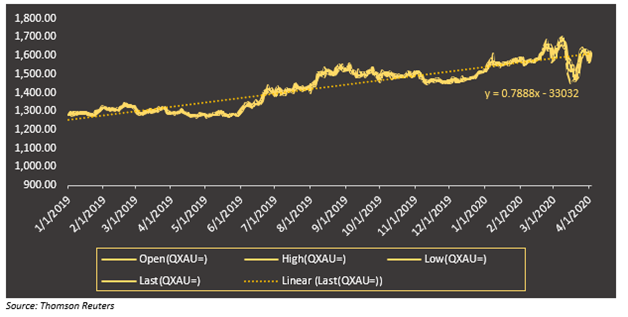

Yellow metal, wold excellent safe-haven investment – Gold, witnessed a surge in LME gold price by 31% from the start of 2019 to US$1,674.7 per ounce on 09 March 2020. However, the price subsequently dropped by 12% to US$1,469.4 per ounce as on 19 March 2020.

Isn’t this Strange? Fall in Safe Haven Investment!!

Indeed, amid the global turmoil over COVID-19, gold is the option for investors to hedge against the risk. However, due to massive volatility in the market, people have started selling gold to cover up the losses that they made in the equity market.

The other panicking factor that wiped out billions of $ money from gold or any other commodity, as well as stock market, is due to the movement of investors toward stocking money by moving out of their asset classes, preparing themselves in these pandemic situations.

It is notable to mention that even the US Federal Bankcut interest rate to zero as announced on 15 March 2020, first time after the 2008 financial crisis to maintain money flow in the market; however, it didn’t help much to retain the shining star position of Gold.

Interesting Read: Volatility in the Market: Gold Pulse Across Multiple Time Frame.

But the question is still there, will it fall further? LME gold price regained its stance by 11% from 19 March 2020 to US$1631.1 on 24 March 2020.

The Department of Industry, Science, Energy and Resources, in its March 2020 edition of Resources and Energy Quarterly, has anticipated gold price to fall gradually to US$1220 per ounce by 2025, once the global economy rebounds.

Prices expected to correct, is there any opportunity left to invest in gold?

Curious to know, let's go-to basic. Gold has always been the preferred option for hedging against the volatility or any other portfolio risk and economic slowdown thus making it to the portfolio of investors for many centuries.However, there is another school of thought that does not consider gold as an investment. This is because gold does not give a fixed source of income like a dividend in stocks. In words of the successful world investor, Warren Buffett, gold does not provide earning to reinvest and thus bars investors from the beauty of compounding.

However, investors with gold in their asset class play the game to garner yield on gold for the portfolio. This is done by exposing a fixed percentage of gold as a hedge. Suppose your 15% of the portfolio is gold. Now, if the gold price increases from US$1500 to US$1700, then you rebalance the portfolio by reducing the investment in gold, while increase when prices go down. In this way, the investor gets the gold yield while maintaining a fixed portion of its portfolio in gold as a hedge.

Having said that, the scenario, where quantitative easing policy- maintaining currency flow in the market, may give easy money to invest in gold. Still, one question may arise, is it the right time?

Gold is trading high, making it attractive for return chasing investors, however at the same it making it expensive for the consumers of gold- jewelry. As discussed earlier there would be some ripples in 2020, benefiting investors for short term. However, when the tides are over and the market sails through the storm of COVID-19, the economy in 2021 is anticipated to rebound aggressively than predicted before the advent of pandemic, could see some buying on gold slowing down.

Buying gold would have been better if purchased at cheap price, i.e. when the margin between the average cash cost or AISC and gold price is low. However, currently the gap between gold price and cash cost or AISC is high, leaving less opportunity for investors or companies to benefit in future. That's why you must have observed that in gold companies’ guidance, they are considering realised price lesser than the prevailing market price of gold.

Also, it is worth mentioning that if you are thinking for long term investment then the return from multibagger stocks is huge than the stable and risk-free return from gold investment. Hence, it lies with the investor risk taking ability to map the portion of its portfolio for gold. Since April 2015 till 3 April 2020, gold has given a stable return of approximately 32.4, which is too less for risk aggressive investors when returns can reap higher returns from equity investment when done prudently.

Do Read: The Ultimate Guide to Find Multibagger Stocks

In the above figure, we can see that the slope (m) of the trend line is 0.7888; there is not high variation in the gold price with respect to the time of holding.

The other interesting fact in the present context is that the businesses across the globe are closing down with the advent of COVID-19, and mining companies are nut spared either. In this scenario, many companies are restricted to operate the mines due to social distancing and lockdown. Additionally, companies informing shareholders that the previous guidance may not hold true, now have dwindled the investors’ confidence.

The ripples can be seen in the LME price, after falling to US$1469.4 on 19 March 2020, the price rebound to US$1631.1 on 24 March 2020 and again fell to US$1582.1 on 1 April 2020. It again rebound to US$1612.1 an ounce next day (2 April 2020). The effect is likely to continue with a falling trend from the coming years.

The current time has been challenging and across asset classes there is unprecedented uncertainty, gold the go to asset under such circumstances as described above has been volatile. Prudent investing calls for thinking from a portfolio level as against the individual asset level and accordingly adjust the allocation taking the risk vs return into consideration. The price movement in gold is going to be interesting as the global economy chugs along, as and when the COVID-19 pandemic abates.

Note: This is just a view of an author and not the investment guidance.

Do Read: Why Money Managers Consensually Buying Gold?