The Australian dairy industry makes an important contribution to the economy as the country is a significant exporter of dairy products. However, the Australian dairy farm income can vary year to year due to the cost of farm inputs, the effects of fluctuating seasonal conditions on milk production and the variations in world prices for traded dairy products.

As per the official estimates, the average farm cash income of dairy farms dropped from ~$125k per farm in 2015â16 to ~$89k in 2016â17. According to the Australian Bureau of Agricultural and Resource Economics, the average farm cash income for dairy farms is expected to be at ~$93k per farm in 2018â19. It is also anticipated that the average farm cash incomes in the dairy industry will fall in every Australian state in 2018â19 except Tasmania, owing to higher expenditure on purchased feed and lower milk production. The drought in south-eastern Australia is likely to be a major contributory factor for inadequate performance of the dairy industry during the year.

ASX-Listed Dairy Stocks

Although the average farm cash incomes are anticipated to decline in the next few years, the Australian agriculture sector has so far proven itself in providing multiple opportunities to investors to participate across the breadth of the sector. The dairy sector offers investors an exposure to a vital and vibrant part of the Australian economy.

Considering this, let us discuss few dairy stocks listed on the Australian Stock Exchange that will offer the investors an exposure to the diversified pool of dairy companies:

Synlait Milk Limited

New Zealand-based company, Synlait Milk Limited (ASX: SM1) produce a wide variety of nutritional milk products for its global customers. The production by the company involves a combination of state-of-the-art processing and expert farming.

Operational Performance

On 1st August 2019, the company informed that it has finalised the acquisition of the certain Talbot Forest Cheese assets. The acquisition involved plant and equipment, property of the Temuka site, and its consumer cheese brand.

Financial Performance

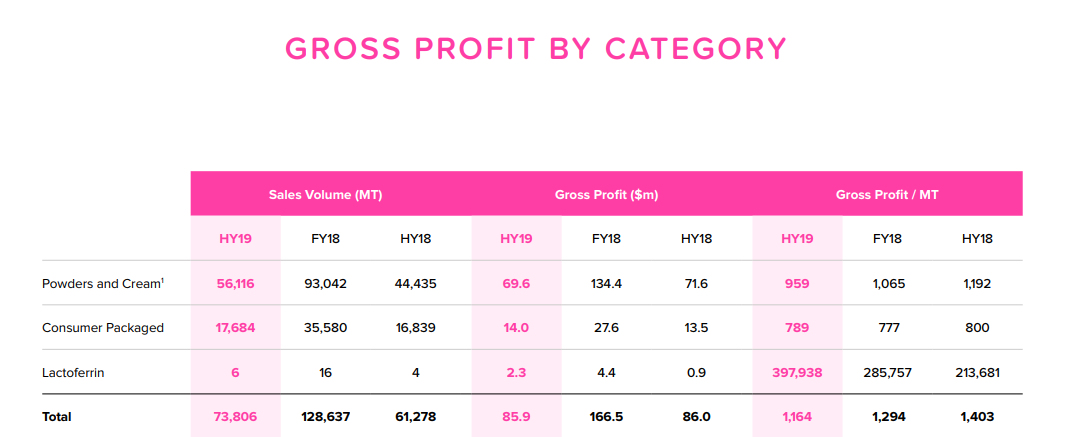

In 1H FY19, the company achieved NPAT of $37.3 million, which was 9.7 per cent less than the $41.3 million NPAT achieved in 1H FY18. The company notified that its canned infant formula volumes rose 5 per cent (pcp) in 1H HY19 to 17,684 MT. Also, the company processed 10.5 per cent more milk during the period, totalling to 90,495 MT relative to 81,828 MT in 1H FY18.

Source: Companyâs Presentation (20th March 2019)

Stock Performance

SM1 closed the trading session at AUD 9.240 with a rise of 1.53 per cent (On 9th August 2019). About 25k shares of the company traded on the ASX with a market cap of AUD 1.63 billion. SM1 has delivered a return of 6.56 per cent on a YTD basis and a negative return of 4.01 per cent during the last six months.

Bubs Australia Limited

Bubs Australia Limited (ASX: BUB) produces goat dairy products in Australia, utilising the milk supply from the major milking goat herds of the country. The company also produces the only infant formula across the globe, which is made from 100% Australian goat milk.

Operational Performance

The company published its fourth quarterly report on 29th July 2019 on the ASX. The report highlighted that the companyâs fourth-quarter sales figures surpassed the values of the full year in 2018, with a 56 per cent uplift in group sales. The sale of its Infant Formula, Organic Baby Food, Total Bubs® products and Adult Dairy products improved 341 per cent, 13 per cent, 236 per cent and 47 per cent on pcp, respectively during the period. The sale of the products in Australia also rose 127 per cent on pcp.

Financial Performance

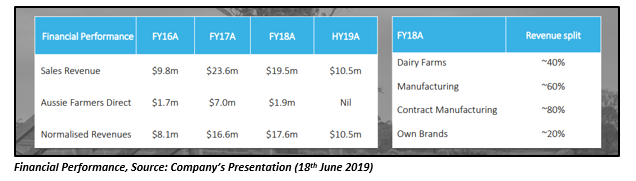

The company delivered the strongest quarterly financial performance in the June 2019 quarter, reporting the highest quarterly revenue on record of $18.46 million. The Q4 FY19 revenue also crossed the full year FY18 revenue figure. The company finished FY19 with $51.3 million of gross revenue, which was 179 per cent higher than the prior yearâs gross revenue.

Take a look at the key financial metrics reported by the company in the below table:

Stock Performance

BUB ended the trading session lower by 1.6 per cent at AUD 1.225, with ~2.6 million shares in rotation (on 9th August 2019). The stock reported a 52-week high and low value of AUD 1.615 and AUD 0.355, respectively. BUB has generated an enormous return of 173.63 per cent on a YTD basis.

Australian Dairy Nutritionals Group

A vertically integrated Australian dairy group, Australian Dairy Nutritionals Group (ASX: AHF) owns a processing facility and high-quality dairy farms located in South Western Victoria. The group is well-known for supplying premium quality branded dairy products utilising fresh milk sourced from its farms.

Operational Performance

On 31st July 2019, the group released its quarterly report for the June 2019 quarter that highlighted the strong sales performance of the group during the period. The group reported a 31 per cent rise in its gross receipts from customers from $4.753 million in pcp to $6.231 million in June quarter.

Financial Performance

During the half-year ending 31st December 2018, the group recorded a consolidated net loss of ~$1.19 million, attributed to its members after providing for income tax. However, its total income improved by 1 per cent during the period to ~$10.74 million from ~$10.63 million in pcp. This was a result of a $143k increase in revenue from the dairy farm segment and a $35k decrease from the dairy processing segment.

Stock Performance

On 9th August 2019, AHF closed the trade at AUD 0.135, up by 3.8 per cent relative to the last closed price. The stock has delivered a return of 8.33 per cent on a YTD basis; however, it has generated a negative return of 13.33 per cent in the last six months.

Beston Global Food Company Limited

The Australian dairy industryâs one of the largest companies, Beston Global Food Company Limited (ASX: BFC) aims to offer consumers with natural, organic, high quality, safe, clean, substantially different food and beverage products.

Operational Performance

In May this year, the company reported that its sales of Mozzarella were consistently greater than 500 MT per month. The company mentioned that the growth in sales was due to its commitment to the persistent pursuit of premium quality cheese products and its fully operational ground-level sales team in each Mainland State.

Financial Performance

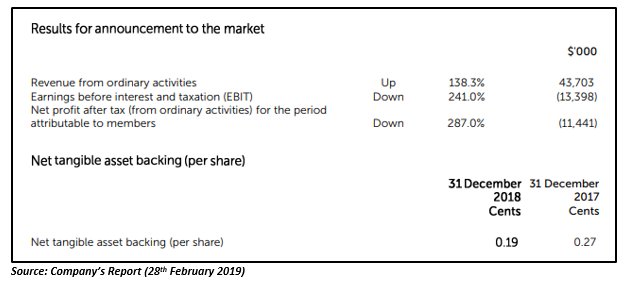

The company recorded a rise of 138.3 per cent in its revenue from ordinary activities to ~$43.7 million during the half-year ended 31 December 2018. However, the EBIT and NBAT of the company were 241 per cent and 287 per cent down, to ~$13.39 million and ~$11.44 million, respectively.

Stock Performance - BFC

On 9th August 2019, BFC ended the trade flat at AUD 0.099. About 156k shares of the company traded on the ASX with a market cap of AUD 43.89 million. BFC has delivered a negative return on a YTD basis and during the last six months of 34 per cent and 23.85 per cent, respectively.

Bioxyne Limited

An Australian health and wellness products company, Bioxyne Limited (ASX: BXN), focuses on clinically effective wellness and health products, predominantly in the immune health areas and the gut. The company is selling consumer health products globally for over 15 years.

Operational Performance

In its recently released quarterly report for the quarter ended 30 June 2019, the company mentioned that it was undergoing discussions with potential partners in China during the quarter regarding its intention to provide dairy formula-based products via wholesale channels. Also, the company informed about the acceptance of its dairy formula-based health supplement product, Mymana in Vietnam.

Financial Performance

The company announced a rise of 83 per cent in its revenue from continuing operations to $1.40 million during the half-year ending 31 December 2018. The Net loss of the company attributable to its members was also 72 per cent down on pcp to ~$202k.

Stock Performance

BXN traded last on 8th August 2019 at AUD 0.019 with a fall of 5 per cent. The stock has delivered a negative return of 42.42 per cent on a YTD basis; however, it has generated a positive return of 11.76 per cent in the last three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.