Growth stocks are the stocks where a company generates significant positive cash flows, the revenues and profits of which are anticipated to grow at a rate faster than the market rate. As these stocks grow faster than the market, investors tend to pay a higher price for these stocks. If what is foreseen happens and the stock price rockets up, investor happens to have a capital gain when they sell the stock.

Characteristics: Frontrunners often share characteristics of optimistic growth prospect, or just a great idea that is incomparable by the competition. Below mentioned are some of the characteristicâs investors can consider for investing in growth stocks are:

- High returns: These companies usually donât pay dividends and reinvest their earnings in order to pace their growth. If the value of the stock zooms up, it tends to give capital gains.

- Volatility in stock: Growth stocks generally are very volatile. The prices rise and fall very quickly. An investor can earn and lose money in no time. So, it is feasible for investors who can bear high risk.

- High Expenses: Growth stocks require to be managed by the experienced and skilled personnel, and therefore, it levies an additional charge on the stock, making it more expensive.

- Competes in fast growing market: Any company which is seeking growth have to compete in a market which is in growing mode or has grown already. This way, it is easier for a company to hold on to the market expectations.

- Free of High Debt: It is essential to take note of the companyâs debt position in the market. A company with higher debt will have to pay higher interest payments and may face a challenging time in recouping from the recession. The controllable debt is better and is easy to manage.

To know more about the Growth stocks, let us have a look on some!

Noni B Limited (ASX: NBL)

Noni B Limited (ASX:NBL) is a consumer discretionary company which is engaged in retailing of womenâs apparel and accessories.

Financial Highlights (as at 30 June 2019)

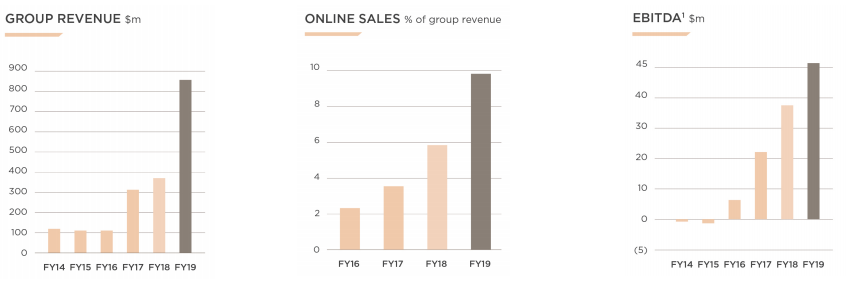

- During the year ended 30 June 2019, the revenue of the company rocketed up by 136.8% to $881.9 million in FY19 from $372.4 million, and EBITDA went up by 22.1% to $45.5 million from $37.2 million in FY18.

- The balance sheet of NBL continued to strengthen, with a positive operating cash flow of $23.5 million and net cash of $7.1 million at year-end. As a result of the strong financial position and the increase in underlying earnings per share, the Board has declared a final fully franked dividend of 5.5Â cents per share making a full year dividend of 14.5 cents, up by 11.5% from the prior period.

- During the year, Noni B reported an increase in online sales wherein it was 9.8% of the total sales this year as compared to 5.8% of the total sales in the prior year.

Financial Performance (Source: Investors Presentation)

What to expect: The company have an increased amount of data with nine brands and an expanded store footprint, that has enhanced the understanding of each brandâs customers, their product preferences, shopping habits and behaviours. The company expects the underlying EBITDA to be in line with the consensus of $75 million. NBL is also enthusiastic about the expansion in stores and in online strategies which will further drive the revenue and earnings growth.

Stock Performance: The stock of the company closed the day at $2.580 on November 8, 2019. As per ASX, the company has given a growth greater than 400% in the long term but has witnessed a fall by 14.58% in the past 30 days. Noni B has increased its database with 4.4 million of emails and 3.4 million of phone numbers, offering an opportunity to increase the share in synergies. The company has also improved the in-store experience and have increased the option count. In terms of valuation, the market capitalisation of the company is $250.05 million, and the stock is trading at a P/E multiple of 30x.

Baby Bunting Group Limited (ASX: BBN)

Baby Bunting Group Limited (ASX: BBN) is a retailer of baby goods, primarily catering to parents with children from new-born to three years of age.

Financial Performance (as at 30 June 2019)

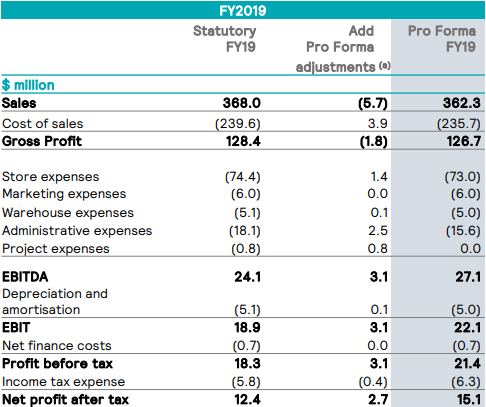

- During the year, total sales of the company went up by 19% to $362.3 million, and gross profit increased by 25.6% and stands at $126.7 million. The company also witnessed a growth in NPAT by 58.2% to $15.1 million. This led to an increase in EPS by 57.9% to 12 cents.

- Best Buys made up 21% of the total sales during F19 as compared to 19.6% in F18 and approximately 24% of total sales year-to-date.

- The company launched a new website platform in early July 2019, which included articles to help customers with their parenting & pregnancy journey.

Financial Performance (Source: Company Reports)

FY20 Operational Priorities and Outlook

- BBN expects to open 5 new stores in FY20: Doncaster, Wetherill Park / Casula in 1H plus 2 more stores in 2H. The company is progressing towards its strategic investments and aspire to grow its gross margin to be higher than 36% without compromising on value to the consumer.

- The company expects that the Pro forma NPAT to be in the range of $20.0 million to $22.0 million and anticipates that the Pro forma EBITDA to lie in the range of $34.0 million to $37.0 million.

- The company also expects a significant investment in transformational projects will grow profitability and will support future growth.

- BBN is also capitalising on shopping centre opportunities and is accelerating investment in Private Label products. It is also prioritising to grow in Private Label and is expecting the exclusive product sales to exceed 35% of sales.

Stock Performance: The stock of BBN ended 8 November 2019 at $3.710. As per ASX, the stock of BBN witnessed a rise in performance by 61.97% in the past 6 months and an increase of 1.88% in the past 30 days. This has resulted in the stock price to trade towards its 52-week high levels of $4.030. In terms of valuation, the stock is trading at a P/E multiple of 38.880x, with the market capitalisation of $486.02 million.

Â

OneVue Holdings Limited (ASX: OVH)

OneVue Holdings Limited (ASX: OVH) is a wholesale service provider to the wealth management industry, the principal activities of which are  to manage fund admin and super member admin and platform admin including managed funds, accounts and administration services.

September 2019 OneVue Quarterly Highlights

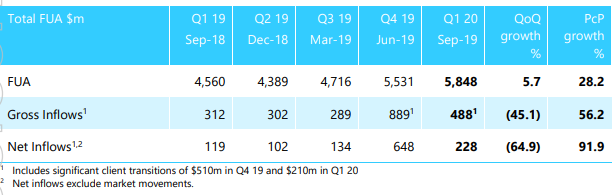

- During the Quarter ended 30 September 2019, the company delivered record results with the number of items processed increased by 44% on prior corresponding period. Growth was driven by both new client transitions and strong organic growth. The total number of Funds administered, were up by 45% on previous period to 1,387 funds.

- Funds under administration which although is not a driver of revenue, closed at $530 billion, indicating the companyâs scale and continued market leadership position. With year end fund reporting completed, the business is focusing on integration and automation to support further growth and margin expansion.

- Platform services represented 36% of the revenues in FY19 and achieved a strong quarter with gross inflows of $488 million, up by 56% on the previous period and net inflows of $228 million, up by 92%.

Platform Services (Source: Company Reports)

Strategy and Outlook: In 2019, the company was fully automated and integrated in buying and selling of custodially held managed funds. It is expecting the new payments platform and the ASX blockchain to automate transactions on Platform further reducing both execution risk and cost. OVH expects that 2020 will deliver increased scale benefits and margin expansion via accelerated FUM particularly on Platform either organically or via a material transaction, either to be funded by increased cash balance

Stock Performance: The stock of OVH closed at $0.395 on 8 November 2019. As per ASX, the performance of the stock witnessed a fall of 17.78% in the past 6 months and a decline of 1.33% in the past 30 days. This has resulted in the current market price to incline towards the 52-week low of $0.350. In terms of valuation, the stock is trading at a P/E multiple of 73.08x with the market capitalisation of $101.7 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.