Australian Dairy Industry:

The dairy industry makes significant contribution to the Australian economy. In FY2018, the dairy industry accounted for ~ 7% of gross value of agricultural production and ~ 7% of agricultural export income.

Victoria is the largest milk producing region in the Australian dairy market. The region accounted for more than 60% of the total milk production in the country in 2017-18. The next in the list is New South Wales, which accounted for 12% of the total milk production and Tasmania, which captured a 10% share.

From 2000â01 to 2017â18, the total number of dairy farms in the country reported a decline of ~ 52%. Victoria accounted for most of the decline, due to a large number of farms in the region. However, the largest percentage decline was reported in Queensland.

During this period, the number of farms milking below 200 cows annually dropped by ~74%. The number of farms milking 200 to 350 cows also reported a decline initially but increased towards the end of the period. The number of farms milking more than 350 cows was relatively stable over the period.

US Farm Production Vs Australian Farm Production:

Australia and the US are into the production of many of the same commodities; however, the underlying climatic, geographic, policy as well as consumer factors impact the production levels. The total share of cattle and calf production as compared to the total value of agricultural production in Australia and the US almost stands at the same level.

In this article, we are discussing one consumer staples sector player that is engaged in the dairy farming business- Wattle Health Australia Limited (ASX: WHA), which aims to make the sustainable goodness of natural and organic health as well as wellness products (Australian) reasonable and broadly available to families across the globe. The company aspires to become an internationally recognised player, catering organic products with superior quality that promote health and wellness at all stages of life.

Products:

Collaboration Agreement with Nouriz:

On 4 November 2019, Wattle Health Australia Limited announced to have inked a collaboration agreement with Nouriz (Shanghai) Fine Food Co. Ltd., supported by a Beijing-based state-owned enterprise, China Animal Husbandry Group (CAHG). Nouriz (Shanghai) Fine Food Co. Ltd. sells its branded nutritional products, including infant formula through extensive distribution channels within China. The products developed by Nouriz are customised to meet the requirements of its Chinese customers.

As per the agreement, the company and Nouriz will establish an equal joint venture, engaged in the production of several certified Australian organic nutritional dairy items. The products, obtained from the Corio Bay Dairy Group (CBDG), will be sold by the JV in the Chinese market. Through this JV, WHA and Nouriz will look for more opportunities to take advantage of the unique products made by CBDG.

The partners will also progress towards the formation of an Australia-based JV and use skills to execute sales and marketing strategies for a new joint brand of certified Australian organic powder products into China.

The agreement will open channels and distribution networks for WHA into China, which is the largest nutritional dairy products market in the world.

Quarterly Report (Period Ended 30 September 2019:

On 31 October 2019, WHA released its September 2019 quarter results for the period ended 30 September 2019. The company, during its third quarter, made significant progress towards its journey of becoming one of the leading organic dairy product suppliers in Australia.

- During the period, the company launched its new premium brand, Uganic, in Australia. The product was launched using a multi-channel branding and promotional strategy via radio, broadcast video on demand, billboards and digital campaign.

- Construction of the first dedicated organic nutritional spray dryer of Australia at Corio Bay is under progress and is expected to complete in the first half of 2020.

- CBDG management, as well as the operational team, got strengthened during the period with the two senior appointments, Technical Manager and Development & Quality Manager. Uday Joshi joined the company as Technical Manager, with over 13 years of experience in the dairy industry. Teguh Jodjaja joined the company as Development & Quality Manager and has around 10 years of experience in the dairy industry.

- WHA continues to progress towards completion of the acquisition of a majority stake in leading CNCA accredited manufacturing facility, Blend and Pack (B&P).

- Initiated legal action in India against Vasudevan and Sons Exim Private Limited (VSEP) with respect to the supply agreement between the companies. WHA, through its legal advisers in India, issued a letter of demand to VSEP. However, it did not receive any response from VSEP and is evaluating its position now.

- WHAâs balance sheet was healthy during the quarter with net cash at bank of ~ $18.5 million with zero debt.

- Sales during the quarter were low as a result of a delay in the production of Uganic. With the increase in the brand awareness and distribution channel, the company expects that its sales would improve quarter on quarter.

- The company used $2,484,945, $6,087,718 and $18,518 in its operating, investing and financing activities, respectively, during the quarter.

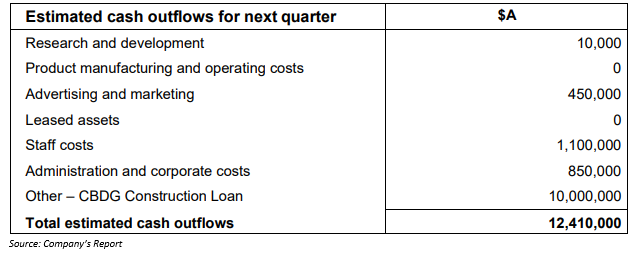

- Total cash outflow in the December 2019 quarter is expected to be $12,410,000.

Stock Information:

The shares of WHA at present are under a trading halt, pending an announcement pertaining to an update with respect to the proposed acquisition of majority stake in Blend and Pack. The shares traded last on 27 September 2019 at $0.530. WHA has ~ 194.5 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.