Summary

- High prices and increased domestic demand for meat boosted the revenues of Muyuan Foods, largest pig farmer of China. With most of its facilities self-owned, better hygiene and safety measures at facilities led to smooth business flow amid the pandemic

- Australian Pork industry is exposed to industry threats such as African Swine Flu, falling demand from food services and international issues, creating a supply-demand gap.

- While leading pork producers have been able to maintain business continuum on the back of strong cash position and ability to invest for business safety, trends in the space are closely monitored. Latest being China reportedly halting purchase of soybean and pork from the US.

In response to the US threat on removing special treatment for Hong Kong including export controls and extradition treatment, China has suspended domestic purchases of US pork and soybeans, apart from cotton and corn. Besides, China is prepared for more stringent import controls on the US farm goods, if the US retaliates.

China depends heavily on pork imports to meet its domestic demand. With the coronavirus pandemic disrupting the supply chain of meat producers, a dearth of international pork supply has led to a supply-demand gap in the Chinese meat industry.

While internationally pork prices remain low, domestic pork prices in China remained high because of the shortage of meat created due to African swine fever. High prices coupled with high domestic demand for pork created a win-win situation for many well-established pig farmers, including, Muyuan Foods, Chinese largest pig farmer.

Large pig farmers have an edge over small players as most of their facilities are self-owned, leading to better control of their facilities with respect to adhering safety and social distancing regulations. With better hygiene and safety measures at its self-owned facilities, Muyuan Foods has been able to run its business better during the pandemic and have boosted its revenues by leveraging the prevailing higher prices of pork.

Also Read: China Pork Import Surmounts Post African Swine Fever Slashes Domestic Output

Lens over Australian Pork Industry

Australian pork industry is also subject to national and international uncertainties. Threat from African Swine Flu, lower prices due to battered domestic demand from restaurants, disrupted supply chain in the meat industry and Chinese suspension on meat imports amid coronavirus have created a supply-demand gap for pork meat, affecting the Australian pork producers. Besides, small farmers do not have the financial edge to beat all the odds and perish amid such economic uproar.

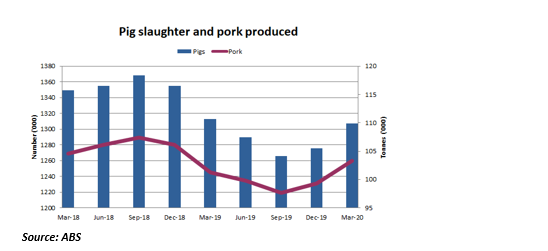

Notably, 1.3 million pigs were slaughtered in Australia in March 2020, representing an increase of 2.4% compared to December 2019. Production of pork also increased by 4.1% to 103,300 tonnes.

However, big commercial farms who have strong cash position are better positioned to survive by investing in safety practices and measures to run their business more efficiently and by serving the local domestic demand for meat.

Let’s dig dipper to understand how pork producers are enduring industry threats and pandemic blues.

Threat from African Swine Flu

According to Margo Andrae, CEO of Australian Pork Limited, Australia is currently trying to protect its $5.3 billion pork industry from the African Swine Flu (ASF) that wreaked havoc in the pork prices during Christmas of 2019.

The Government has increased vigilance to stop illegally imported infected pig meat and preventing pigs from ASF infected food in southern Australia by strengthening on-farm biosecurity at their piggeries.

Plummeting pork price amid outbreak

Around 25% of all Australian pork sales are dependent on the foodservice sector that offers range of pork dishes to consumers. The COVID-19 restrictions have disrupted the foodservice industry and its supply chain, creating a dip in the pork prices.

While, exports to Singapore, Hong Kong and Vietnam also trigger pork prices as exports are important in maintaining supply balance in the domestic market during COVID-19 restrictions.

However, with the economy set to open in phases which will also include malls and restaurants, the food service sector may recover and thus create more demand for Pork.

Chinese suspension on meat imports

Chinese suspension on meat imports from major Australian meat suppliers has added to supply of meat at domestic level. The suspension was reported to be on account of inappropriate labelling and health certificate requirements and affected four Australian meat establishments, although analysts are anticipating virus spat angle in this.

Also Read: Australia’s Meat Industry and the Disruption in the Plant-based Space

Local demand acts as silver lining

As Australians restrict themselves to home, the restaurant industry is experiencing a sharp downturn, pushing meat producers including pork producers to meet the demand at supermarkets and butchers.

Australian domestic pork producers are engaged in meeting the local demand and stay afloat by beating supply chain disruptions. With international trade affected due to coronavirus restrictions, Australians are more depended on the local meat producers.

While the pork producers fall under the Consumer Staples industries that tend to be less affected by economic cycles, the resilience of the space amidst current demand pressure and supply constraints make it an interesting one to watch out for.