Copper prices are finally recovering across the global front as more and more stimulus packages are getting announced to boost global economic conditions, and as the International Monetary Fund anticipated, the upcoming policies by various Federal Governments across the globe would now determine the shape of overall economic activities worldwide.

While the future of global demand is yet uncertain, the ongoing recovery across the base metals such as copper, nickel, is reflecting some of the recent developments, in particular, the resumption of infrastructure sector in China and day-to-day economic activities.

Copper futures (CFD) on the Chicago Mercantile Exchange are on recovery from its recent low of USD 4,371.00 (intraday low on 19 March 2020) and has reached to the level USD 5,238.25 (as on 17 April 2020 1:36 PM AEST), reflecting a percentage change of ~ 19.84 per cent, and while the commodity is showing some steam, many independent forecasters anticipate a much higher recovery in price over the long-run.

The Department of Industry, Innovation and Science (or DIIS) estimates the copper price to average around USD 5,990 per tonne by next year while rising with an average of 2 per cent each year to reach USD 6,900 per tonne by 2025.

In the wake of higher price, the export from the continent is also projected to surge and stand at 1.1 million tonnes (in metal context terms) by 2024-2025, and exports earnings are anticipated to grow from USD 10 billion in 2018-2019 to $13 billion in 2024-2025.

The ASX-listed copper mining companies would be the ultimate driver of the 30 per cent rise in export revenue ahead. As copper prices would increase, the ASX-listed copper mining companies are anticipated to devote significant resources to top the game.

ASX-listed Copper Mining Companies

- OZ Minerals Limited (ASX:OZL)

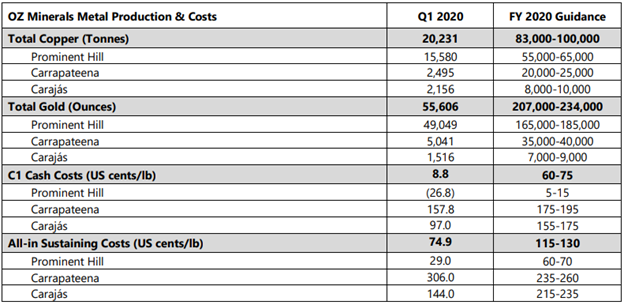

OZ Minerals recently announced its first-quarter production figures for the period ended 31 March 2020 and reported production of 20,231 tonnes of copper from its Prominent Hill, Carrapateena, and Carajás prospects.

The Company also reported production of 55,606 ounces of gold for the period, a commodity which is currently under a bull run.

To Know More, Do Read: Gold Shatters 7-Year High, Joy Ride Coming For ASX-listed Gold Stocks?

OZL suggested that the Company delivered a strong gold production with negative C1 costs, and the copper production for the period was in-line with the plan and in tandem with the FY2020 production guidance of 83,000-100,000 tonnes.

The cash cost for the Prominent Hill stood at -USD 26.8 per pound, while the overall cash cost for the period stood at USD 8.8 per pound.

The production and cost snippet for the period is as below:

(Source: Company’s Report)

OZL further suggested that it made significant progress at the Carajás Hub, and also mentioned that the decline development at the Pedra Branca is on track. The Company installed ore sorting at Antas and prepared first concentrate parcel for transport via Vale logistics network.

Oz also mentioned that there had been no material production impacts experienced at its mine site; however, the miner deferred ~ $150 million of 2020 capital and operating costs post conducting a review on the business amidst COVID-19 outbreak.

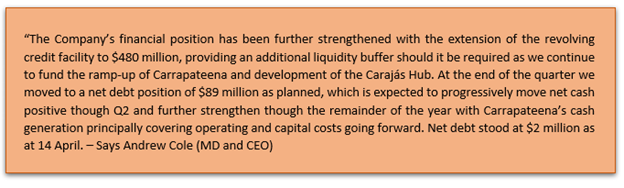

The Company suggested that all operations are on track for 2020 production guidance based on current operating conditions. The revolving credit facility of the miner surged to $480 million to boost the liquidity, and the Company ended the first quarter with net debt of $89 million.

OZL further anticipate moving net cash positive through the second quarter and the remainder of the year. The net debt as on 14 April 2020 stood at $2 million.

The stock of the Company last traded at $8.940, down by 0.77 per cent against its previous close on ASX.

- Sandfire Resources Limited (ASX:SFR)

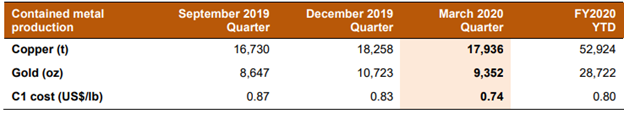

SFR recently announced its March 2020 quarterly production figures and reported a cooper production of 17,936 tonnes, down by ~ 1.76 per cent against the previous quarter; however, the cash cost of the miner declined as well by ~ 10.84 per cent against the previous quarter to stand at USD 0.74 per pound during the period.

The snippet of production and cash cost for the period is as below:

(Source: Company’s Report)

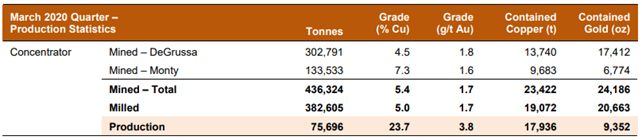

The mine production for the period stood at 436,324 tonnes with production sourced from all lenses at the DeGrussa Copper-Gold Mine, which mined 302,791 tonnes at an average grade 4.5 per cent of copper and from the Monty Copper-Gold Mine, which mined 133,533 tonnes at an average grade 4.5 per cent of copper.

During the quarter, the Company milled a total of 382,605 tonnes of ore at an average feed grade of 5.0 per cent of copper, with recovery average of 94.0 per cent.

(Source: Company’s Report)

SFR shipped a total of 73,945 dry metric tonnes of concentrate during the period, containing 17,564 tonnes of copper, out of which 6,801 tonnes is payable. The Company also shipped 9,226 ounces of gold during the quarter, out of which 8,369 ounces is payable.

The Company has withdrawn its production and cost guidance for FY2020 in the wake of the COVID-19 outbreak and suggested that to date, production and costs have remained broadly in line with the previous guidance of 70-72kt of contained copper and 38-40koz of contained gold.

On the development counter, SFR suggested that it has made excellent progress with permitting at the Black Butte Copper Project in Montana and had issued an EIS or Environmental Impact Statement during the quarter. By the end of the period, SFR also released Record of Decision (or ROD), which would now represent the final permitting requirements for the project development, post which, SFR would proceed with a Feasibility Study.

Over the exploration counter, the Company continued multi-pronged exploration programs across the Greater Doolgunna Project and completed an extensive reverse circulation, diamond, and air core drilling during the period at the Morck Well, Cheroona and Springfield Projects.

The stock of the Company last traded at $4.250, up by 1.43 per cent against its previous close on ASX.