The economic trauma triggered by the COVID-19 epidemic continues to influence the share markets across the globe. Humanity is against a race with time, as the pandemic coronavirus is accelerating. According to the WHO, the number of incidents around the world has exceeded 638,000 while the number of deaths has surpassed 30,000.

However, in the event of current COVID-19 the demand for medical devices, sanitizers, gloves, masks are increasing while at the same time, the companies are also focusing on developing the laboratories for detecting and diagnosing the deadly virus.

Interesting Read: How FDA approvals can change the fate of healthcare stocks?

In recent weeks markets have been volatile, seeing sharp movements in both directions as agencies throughout the world revealed massive amounts of stimulus to stem the economic impact of the COVID-19.

On 30 March 2020, the S&P/ASX 200 health care sector traded higher at 42,884.1 points, with a rise of 11.42% compared to the last close. The S&P/ASX 200 Index was leading gains as it surged to 5,181.4 points, up by 7% from its previous close.

One ASX-listed organisation noted that it has been experiencing recent high demand for its hand and body protection products - single-use examination gloves and surgical gloves. The high demand led to a surge of 25% in the share price of the Company as the market closed on 30 March 2020.

Let us acquaint you with this healthcare sector player whose Share price witnessed a substantial increase on 30 March 2020 - Ansell Limited.

The stock of ANN closed the day’s trade at $29.030 on 30 March 2020. The Company had a market capitalisation of nearly $2.99 billion, with almost 128.89 million shares outstanding. ANN stocks 52 weeks high and low price were noted at $33.430 and $20.190, respectively. The P/E ratio of stood at 15.600x, with an annual dividend yield of 3.07%.

About the Company:

An ASX-listed world-leading superior health as well as safety protection supplier, Ansell Limited (ASX:ANN) engages in enhancing human well-being. The Company is constantly working on the advancement of technology and product innovation and operates in two major business segments: Healthcare and Industrial. Ansell is involved in the production of personal protective equipment, including gloves, face masks which can be used in the fight against the COVID-19.

ANN has operations in Asia Pacific, North America, Latin America/Caribbean and EMEA, and has more than 12,000 employees across the globe.

Related: Ansell Limited Makes an Announcement for FY 2019 Half-Year Results

On 30 March 2020, Ansell updated the market on the COVID-19’s impact on its business operations & financial performance as well as the measures the Company is taking in response to the rapidly evolving environment.

Business Update:

Ansell disclosed that the Company is experiencing high demand for AlphaTec® hand and body protection products which are examined and approved to recognised standards for protection from infective agents.

Moreover, the Company also disclosed that it has a high demand for several other products such as TouchNTuff® and Microflex® single-use examination gloves as well as Gammex® & Encore® surgical gloves.

However, Ansell anticipates this to be counterbalanced by the falling requirement for some of the industrial products, because of temporary lockdowns, export restrictions within Europe and in other places, and restrictions imposed to contain the spread of the virus coupled with lowered economic growth outlook.

Furthermore, the Company updated that as the situation of coronavirus infection changes daily, there is an escalating possibility of postponements and disruptions to transport and local distribution.

Regarding production facilities, the Company is taking further measures for alleviation of the effect of coronavirus, including entry screening (such as temperature, travel history), sanitation of surfaces, and social distancing, among others.

Ansell also disclosed that it is working closely with governmental authorities continuously for maintaining the capability to manufacture protective products and supply them to areas where their demand is the maximum.

Notably, the members of the Company are working determinedly for maximising output, including making selective investments in new capacity and by leveraging manufacturing locations that are not impacted.

The Company believes it can continue shipping large quantities of product to major markets.

Good Read: A Technical Overview Of Ansell Limited’s YTD Performance

FY2020 Guidance Affirmation:

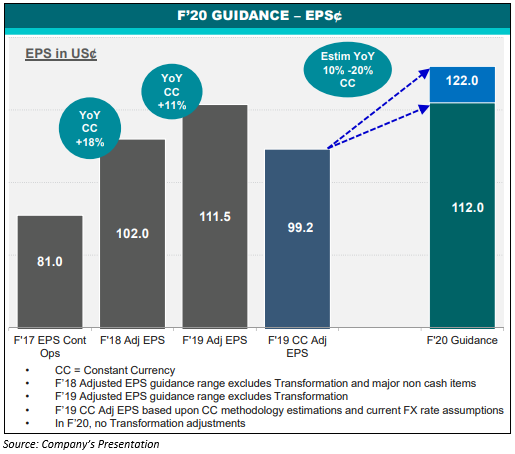

Forward view on order pipeline and how the business is tracking, the Company is reiterating its financial year 2020 earnings per share (EPS) guidance range of 112 US cents to 122 US cents. Ansell continually examines the impact of coronavirus on its business and would make further updates if required. Despite the unprecedented uncertainties and implications from the unknown extent of the coronavirus pandemic, Ansell still anticipates providing guidance for the fiscal year 2021 in August, as usual.

It is noteworthy to mention that Ansell has a strong balance sheet with about $515 million of cash and pledged undrawn bank facilities available as at 29 February 2020. The Company also continues to deliver positive operating cash flow, having generated $47.8 million for the first half of the financial year 2020 and $133.3 million for the fiscal year 2019.

Additionally, the Company disclosed that it has no significant debt maturing in the next year.

As the COVID-19 crisis continues, the requirement for gloves, mask and other related products are very likely to increase in the upcoming few months, thus benefiting Ansell. Further, the Company is well-positioned and believes that overall, there are fewer chances to have a material long-term impact on the business of the Company.

Do Read: Tips to Invest like an Intelligent investor in a lockdown scenario

_09_03_2024_01_03_36_873870.jpg)