Biotechnology is defined as the use of scientific and engineering standards for the managing of materials by biological agents for delivering goods and services. Biotechnology in the health care field is limited to the diagnostic production, prophylactic and therapeutic agents. Over the past three decades, the field of biotechnology has had an astonishing effect on health care, the regulatory environment, law and sciences. Traditionally, most medicines for human diseases were chemical or small-molecule drugs developed by well-established pharmaceutical companies. No doubt that the new biotech companies are leading health care industry into the new areas of productive endeavor and effective merging of the innovative approaches with pharmaceutical research has an advantage for manufacturing useful therapeutic products which are as of now unidentifiable and unpredictable.

Biotech industry has had an extraordinary impact on health care and it will continue into the foreseeable future, as understanding of the pathophysiology of various disease or disorders that are currently untreatable, rises; governments across the globe continue to advance initiatives to support the innovations in biotechnology industry; and business practices evolve to manage the risky, time-consuming and expensive product development process. As a result, the growth of new/innovative medicine will continue and lead to advances in patient care.

In this article, we are discussing an ASX listed global biotechnology company- CSL Limited

A leading global ASX listed biotechnology company CSL Limited (ASX:CSL) is engaged in providing life-saving treatments, including those medicines that are used for the treatment of immune deficiencies and haemophilia, and also has a portfolio to provide vaccines for influenza prevention. The company operates two businesses- CSL Behring and Seqirus and employs 25,000 people. CSL provides life-saving medicines to more than 70 countries. The unique combination of focus on research & development, operational excellence and commercial strength enable the company for developing and delivering innovations so that the patients can improve their conditions and live life to the fullest.

The company updated the market with its JP Morgan healthcare conference presentation (2020) on 14 January 2020, discussing its CSL Behring and Seqirus businesses, with the financial year 2019 highlights-

CSL Behring Portfolio- CSL Behring is into development and delivering the widest range of products in the industry for the treatment of serious and rare diseases like primary immune deficiencies (PI), von Willebrand disease (vWD), chronic inflammatory demyelinating polyneuropathy (CIDP), inherited respiratory disease, haemophilia and hereditary angioedema (HAE). The products provided by CSL Behring are also applied in burn treatment, cardiac surgery and for urgent warfarin reversal.

The therapeutic areas of CSL Behring comprise; Immunology and Neurology; Haematology and Thrombosis; Cardiovascular and Metabolic; Respiratory and transplant.

- HIZENTRA® indication for chronic inflammatory demyelinating polyneuropathy was approved in March 2018 in the United States and Europe, and in March 2019 in Japan. Orphan Exclusivity has been granted for HIZENTRA® for the treatment of CIDP.

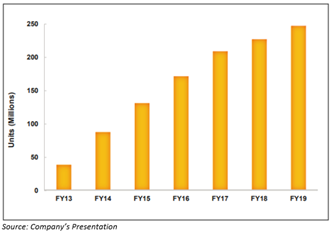

- KCENTRA® remains the first and only Food and Drug Administration approved 4F-PCC for reversing patients who are on warfarin. The growth of KCENTRA® driven by expansion into new regional accounts and penetration within existing large hospital systems. Growth of KCENTRA® in the United States in the last seven years-

- CSL112, a novel plasma derived apolipoprotein A-1 (ApoA-1) infusion therapy is progressing well, the study enrollment is still active in more than 45 countries and Pharmaceuticals and Medical Devices Agency (PMDA) approval for Japan has been obtained to join trial. The first futility analysis will happen in 2020.

Innovation for Future Growth-

- CSL200, lentiviral stem cell gene therapy and CSL889, Hemopexin for Sickle Cell Anaemia;

- CSL312 Garadacimab for Contact-Mediated Thrombosis;

- CSL311, Anti-Beta common for respiratory disease;

- CSL346 (Anti-VEGF-B) for diabetic Nephropathy;

- CSL324 (Anti-GCSF) for Neutrophilic Dermatoses;

- CSL362 (Anti-IL-3Ra) for Systemic Lupus Erythematosus (SLE);

- PRIVIGEN® and HIZENTRA® to treat scleroderma;

- HIZENTRA® for treatment of dermatomyositis;

- CSL312 Garadacimab for management of hereditary angioedema.

Seqirus Product Portfolio- Seqirus is a key contributor to the prevention of influenza globally and manages state-of-the-art manufacturing facilities in Australia, the United States, and the UK. Seqirus has leading research and development capabilities, a comprehensive and differentiated product portfolio and commercial operations in beyond 20 countries.

- The Seqirus influenza vaccine market of CSL is evolving, and the volumes of vaccine market remain in between 500-600 million doses, including 150 million doses distributed in the United States in the 2018-2019 season. The seasonal global market value was approximately US $4 billion.

- The main growth catalysts for Seqirus are plasma proteins, influenza and efficiency & flexibility. In plasma protein, the Seqirus group has strong demand and commercialization of five global launches of the product. The R&D pipeline includes cardiovascular disease, transplant, gene therapy.

- The most important driver has been the shift to Quadrivalent influenza vaccines- Flucelvax® and a significant increase in demand for FLUAD® and QIV.

- From the new technology investments, Seqirus is harnessing benefits and is planning to expand manufacturing capacity. In the financial year 2020, the company is planning to open forty new collection centres.

Outlook for FY2020-

In CSL’s Annual General Meeting (AGM) 2019 presentation, the company discussed its outlook for the financial year 2020 and the highlights are-

- The company expect continued strong demand for plasma and recombinant products and there would be a one-off effect on albumin sales arising from the transition to new distributor model in China.

- Slight margin growth from plasma product mix shift, recombinant products growth & conclusion of HELIXATE®.

- CSL’s Seqirus portfolio to result in line with prior guidance and continues to benefit from product differentiation and process improvement.

- The company is expanding the market for Flucelvax by launching in Europe in the 2019/20 northern hemisphere season and have submitted a dossier to the Therapeutic Good Administration (TGA) in Australia.

- For the fiscal year 2020, the company is anticipating a net profit after tax (NPAT) of approximately $2,050 million to $2,110 million at constant currencies, up by approximately 7-10% on the financial year 2019.

- The company expects revenue growth of nearly 6 per cent up by ~10% adjusted for GSP.

Stock performance-

On 16 January 2020 (at AEDT 01:19 PM), the CSL stock was trading at $299.990, up by 0.756 per cent from its last close. The company’s market capitalisation stood at approximately $135.14 billion, with nearly 453.87 million shares outstanding. The P/E ratio of the stock stands at 49.290x with an annual dividend yield of 0.89%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.