The oil exploration companies across the globe are facing some strong head winds from the ongoing pricing war between the oil kingpin-Saudi Arabia and Russia, which coupled with the weaker demand for oil in the wake of COVID-19 pandemic is exerting tremendous pressure on the crude oil prices.

While Russia and Saudi both claim that they could bear the low-price environment, the same cannot be said for the United States oil producers, who are feeling the heat of the lower oil prices much more as compared to their global peers.

To Know More, Do Read: Oil Price War-A Trigger for Price Amidst Weak Demand; Stimulus Hope Upticks Oil

The higher API makes the United States crude much sweeter as compared to the crude from the Middle East and Russia, which makes it cost-intensive for the local producers; however, Brent often trades slightly above WTI due to higher demand from refineries across the globe amid existing long-life infrastructure favourable for refining Brent and the cost of transportation is other factor too.

The higher preference of Brent oil among refineries offers tough competition to the United States oil producers, and WTI prices generally trackbacks against Brent prices; thus, a fall in Brent prices reduces the price of WTI, which is also known as sweet oil.

This double-edged gizmo of Brent crude oil preference by global refineries and WTI price reference to Brent makes low pricing environment more difficult to sustain for the United States oil producers as compared to the global peers like Aramco in Saudi Arabia, and Rosneft in Russia.

While the United States refineries could not bear a low price environment for over a long-run as Russian and Saudi oil producers could, the ASX-listed U.S. frackers are also caught between the cross fight of Saudi and Russia.

ASX-Listed U.S. Frackers and Producers

- Fremont Petroleum Corporation Limited (ASX:FPL)

FPL is an ASX-listed US-based oil & gas production and development Company with key assets Florence Colorado, USA. The Company operates in Pierre formation and is one of the companies that has successfully drilled a horizontal well into the Niobrara formation.

Presently, FPL operates 21,500-acre Pathfinder project in Colorado across the historic Florence oil field of Fremont County.

FPL reported revenue of $433,839 for the half-year ended 31 December 2019, which remained ~ down by 29.13 per cent against the previous corresponding period (or pcp).

The net loss of the Company stood ~ 70.10 per cent higher against pcp to stand at $1,585,648.

FPL produced 9,340 barrels of oil during the period and reported a revenue of $571,919 from the oil sales, including $138,080 from Kentucky Joint Venture. FPL held an unsold inventory of 2,300 barrels at the end of the period on 31 December 2019.

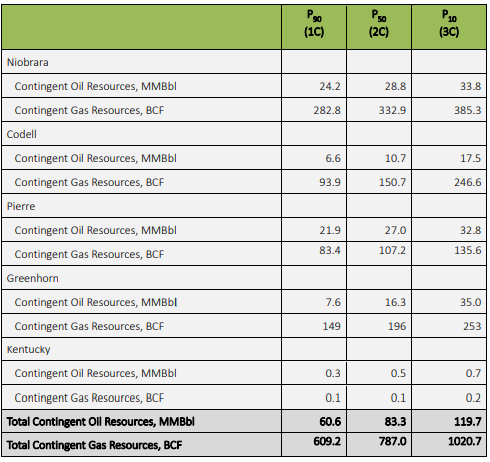

The overall resources of the Company’s prospect are as below:

(Source: Company’s Report)

FPL last traded at $0.003, up by 50 per cent against its previous close on ASX (as on 27 March 2020).

Just like Fremont, many other ASX-listed US frackers and explorers such as Australis Oil & Gas Limited (ASX:ATS), Brookside Energy Limited (ASX:BRK), 88 Energy Limited (ASX:88E), Byron Energy Limited (ASX:BYE) are facing the same pressure, and a majority of such stocks are trading near their 52-week low.

The United States Announces American Oil Purchase for SPR

In his recent statement to the local media, the United States President Donald Trump had mentioned that the United States would intervene at the right time in this oil price war and suggested that the price war would be very devastating for Russia, as their whole economy depends on it.

The United States seems to be taking advantage of the price war and is currently accumulating oil in the Strategic Petroleum Reserve (or SPR) from the domestic chain to support the local producers. The United States Department of Energy recently announced that it would buy 30 million barrels of American oil for delivery in May and June 2020, following Trump’s directive to purchase oil for the SPR.

The stance of the United States President to support the local producers could be supportive for the Australia-based oil & gas explorers, developers, and producers operating in the United States over the medium-term provided most of them remain in the business amidst the intensifying price war.

Business Can Sustain over the long-run in the low oil price environment- Says Beach Energy Limited (ASX:BPT)

While the ASX-listed oil & gas exploration companies operating in the United States are facing some strong headwinds, the domestic operators are also tackling the same industry challenges; however, some are aggressively adopting the diversification policy to shift towards gas.

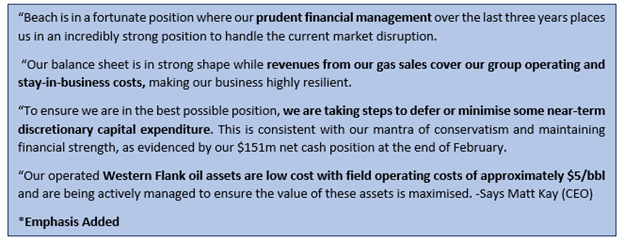

ASX-listed oil & gas explorer and producer- Beach Energy Limited (ASX:BPT) announced that the Company holds the ability to sustain a low oil price environment for quite some time with a parity price of USD 0 a barrel.

BPT mentioned to the shareholders that it holds $151 million net cash (as on February 2020) with access to more than $600 million in liquidity through a commitment of revolving credit facility of $450 million; however, considering the prevailing market condition, BPT decided to defer the capital investment by 30 per cent for FY21.

The Company also suggested that its revenue from the gas business is sufficient to cover the group’s operational expenses, and projected FY21 free cash break-even oil prices below USD 0 a barrel of oil, prior to any growth investment.

The ongoing depreciation in the home currency is further providing a cushion to the Company, which coupled with a selling price of its crude at a premium to Brent is a stronghold.

Beach seems to be poised for taking diversification benefit and anticipates that 97 per cent of forecasted East Coast gas sales in FY2020-21 would be sold under the term contract, out of which only 25 per cent is oil-linked.

Suggested Read: ASX Oil & Gas Explorer- Senex Buckle Ups for East Coast Gas Crisis

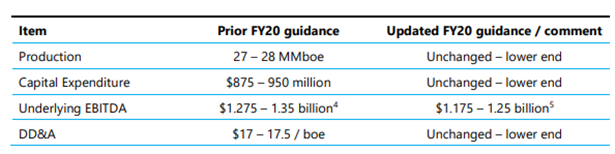

However, in the wake of low oil price, the Company lowered its FY2020 underlying EBITDA guidance by ~ 8 per cent below the mid-point of the previous guidance range, which now stands at $1.175-1.250 billion.

Apart from that, BPT is now targeting the lower end of the guidance range for its FY2020 production, capital expenditure and DD&A guidance.

Guidance Summary (Source: Company’s Report)

The stock of the Company last traded at $1.045, down by 5.0 per cent against its previous close on ASX.