BHP Group Limited (ASX: BHP)

Petroleum Briefing

On 11 November 2019, BHP gave a petroleum briefing, highlighting that the petroleum business is positioned to deliver strong returns and contribute significantly to deliver value through the 2020s and beyond for the group.

Mr Geraldine Slattery, BHP President Operations Petroleum, stated that the petroleum division has a great business with competitive growth potential.

Considering the most recent long-term oil and gas price forecasts, and execution of all unsanctioned projects at present equity interests, Mr Slattery said that BHP could potentially (not guidance):

- Deliver a robust EBITDA margin of over 60 per cent along with an average return of capital employed of over 15 per cent in the next decade;

- Generate average Internal Rates of Return of around 25 per cent for major projects that are resilient across cycles;

- Underpin an average annual volume growth of up to 3 per cent between the 2020 and 2030 financial years.

He said that the portfolio of quality assets and pipeline of competitive growth options could potentially generate strong free cash flow and returns through the 2020s and beyond. Moreover, the companyâs capability in safety, exploration and deepwater operations, backed by high performance culture, is expected to help in achieving its future targets. Further, BHP has production guidance of 110 to 116 MMboe of conventional petroleum at unit costs of USD 10.5 to 11.5 per boe for FY20.

Presentation

Petroleum Business

The group stated that over the past five years, BHPâs portfolio has delivered consistent high margins and strong returns with highest EBITDA margin within BHP at >65% and average ROCE of ~15%.

The group continued to focus on replenishing resource with addition of ~800 MMboe in 2C resources since FY17, exploration unrisked value of USD 14 billion, and counter-cyclical investments in developing value accretive exploration.

It was also mentioned that the current opportunities deliver significant volumes and more than to offset the Bass Strait and North West Shelf field production declines;

- In base production, the group expects strong free cash flow and returns through 2020s with 10+ years of meaningful production from the base, and high-returning investments limit overall production decline to ~1.5% CAGR over the next five years.

- In sanctioned projects, the group has Atlantis Phase 3, Mad Dog Phase 2, Ruby and West Barracouta to add ~25 MMboe in FY23, and these oil-dominated projects are positioned to deliver strong returns.

- In unsanctioned projects, the group has a competitive pipeline of high-return and improvement projects to yield ~3% production CAGR from FY20-30. The Scarborough, Trion and US GoM embedded options would add significant potential growth from mid-2020s.

Petroleum for BHP

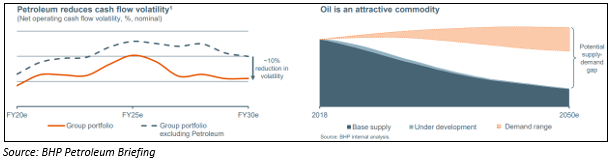

The group believes that petroleum creates a stronger and more resilient BHP, provides portfolio benefits, beyond being an attractive commodity.

Petroleum increases competition for its capital allocation with greater opportunity to invest in large, valuable projects, multiple high-quality options, with attractive economics available, and diversification encouraging greater counter-cyclical investment.

In the meantime, it provides opportunity for the group to leverage its core capabilities, including shared safety, project execution and operational learnings, differentiated and integrated geoscience expertise, and global view of industrial commodities and energy markets.

In addition, the petroleum business aligns directly with BHPâs strategy â best culture and capabilities, best commodities and best assets. BHP has a focus on safety and sustainability with access, exploration and appraisal capabilities, backed by inclusive, empowered and high-performing culture.

BHPâs crude oil & advantaged natural gas assets of large, high margin, long-life and expandable nature positions the group to meet the worldâs growing energy needs.

High-Return Assets & Opportunities

Australia

BHPâs Australian assets deliver strong free cash flow generation, and the Bass Strait and North West Shelf projects demonstrate the strength of its base assets. In Bass Strait, the group is positioned with highly cash generative advantaged gas play, while West Barracouta was sanctioned in FY19 with a ~20% IRR and multiple improvement projects are in place with expected average IRRs >30%. In North West Shelf, the group has strong free cash flow generation from equity gas, followed by revenue generation from other resource owners.

In Scarborough, the group is working to advance development, and the project is a large, long-life resource with 2C resources: 11.1 Tcf1 (gross). It has proposed a development concept of 13 subsea wells tied back to a semi-submersible floating production unit. It also provides an opportunity for further expansion through Thebe/Jupiter tieback.

US Gulf of Mexico

BHP has a growing pipeline of high-return projects across all three assets that include Atlantis, Mad Dog, and Shenzi. In Atlantis, the group has unlocked additional targets with advanced seismic, and multiple future development projects are in the planning phase.

Further, Mad dog is a tier one asset in the US Gulf of Mexico, and its future unsanctioned projects include Northwest Water Injection (NWI) and tieback opportunities. In Shenzi, the future unsanctioned projects include Shenzi Subsea Multi-Phase Pumping and further infill targets.

Trion â Mexico

Trion is Mexicoâs first deepwater development with material oil resource advancing towards an early 2020s final investment decision. The project has a large oil resource: 222 MMboe net 2C resources.

Also, a successful appraisal program has reduced uncertainty, and first deepwater well was drilled by an international operator. BHP is deploying its deepwater capabilities in Mexico with a focus on building strong relationships, safety performance and social value.

Further, additional exploration drilling in the Trion block is expected in FY21, and the group continues to look for attractive investment opportunities to expand its position in Mexico.

Trinidad & Tobago

The group has a material, deepwater gas discovery, and intends to build on its existing position in the region and successfully unlocking a frontier basin. A T&T North deepwater gas exploration program was successful, discovering 3.5 Tcf gross contingent resources, with additional unpenetrated potential (net interest 70%).

Further, a final investment decision is expected by CY24, and it is evaluating a deep test in the southern deepwater licenses while assessing the commerciality potential of gas discovery in the south.

On 12 November 2019 (AEST 12:55 PM), the BHP stock was trading at $36.795, down by 1.036% relative to the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.