ASX listed gold stocks had a good rally thanks to the surge in gold prices past week. However, the gold prices pulled back slightly over the delineation of the United States response concerning the U.S-Iran war tensions from the market expectations.

In the status quo, the United States President Donald Trump mentioned that Washington would be hitting Iran with more stringent sanctions, while the bullion market was expecting more actions in response to the recent ballistic missile attack by Tehran on the American soldiers in Iraq.

To Know More, Its Impact on Base Metals, Do Read: U.S-Iran Tensions Weighing Down Copper; Short-Term Correction Seems Likely?

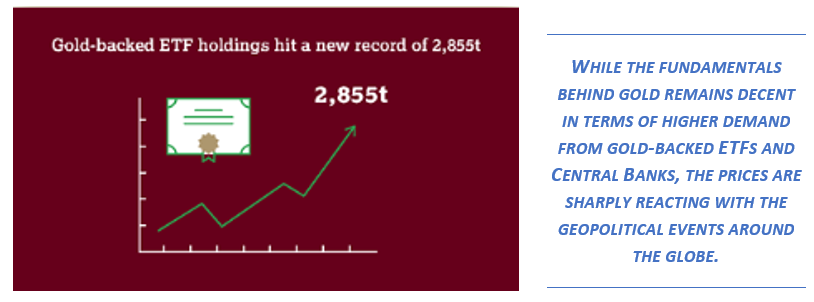

While the fundamentals behind gold remain decent in terms of higher demand from gold-backed ETFs and Central Banks, the prices are sharply reacting with the geopolitical events around the globe.

Gold Fundamentals: Gold Price- Unappreciated or Appreciated

The response of gold that in line with the geopolitical shift is further dictating the price action in the ASX gold stocks, which till now have shown decent correlation with gold prices.

To Know More, Do Read: ASX Gold Stocks- A Healthy Buy for Profits?

On weekly charts, gold prices have given a healthy breakout from a bullish flag pattern, which is further in sync with the gold fundamentals.

To Know More, Do Read: Get Ready to Pay ~2.8k for 24k Gold; Gold Bulls Break the Gated Cage

In response on the geopolitical event, the gold spot corrected from $2,351.55 (intraday high on 8 January 2020) to the present level of $2,251.35 per ounce (as on 10 January 2020, 4:56 PM AEDT) 2:57 PM (AWDT), which marked a correction of over 4.26 per cent.

The gold spot plunged from its intraday high of $2,351.55 to close the session at $2,265.86 (as on 8 January 2020), which reflected the biggest intraday correction since September 2019 quarter, a correction of over 3.64 per cent.

Apart from the geopolitical event, the improvement in non-farm employment across the United States in December 2019 also exerted slight pressure on gold and provided strength to the United States Dollar (USD).

Positive Trade Balance and Appreciating AUD

The trade balance figures noticed a surplus of $5.80 billion against the market forecast of $4.10 billion amid weak dollar; however, the domestic currency is gaining momentum, which is exerting pressure on ASX gold stocks, and investors are discounting the value of ASX gold mining companies over the expectation of further appreciation in the domestic currency.

As a result of the above-mentioned factor, the ASX gold stocks are currently under pressure, and while the rally in gold has supported the ASX gold stocks, at moment ASX all ordinaries (gold) is underperforming the Arca Gold Miners Index.

Green (Arca Gold Miners Index) Purple (ASX All Gold Ordinaries) Orange (AUD) (Six Months) (Source: Thomson Reuters)

Over the last six months, the Arca Gold Miners Index delivered a return of 7.86 per cent while ASX All Ordinaries Gold Index has delivered a return of -2.79 per cent. On the benchmark-adjusted basis, the return provided by the ASX All Ordinaries Gold Index over the last six months is at -10.65 per cent.

However, over the last one year, the ASX All Ordinaries Gold Index has clearly outperformed the Arca Gold Miners Index by 14.19 per cent, amid weak AUD, which has supported the export earnings.

Green (Arca Gold Miners Index) Purple (ASX All Gold Ordinaries) Orange (AUD) (One Year) (Source: Thomson Reuters)

But, at the current moment, the strengthening AUD is exerting pressure on the domestic gold prices, which in turn, is keeping the ASX gold stocks under check despite a bull rally in gold prices.

Green (Arca Gold Miners Index) Purple (ASX All Gold Ordinaries) Orange (AUD) (One Year) (Source: Thomson Reuters)

On the chart shown above, it could be seen that the ASX All Ordinaries Gold Index took the support of rising gold prices and depreciating currency; however, at present, while the gold prices are gushing high, the domestic currency is also showing a slight recovery, which in turn, is keeping the gains of ASX gold stocks under check.

While in USD terms, the global miners are relatively enjoying the gold leverage in USD terms.

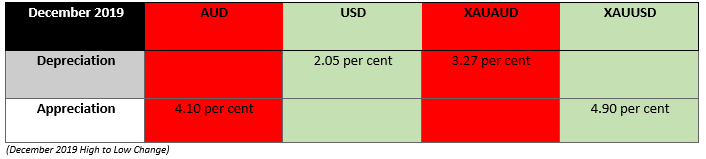

While the relative appreciation in XAUUSD and depreciation in USD is working out for the global miners, the relative appreciation in AUD and depreciation in XAUAUD is keeping the gains of ASX listed gold stocks under check.

The future of ASX gold stocks would now largely be dictated by above explained relation and reasons, and investors should keep them in check, especially AUD, which is projected by the Department of Industry, Innovation, and Science to showing decent recover over the medium- to long-term.

Albeit, it would be worth tracking if the much-anticipated gold rally could jaw-down all the relative changes in currency and provide impetus for the Australian gold industry and boost for the ASX gold stocks.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.