 20 February 2020 to $1.76 on 23 March 2020 amidst the virus spread. RFF stock closed the day’s trade at $1.925 on 27 March 2020, down 0.259% compared to its previous close.

Rural funds Management Limited (RFM), an entity of Rural fund Group detailed proposed an increase of the Guarantee to J&F Australia Pty Ltd. RFM reaffirmed its projections released on 02 March 2020:

- FY20 Adjusted funds from operations (AFFO) per unit of 13.5 cents to reflect an approved increase of $7.5 million for the remainder of FY20.

- FY21 distributions per unit (DPU) of 10.85 cents, up 4% compared to last year

- FY21 DPU of 11.28 cents, up 4% from last year

On 02 March 2020, an unfranked dividend for the Group was announced at $0.027118 per share. RFF declared its ex-dividend date as 30 March 2020 with payment of dividend date as 30 April 2020.

Brickworks Limited (ASX:BKW)

Brickworks Limited is engaged in manufacturing and distributing building products for both commercial and residential markets.

The Company has been surrounded by significant uncertainties due to the coronavirus pandemic, which continues to spread rapidly across the globe.

The stock price of the Company fell from a high of $20.6 on 24 January 2020 to $14.5 on 16 March 2020 amidst the virus spread. The stock hit its 52-week low price of $13.480 on 27 March 2020, a decline of 10.432% from its previous close.

“Rising rental income from the Property Trusts and trustworthy dividends from WASHINGTON H SOUL PATTINSON & COMPANY LIMITED (WHSP) has helped the Company’s directors in improving confidence to increase dividends and support shareholders during tough times”, stated the Chairman of Brickworks, Mr Robert D. Milner.

The Company announced an interim dividend of $0.200 (fully franked) on 26 March 2020, with a record date of 14 April 2020 and payment date of 05 May 2020. The interim dividend was up 5% aided by BKW’s diversified portfolio and a robust balance sheet.

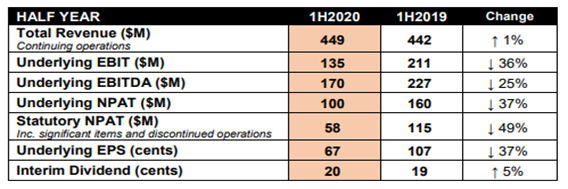

In its 1H20 trading update of 26 March 2020, Brickworks announced underlying Net Profit After Tax from continuing operations of $100 million for the half-year ended 31 January 2020, down 37% from the corresponding prior period. The statutory NPAT was $58 million, down by 49%.

Source: BWK Half-Year Results Report

The Directors declared a fully franked interim dividend of 20 cents per share, an uptick of 1 cent or 5% compared to prior equivalent period. The record date for the interim dividend is 14 April 2020 with payment on 5 May 2020.

Significant progress was made on several key initiatives during the first half of FY20, despite a fall in earnings compared to record profits logged in the prior period. The firm believes that its robust balance sheet and diversified portfolio of investments make it resilient to overcome any downturn in the business in the months ahead. It has an excess of $290 million in funding headroom, based on committed debt facilities and cash on hand.

However, critical medium-term supply chain risks are inevitable in the coming months. To preserve cash, all non-contracted capital spend and non-essential expenditure has been delayed while employees can utilise accrued leaves to take time off work where possible.

Hence, Brickworks has withdrawn its previous outlook statements and will not be able to provide earnings guidance due to uncertainty on the extent and duration of the virus.

_09_03_2024_01_03_36_873870.jpg)