Crude oil prices jolted in the international market as supply constraint diminishes from the market.

The benchmark, Crude spot (XBR) dropped from the level of $75.72 (Dayâs high on 25th April 2019) to the level of $71.12 (Dayâs low on 29th April 2019) initially. The prices, however, recovered slightly to the level of $73.29 (Dayâs high on 30th April 2019). But the diminishing supply concerns again dragged the crude oil prices to the present level of ~$72.2.

The factor which exerted pressure on crude oil prices was the building United States inventory, which raised concerns among energy speculators and investors over the emergence of the United States as a net exporter of crude oil. The fear coupled with building crude stockpiles in the United States exerted pressure on crude oil prices, and the prices posted an intraday loss of more than 5% on 26th April 2019.

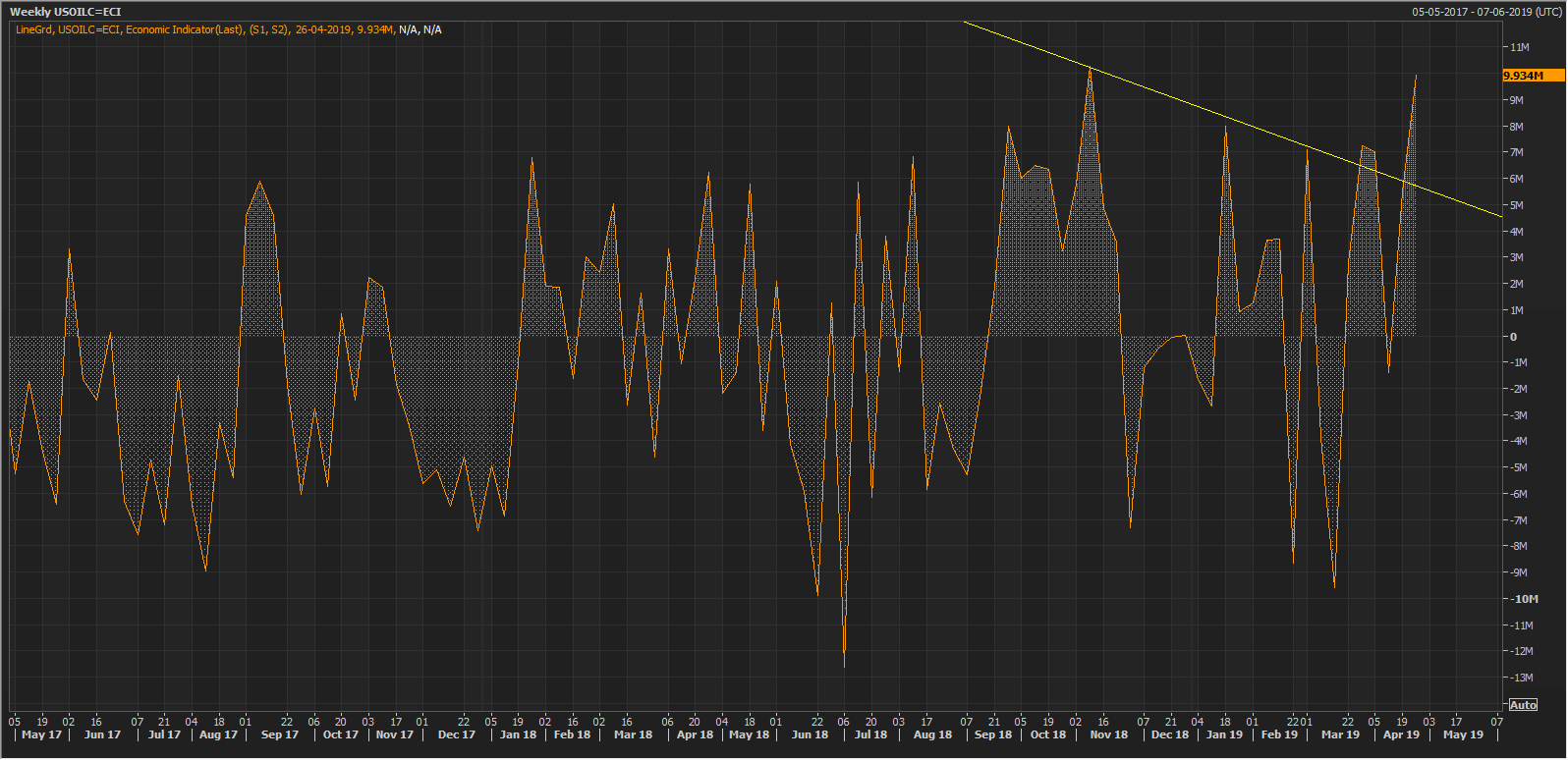

On the data front, the United States Weekly Crude Oil Inventory has observed a substantial increase over the past few months, which again kept the United States against the oil-producing cartel. As per the data, the U.S. Weekly Crude Oil Inventory stood at 9.9 million barrels against the market expectation of just 1.3 million barrels for the week ended 26th April 2019.

The United States oil inventory is building for quite some time; however, the market events such as Civil war breakout in Libya and removal of Iran crude import waiver created a panic in the market and speculation took the prices high. As per the data, the initial rise in the inventory (post decline of 9.6 million barrels for the week ended 15th March 2019) was at 2.8 million barrels for the week ended 22nd March 2019.

The United States oil inventory is building for quite some time; however, the market events such as Civil war breakout in Libya and removal of Iran crude import waiver created a panic in the market and speculation took the prices high. As per the data, the initial rise in the inventory (post decline of 9.6 million barrels for the week ended 15th March 2019) was at 2.8 million barrels for the week ended 22nd March 2019.

The crude inventory in the United States picked after that, and the rise of 7.2 million barrels (as on 29th March 2019) breached the downward sloping trendline in the chart above initially. After that, the inventory took a drop over the suspension of few rigs in the United States.

However, the inventory again picked up and reached 9.9 million barrels in the last week of April; the sudden rise in the inventory marked a level far more significant than seen in March 2019, which in turn, exerted the pressure on crude prices.

The effect of building inventory was ignored for quite some time amid sudden developments and events in the international oil market. Events such as Libya civil war between the Khalifa Haftar and U.N backed Tripoli dampened the supply gap created by the OPEC members through voluntary production cut, which in turn supported the crude oil prices initially. Apart from that, the sudden waiver end on oil import from Iran by the United States created a panic of supply shortage, which again supported the crude oil prices.

To further reckon the trend, the energy investors and speculators are eyeing on the upcoming OPEC meeting in June and the United States emergence as a net exporter of oil.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.