Stock trading helps in making quick profits based on market fluctuations, but at the same time, any wrong decision can also result in huge losses. Investors who have risk appetite may prefer to do stock trading; however, it is very important to do a thorough analysis and research before making any investment decision and parking funds in the stock market.

Interesting Read: Tips for amateur investor

Warren Edward Buffett, investor and Chairman and CEO of Berkshire Hathaway, advises new investors to:

- Invest in a long-term game.

- Invest in those companies, wherein you have an idea of the business.

- Have faith in your investment decision.

- Think as if you are the owner of that business and make changes based on its fair valuation.

- Prefer quality stocks over cheap stocks.

- Don’t get carried away by price changes.

Investors, who are new to the trading world, should keep themselves updated with recent news and events impacting the stocks, along with the interest rate plan by central banks and economic outlook. They should also set aside the amount of capital that he/she is ready to bear.

Newbie investors always start with a small amount. When you are new to the market, according to experts, one should invest in those companies that are established rather than penny stocks owing to the level of risk associated with investment in penny stock as compared to large-cap or blue-chip stocks.

In the present scenario, with the number of coronavirus cases growing, globally, almost every sector has been hit. There is immense volatility in the market surrounding COVID-19.

Good Read: 5 Tips to Invest like an Intelligent investor in a lockdown scenario

In this article, we are discussing few ASX-listed stocks.

MFF Capital Investments Limited

As an investment company, MFF is engaged in injecting funds in a portfolio of international as well as Australian companies (exchange-listed).

The Company has been a consistent dividend payer for the last five years, with an interim dividend of 2.5 cents per share due to be paid for 1H FY2020 ended 31 December 2019.

In the first half, revenue stood at $253.245 million, while net profit reached $173.445 million. The balance sheet of the Company witnessed an increase in net asset base from $1,443.594 million at the end of June 2019 to $1,608.242 million in 1H FY2020. The pre-tax net tangible assets per ordinary share of $3.610 as at 31 December 2019 compared with $3.225 as at 30 June 2019.

MFF reported an increase in its operating cash inflow during the period to $94.376 million. Cash outflow due to financial activities was noted at $52.196 million.

By the end of 1H FY2020, net cash available with the Company was $42.424 million.

Stock Information: On31 March 2020 (AEDT 12:47 PM), MFF stockwas trading upward by 5.512% to $2.680. MFF has a market capitalisation of $1.39 billion, approximately 548.65 million outstanding shares and annual dividend yield of 1.77%.

Future Generation Investment Company Limited

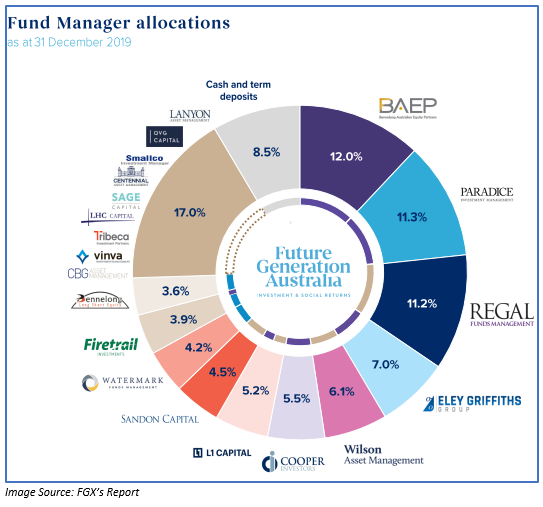

Future Generation Investment Company Limited (ASX: FGX) is an investment company with funds aiming to achieve positive returns irrespective of market conditions.

According to its FY2019 results for the full year ended 31 December 2019, the investment portfolio increased 20.7% with an average cash level of 9.9%. The Company reported an operating PBT of $25.5 million while operating PAT of $22.4 million.

The Company’s solid performance of investment portfolio and capital growth was achieved on the investments with the underlying fund managers, resulting in an impressive increase in total comprehensive income to $63.3 million for the 12-month period to December 2019.

FGX declared a fully franked dividend of 5 cents.

Stock Information:On 31 March 2020 (AEDT 01:06 PM), FGX stock was trading at $0.900, advancing further by 5.263% from its previous close. FGX has market capitalisation of $340.49 million and annual dividend yield of 5.85%.

Transurban Group

Transurban Group (ASX: TCL) is the owner, operator as well as developer of electronic toll roads and intelligent transport systems. It designs roads for the long-term to ensure real & lasting advantages to cities and their communities. The Company is also engaged in research &development of innovative tolling as well as transport technology that facilitates easy travelling for everybody. Also, there are 1.7 million daily trips that happen across its roads.

The Company has 18 roads under operation and 8.6 million customers, coupled with 20+ years of experience. It is amongst the top 15 listed companies on ASX.

In 1H FY2020 for the period ended 31 December 2019, the Company reported 2.3% growth in its average daily traffic. Proportional toll revenue rose 8.6% to $1,396 million. Proportional EBITDA improved 9.5% to $1,094 million. Statutory profit for the period was $162 million. TCL declared 1H FY2020 distribution of 31 cents per share.

Recently on 25 March 2020, Transurban’s Hills M2 Motorway entered into a deal to raise $815 million via two new bank debt facilities funded in the Asian loan market, which would be used to refinance current bank facilities that would mature in December 2020 and November 2022, respectively. The Company also confirmed that it would update recent performance due to COVID-19 plus the initial impacts of closures lately passed by governments across the markets.

Stock Information:The stock of TCL was trading upward by 3.704% to $12.600 on 31 March 2020 (AEDT 01:12 PM). TCL has a market capitalisation of $33.23 billion and annual dividend yield of 5.02%.

Telstra Corporation Limited

In this digital era, the products offered by TLS, a provider of telecommunication and information services, are the need for an individual. Other than this, IoT is also has a brighter future in the coming decade. Further, Telstra was the first company in Australia to launch5Gcommercial device connection.

In 1H FY2020, Telstra reported a drop in total income by 2.8% to $13.4 billion. EBITDA was $4.8 billion and NPAT stood at $1.2 billion, a decline of 6.4%. It also made strong progress against its T22 strategy as well as cost reduction. The Company also reported continuous growth in customer base because of its multi-brand strategy as well as 5G leadership. TLS confirmed an interim dividend of 8 cents for each share.

Recently, the Company has noted anincrease in the use of broadband and mobile phone calls due to COVID-19 outbreak, as more and more people are working from home.

Stock Information:On 31 March 2020 (AEDT 01:19 PM), TLS stock was trading downward by 0.923% to $3.220. TLS has a market capitalisation of $38.65 billion, approximately 11.89 billion outstanding shares and annual dividend yield of 3.08%.

_09_03_2024_01_03_36_873870.jpg)