If you want to invest in the stocks, you must be aware of the positive and negative results of the investment. Investing across different class of assets, sectors and geographies help the investors to manage their risks effectively. It helps to narrow down the range of outcomes between expected and the best return. Also, it helps to reduce the dependency on any one investment.

Investment across different classes - A Good Choice

Investment throughout several classes like native and global market securities, aid in cutting down the risk by allocating the resources into different sectors. Sometimes, investment does not perform in the way one had anticipated. Diversified stocks help an investor to not rely on a single source of income thus, creating more returns from several other investments. It helps an investor achieve a positive return on investments, when one of the investments provide a negative return than the other.

Some of the investors save their capital for further investment, and the diversified stocks help them to preserve rather than just focus on the rate of return on the investment. In the stock market, return on the capital employed may be measured by the profitability of the business. If the company follows the best practices, declares dividends to its shareholders and shows the positive side of the business, it is one of the best choices for an investment.

An upward trend in the S&P / ASX 200 index could be seen on 23 September 2019. The S&P/ASX 200 index was trading higher at 6,751.6 points, with a rise of 0.3% (at AEST 1:34 PM).

In this article, two stocks from the two different sectors have been discussed that are up on ASX charter (as on 23 September 2019). Let us have a look at their recent updates.

CSL Limited

CSL Limited (ASX: CSL), established in 1916, is engaged in the manufacturing, research and development, commercialisation as well as distribution of biopharmaceutical and related products. CSL has facilities in the regions like Switzerland, United States, Australia, Germany and the UK. The company has key operating divisions namely, CSL Behring, CSL Intellectual Property and Seqirus.

Recent updates

On 12 September 2019, the company declared a dividend of US$1.00, (~A$ 1.48), with respect to the six months period ended 30 June 2019. This takes the total full year dividend to US$1.85 per share, up 8% (A$ 2.68 per share at CC, up 18% on FY18). The following dividend is to be paid on 11 October 2019.

On 6 September 2019, CSL has announced the change in one of its directors- Robert Andrew Cuthbertson interests in the company with the acquisition of 4,348 ordinary shares on 2 September 2019. The number of securities held after the change were 89,182 ordinary shares, 11,389 performance rights (unchanged), and 10,930 performance share units.

Additionally, the other director- Paul Perreault interests in CSL also changed with the acquisition of 22,375 ordinary shares on 2 September 2019. The number of shares held after the change were 133,381 ordinary shares, 51,727 performance rights, 163,514 performance options and 54,113 performance share units.

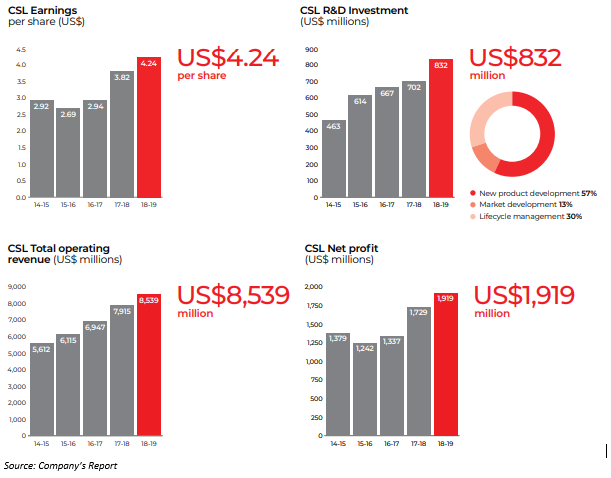

Financial Highlights for FY 2019

On 6 September 2019, CSL declared the full year report, for the period closed 30 June this year. Some of the highlights are as follows:

- The companyâs revenue increased by 11 per cent to US$8,539 million compared to the previous corresponding year

- Net profit after tax increased by 17 per cent to US$1,919 million compared to pcp.

- Consistent solid growth rate of immunoglobulin and albumin therapies.

- Opening of 30 new plasma collection centres in the United States.

- Net cash flow from operating activities stood at US$1,644 million.

Outlook

Going forth in FY20, the company expects net profit after tax to be somewhere between US$2,050 â US$ 2,110 million at the rate CC2, which would be a growth of ~ 7 per cent â 10 per cent over FY19, considering the financial headwinds created due to recent transition to a new model of CSL directly distributed across China.

Stock Performance

The stock of CSL was trading at $236.970 on 23 September 2019 (AEST 2:14 PM), edging up by 1.053 per cent. The company has a market cap of $106.43 billion and approx. 453.85 million outstanding shares. The 52-week high and low value of the stock is at $242.100 and $173.000, respectively. The stock has generated a positive return of 20.60 per cent in the last six months and 26.50 per cent on a year-to-date basis.

Woolworths Group Limited

Woolworths Group Limited (ASX:WOW) operates in general merchandise, supermarkets and consumer stores and procurement of food, liquor and products in the region of Australia and New Zealand with ~ 3,000 stores . The company had approximately 201,000 team members serving 29 million customers across various brands every week. The company runs hotels which comprises of food, accommodation, pubs and gaming operations. It operates majorly through three segments- Australia food, News Zealand Food and Endeavour Drinks.

Recent Updates

On 20 September 2019, WOW updated on the earlier declared fully franked ordinary dividend of A$ 0.57 per share pertaining to the period closed 30 June this year. It is payable on September 30, 2019, with an ex date of 3 September this year and record date of 4 September this year.

Recently, WOW released a notice with regards to the change of one of the directorâs Gordon Cairns interest in the company on 17 September 2019. The number of securities held after the change were 28,058 Shares held for Mr Cairnsâ superannuation fund and 5,171 shares held under the NED plan. The director acquired 678 NED share rights at a value/consideration of $24,972.64.

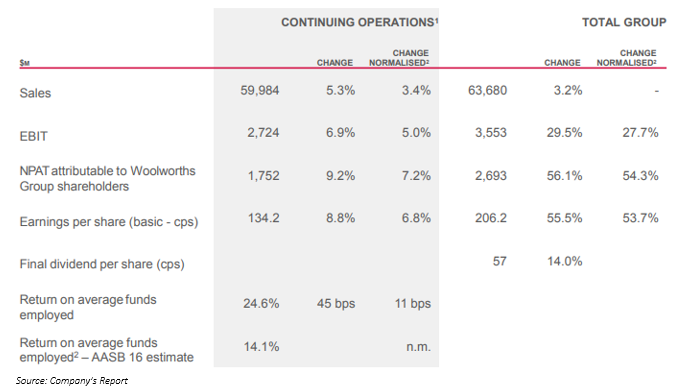

Financial Highlights for FY 2019

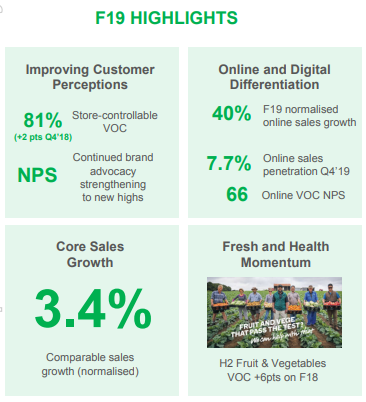

WOW declared annual report on 29 August 2019, for the period closed 30 June 2019. The highlights of the same are as follows:

- The companyâs sales from continuing operations were increased by 3.4 per cent to $59,984 million compared to previous corresponding year.

- EBIT from continuing operations rose to $2,724 million compared to pcp.

- Net profit after tax from continuing operations grew by 7.2 per cent to $1,752 million.

Segmental Reporting â Australian & New Zealand Food

Australian Food

- Sales for this segment improved by 5.3 per cent to $39,568 million compared to pcp.

- EBITDA was increased to 7.5 per cent to $2,613 million.

- EBIT rose by 3.8 per cent to $1,857 million.

New Zealand Food

- Sales for the segment witnessed a change of 4.3 percent to $6,712 million compared to PCP.

- EBITDA was reflected a change of 3.0 per cent to $425 million.

- EBIT saw a 3.9 percent change to $296 million.

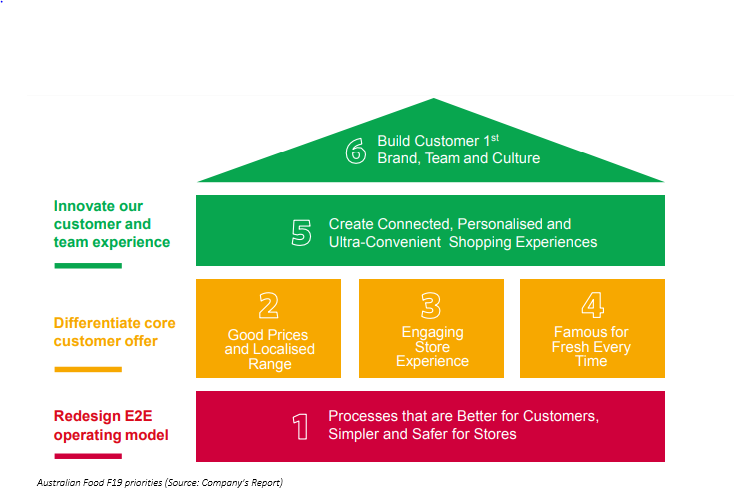

Outlook

The companyâs online sales in the Australian Food segment is expected to continue to grow stronger, together with an increase in the roll out of Metro store. While the New Zealand food segment, is focused on providing fresh quality and experience to the consumers. CountdownX and Endeavour drinks are expected to continuously improve and innovate customersâ digital experience. Further, in FY20 period, decrease in losses are anticipated as BIG Wâs turnaround continues, and unprofitable stores are shut down.

Stock Performance

The stock of WOW was trading at $37.640 on 23 September 2019 (AEST 03:16 PM), higher by 0.561 per cent. The company has a market cap of $47.11 billion and approx. 1.26 billion outstanding shares. The 52-week high and low value of the stock was noted at $38.100 and $27.030, respectively. The stock has generated a negative return of 23.08 per cent in the last six months and negative return of 28.40 per cent on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.