The Australian Government on 7 February 2020 has provided a summary which gives the latest update on novel coronavirus in Australia. As of morning, on that date, there were 15 cases of 2019-nCoV which has been confirmed in Australia. Out of these 15 cases, 5 was from Queensland, 4 from New South Wales, 4 from Victoria and remaining two from South Australia. All of these cases reported in Australia came from Wuhan except the one in New South Wales, where it was due to contact with a confirmed patient in Wuhan.

On a global scale, there are around 37,562 confirmed cases of 2019-nCoV. 813 occurrences of death have also been reported. The International Health Regulations Emergency Committee of the World Health Organization has declared the coronavirus outbreak as a Public Health Emergency of International Concern.

Actions taken in Australia:

- Australian Health Protection Principal Committee (AHPPC) meets on a daily basis to make a recommendation to adapt Australia’s responses to the 2019-nCoV outbreak.

- Australia has border vigilance, isolation, surveillance and case tracing mechanisms. The health emergency response arrangements are flexible & scalable and can be customised according to the case and awareness about the virus and how it spreads.

- Australians are being made aware of the coronavirus based on the most recent medical advice.

- Department of Foreign Affairs and Trade (DFAT) has issued a red alert for those travelling to mainland China.

As per the advice of the AHPPC & the Communicable Diseases Network Australia, below are the travel limitations applied by the Prime Minister to an individual who enters Australia having departed from mainland China post 1 February 2020.

- Foreign nationals who are in mainland China could not enter the country until 14 days after they have left or transited via mainland China.

- Australian citizens, permanent residents & their direct family would be able to enter the country, along with airline crews who have been using a proper personal protective kit.

- Other than this, if any individual has travelled to Hubei Province within the past 14 days is required to remain isolated for 14 days after leaving Hubei Province.

- In case, any individual has left or transited through mainland China on or after 1 February 2020, he is required to remain isolated until 14 days after leaving China.

- If the individual was in close contact with the coronavirus suspect, he is also required to be isolated for 14 days after last interaction with a confirmed case.

Australian Government, along with Qantas together are making efforts to bring back Australian citizen who wish to leave Wuhan.

In this article, we would take a look at two stocks under the impact of coronavirus.

Kathmandu Holdings Limited (ASX: KMD)

Kathmandu Holdings Limited (ASX: KMD) is the retailer of clothing and equipment for travel and adventure. Travel is a part of Kathmandu’s culture. Since 1987, the company have been designing gear to take on New Zealand and the world.

The apparel of KMD is designed for travel & outdoor adventure which enables the user to pack less and do more.

On 7 February 2020, Kathmandu Holdings Limited released its trading update and provided profit guidance for 1H FY2020 ended 31 January 2020.

- Group underlying EBIT for 1H FY2020 is expected to be up by ~ 40% as compared to the previous corresponding period after the successful acquisition of Rip Curl.

- The result includes three months of Rip Curl results from 1 November 2019 to 31 January 2020.

Outdoor:

- Kathmandu attained store sales progress of more than 1.5% for the 26 weeks ended 26 January 2020.

- There was an increase in online sales by more than 30% in 1H FY2020 supported by improvements made to the online platform during 1H FY2019.

- Gross margin is 1.4% less than 1H FY2019 because of the impact of YoY foreign currency movement.

SURF:

- Rip Curl total sales for the 3 months of KMD’s ownership are projected to be more than 2.7% above the comparable three-month period of the previous year.

- Direct to consumer same store sales have gone up by more than 2.6% from 4 November 2019 to 26 January 2020.

Coronavirus Update:

The Group obtain products from various range of markets all over Asia. The company is actively examining any impact on its supply chain due to the Coronavirus outbreak in China.

In the short term, there is no anticipated material supply disruption because of adequate inventory levels along with the longer stock turning nature of technical product classes. Additionally, the impact on consumer demand across the Group at present is not considerable. Also, the Group has mitigation plans in case of continued interruption to its Chinese suppliers.

Stock Information:

By the end of the trading session, KMD shares were quoted on ASX at $3.410 on 10 February 2020, down 3.672% from its previous close.

Crown Resorts Limited (ASX: CWN)

Crown Resorts Limited is one of the largest entertainment groups in Australia. It has a major contribution to the Australian economy because of its role in the field of tourism, employment, training, along with its corporate social responsibility programs.

The core business and investment of the company are in the integrated resorts sector. The company owns as well as operates the two leading integrated resorts in Australia, namely Crown Melbourne and Crown Perth.

There are two projects in the pipeline- Crown Sydney Hotel Resort in Sydney & the One Queensbridge development site in Melbourne.

Tourism Statistics of 2019:

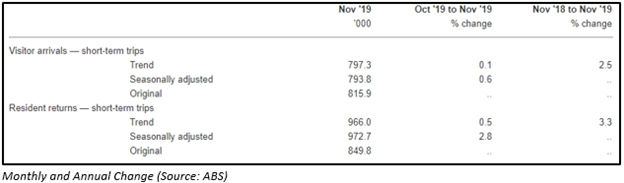

In 2019, more than 9 million visitors visited Australia from July 2018 to June 2019. A report released by ABS on 16 January 2020 related to the arrival and departure of travellers. Below are the stats for the month of November 2019:

Recent Announcement:

Crown Resorts Limited (ASX: CWN) referring to the announcement made on 31 May 2019 & 29 August 2019 regarding the entry into the Share Sale agreement related to the sale of 19.99% of issued capital of Crown to Melco Resorts & Entertainment Limited (Melco Resorts) by CPH Crown Holdings Pty Limited has provided further update on that agreement. CPH Crown Holdings Pty Limited is a 100% owned subsidiary of Consolidated Press Holdings Pty Limited.

CPH Crown Holdings Pty Limited has informed the company that CPH Crown Holdings Pty Limited & Melco Resorts have signed an agreement to end the obligations under the Share Sale Agreement related to the end of the sale of the second tranche of Crown shares.

Brief About the Deal:

On 31 May 2019, Consolidated Press Holdings Pty Limited announced that it sold its part of shareholding in Crown Resorts Limited for diversifying its investment portfolio in CPH for $1.76 billion. The first tranche of the payment was completed in June 2019 while the second tranche was subjected to written notice from several regulators appropriate to handle casino business.

Probable Reason for Deal Termination:

The probable reason for the termination of the deal is the coronavirus outbreak followed by the government restriction, which has resulted in the number of tourists visiting Australia to a sharp decline.

Also, Melco Resorts & Entertainment Limited (Nasdaq:MLCO) also announced on 6 February 2020 that as a result of coronavirus epidemic, which includes severe fall in tourism in Asia to the Integrated Resort facilities in the region, the company is reassessing the viability of all its non-core investments in the region. It also highlighted on the latest decision by the Macau SAR government to shut all casinos in Macau. Based on this, Melco has decided to re-evaluate all non-core investments scheduled in 2020.