Short selling means borrowing security for a short span and selling it in the open market with a promise to buy it back in a few days. The trade is profitable when these securities are bought back at a lesser price. Short-sellers bet on a drop in a security’s price and can earn really big profits, but losses can also mount quickly and infinitely.

The expectation in the wake of shorting a stock is that the company’s shares will take a dip. The reasons for the shares to go south could be many, such as:

- The stock price could be overvalued

- The company could be expected to/ put out an announcement informing about a dip in its fundamentals like poor results, excessive competition, management changes, cut in dividends, etc.

- Also, there are cases wherein a company could go bust.

When these events unfold, it offers the short seller to purchase the stock back at a much lower value and return the borrowed shares to the broker, keeping the difference by modifying for any surplus in the form of dividend payments which were received during that time span.

For instance, if you want to say short 100 shares of company ‘A’ which is trading at $50 per share. You have access to hundred shares for $5,000 from your broking account and sell them in the market to receive the cash. Now, there can be two situations where one profits or the one where the short seller incurs losses. Let’s see the outcome:

- Where you pocket profit from the transaction: Say one month down the line, the stock price declined by 20% to $40 per share. You buy the shares back at $4,000. Therefore, your profit stands at $1,000.

- One where you incur the loss: In another situation, let us assume that the company comes up with a positive announcement, for instance, it has upgraded its profit guidance, or it is being acquired at a much higher price, say $900. Now the short seller has to buy 100 shares at $100for $9,000 and has to return to his broker, incurring a loss of $4,000.

Understand the rationale to short sell!

- Many investors try to gain from short selling because they are in the opinion that the price of the stock might slide down the hill and that if they sell the stock today, they'll be able to buy it back at a much lower price in the upcoming period. If the short-sellers are successful in this strategy, a considerable profit is realized.

- Many Investors are also incentivized to short sell for the purpose of speculation, while others might hedge and protect themselves from the downside.

This may seem simple, and investors might think they just have to bet on the price going down! But it is essential to keep in mind that short selling is not for someone who is not experienced in the market. Short selling is typically restricted by many brokers and is banned if in case you do not maintain margin accounts (When you open a brokerage account with a firm you have the option to open a cash or margin account. Under margin accounts, short-sellers have the opportunity to borrow money from your broker).

But are short-sellers the evil lot amongst the market participants? Well its not fair to paint them in such a negative manner. Let’s look at some of the positive aspects of short-selling.

Benefits of Short Selling

- The most apparent benefit to short selling a stock is being able to make money not just when a investor is bullish, but also when he/she is bearish. Thus, providing investors with an opportunity to make money even when the stock prices are crashing.

- One More benefit of short selling is you can guard against any risks in your portfolio. If there is any chance of the bubble to burst up or any economic catastrophe to take a hit, there is a good possibility that your portfolio is going to encounter a stumbling block. Even if you’re not a passive investor and have invested in some really sound and stable companies, shorting stocks could offer gains and hence can offset the losses in your portfolio.

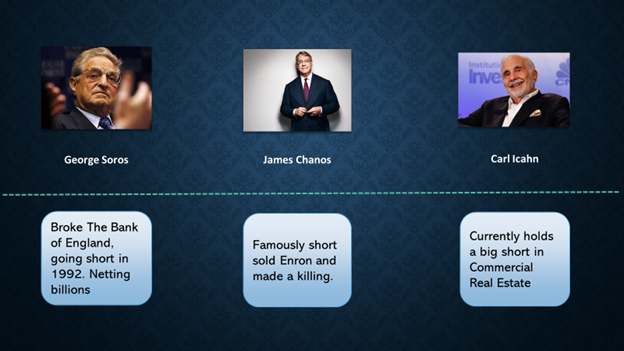

- Short-sellers are also active in the activist investing They keep a check on companies which tend to involve in financial frauds or capital miss allocation. Carl Icahn is one such famous activist investor who is known for taking short positions.

Few Famous Short sellers who made it big.

Don’t Just look at the benefits, Short selling comes with a lot of risks! Beware.

As soon as you short a stock, you are subjected to a possibly huge monetary risk. In few instances, when investors and traders are in the hope that security has huge short interest, that is a large proportion of its existing shares have been shorted by opportunists, they try to push up the stock price. This can compel the risk-takers with short positions to recover or buy back the securities sooner than the price goes too high. This wields some amount of influence over the stock price earlier than a large quantity of conjecture results in huge losses.

If you intend to short sell the stock, it is always important for you to realize that that you’ll not be able to repurchase it whenever you like, or at a price of your need. The given stock must have a market. If by no means the stock is trading, or on the contrary, there are a lot of buyers, instigated by other short-sellers struggling to close down their positions, they might suffer the loss of additional money, and hence, you may be in a situation to suffer severe damages. One possibly can also come up to a revelation that a company might get purchased for a premium of 30% over its present price as well as a special dividend of $5 per share is payable, which might result in the short-sellers in serious indebtedness.

You might or might not have the chance to purchase or offer on either route, up and around. Prices may suddenly change, with the proposal or ask over prices soaring up extremely fast. The probability of damages on a short sale is limitless, for the reason that the stock value could persist in increasing without any restriction.

The tactic to short sell is safest if used by expert traders who understand and comprehend the consequences. In the last, shorting a stock is reliant on its specific set of regulations and guidelines which are distinct from ordinary and regular stock investing. This involves a directive aimed to curb short-selling from additional pushing down of the stock price, which has plummeted more than 10% in a single day in relative to the close down price on a preceding day.

However, banning short-selling would not be a prudent idea for healthy market participation. If there was no short-selling then, as per a school of thought, many managements would miss use their position and game the system. More importantly, short-selling allows the investors to hedge their portfolio and thus help in getting a good risk adjusted return over time. Thus, short-sellers are a very vital part of the market dynamics and ensuring their participation in the system is very much a necessity.