Centuria Metropolitan REIT (ASX: CMA) is a listed property trust, allowing investors to grow money with underlying investments in commercial properties. Its portfolio of properties comprises of assets from the various cities in Australia, including Sydney, Melbourne, Brisbane, Perth and Adelaide.

Institutional Entitlement Offer and Placement

On 19 September 2019, CPFL or Centuria Property Funds Limited, a responsible entity of CMA notified the market, that it has concluded the Institutional Entitlement Offer and Institutional Placement to raise ~$273 million (as notified on 18 September). The Institutional Placement raised around $141 millionand the Entitlement component of the 1 for 10 accelerated non-renounceable offer which raised ~65.4 million.

Further, the retail component of the entitlement offer would open on 24 September 2019 and is anticipated to raise ~36.5 million. The Equity Raising consists of placement of $30 million to Centuria Capital Group, which depends on CMA security approval.

On 18 September 2019, the securities of CMA were placed in trading halt on ASX as per its request, pending on release of an announcement about the outcome of the institutional component of the accelerated entitlement offer. Subsequently, the property trust released a series of announcements related to the developments taking place in the company.

Acquisitions

Reportedly, the trust is set to acquire interests in two office properties in central business districts of Sydney & Perth for a total consideration of $380.5 million. It would be investing $191 million in 8 Central Avenue, Eveleigh in NSW to acquire an interest of 50%.

Besides, the second property â William Square, Northbridge in WA will cost $189.5 million for its complete ownership. While commenting on the development, CMAâs Fund Manager, mentioned that the new properties were situated at key locations, with transport infrastructure and retail amenities.

On Sydney location, he stated that the property was going through valuable adjacent developments resulting in a fulfilling location for work, and the acquisition would enable the property trust to obtain exposure to Sydney Metropolitan markets.

On Northbridge, WA location, he stated that the area (Northbridge) had been lining up for an investment of close to $6 billion from both the government and private, which involves hospitality and retail offerings to attract tenants.

On both acquisitions, he stated that the properties would provide a WALE of 8.1 years, fixed rental reviews of 3% per annum or greater across 90% of income. Additionally, he stated that the tenant portfolio of the property trust had seen improvement, and the government tenants made up for 20% of the portfolio, which was 11% earlier, while WALE had increased to 4.8 years from 3.9 years.

Equity Raising

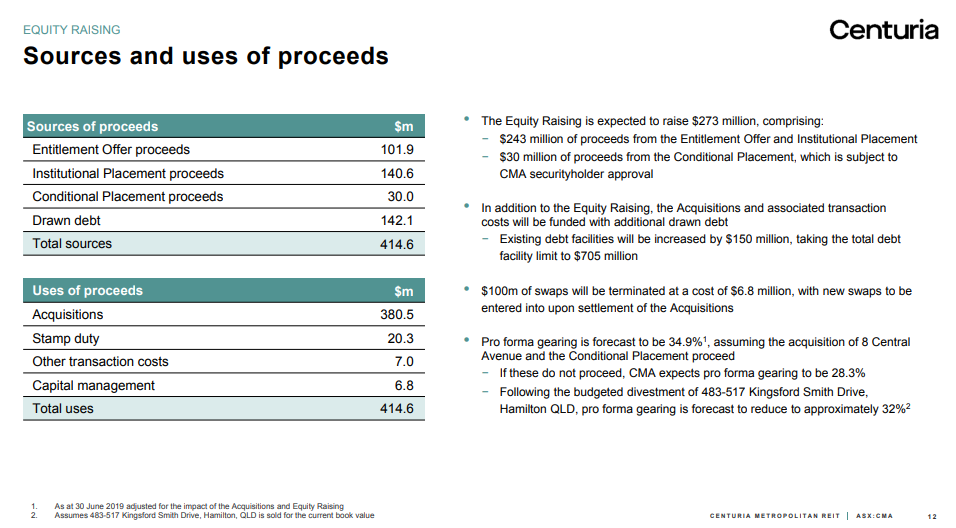

Reportedly, the company announced an equity raising offer to raise $273 million to fund the acquisitions partially. The offer is further divided into three separate parts, which includes of Entitlement Offer, Institutional Placement, and Conditional Placement.

Entitlement offer intends to raise $102 million via an underwritten 1 for 10 accelerated non-renounceable entitlement offer. Institutional Placement is targeting to raise $141 million. Meanwhile, Centuria Capital Group (ASX: CNI) to invest $30 million through Conditional Placement, depending on securityholders approval.

Centuria Capital, the trustâs largest stakeholder, has committed $37.5 million to the trust under the equity raising. The $37.5 million investment includes a $7.5 million in the Entitlement Offer and $30 million via Conditional Placement.

More importantly, the equity raising would be executed at an issue price of $2.86 per security, resulting in a 4% discount to distribution-adjusted 5-day VWAP of $2.98 on 17 September 2019. The new securities issued under the equity raising would not be entitled to the latest distribution announced by the trust.

Application of Funds (Source: CMAâs Investor Presentation)

Application of Funds (Source: CMAâs Investor Presentation)

Securityholder Approval

According to the release, the 50% interest in the Sydney-based property is being acquired from Centuria 8 Central Ave Fund â an unlisted closed-end fund managed by Centuria Property Funds Limited.

The unlisted fund has reached its end of the investment term, which is resulting in a sale of its property. Consequently, the trust is seeking securityholders approval through an ordinary resolution.

The ordinary resolution would allow the security holders to vote on the acquisition of 8 Central Avenue due to vendor being a related party of the trust. The conditional placement to CNI will also require securityholders approval, as CNI is a related party to the trust.

More importantly, the trust has scheduled a meeting of securityholders, anticipated to take place on 29 October 2019, and a separate notice would be sent to the CMA securityholders.

Distribution

Reportedly, the trust has declared a fully franked distribution of 4.45 cents per share for September Quarter this year. The distribution is scheduled to be paid on 30 October 2019 to the securityholders and has a record date of 30 September 2019.

FY2020 Guidance

Reportedly, the property trust has reiterated the previously provided FY20 guidance, which remains unchanged after considering the impact of acquisitions and equity raising. Besides, in the previously provided guidance, the trust had anticipated FFO of 19 cps, and distribution of 17.8 cents per security.

FY 2019 Review

Reportedly, during FY 2019 period, the trust had divested two of its industrial assets to become a pure-play office REIT. CMA recorded the total revenue from continuing operations of $108.86 million for the period compared to $77 million, a year ago.

Besides, the total other income for the period was $7.49 million against $42.18 million a year ago. The substantial decrease in net gains on fair value of investment properties had taken a toll on other income, resulting in a relatively subdued profit compared to a year ago.

Net profit from continuing operations for the year was $53.58 million compared to $85.089 million in FY 2019. Consequently, the basic earning per unit for the period was 16.3 cents compared to 37.4 cents in FY 2018.

The portfolio value of the trust at the year-end was at $1.4 billion compared to $0.87 billion as on 30 June 2018. As on 30 June 2019, the trust had a multi-bank debt facility of $555 million with a weighted average expiry of 4.03 years. The trust had drawn borrowings worth $498.5 million at an all-in interest cost of 3.23%, and 58% of the drawn debt was hedged.

Stock Performance

On 19 September 2019, CMAâs stock was quoted at A$2.97, down 1% (as on 19 September 2019, AEST 12:51 PM). Over the year-to-date period, CMA has delivered a return of +27.66%. Besides, in the last three months, it has delivered a return of +6.76%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.