Australia bags the favourite spot when it comes to investing in the mining stocks as the country hosts and produces an abundance of commodities for the international market. The Australian Securities Exchange is inundated with mining stocks, which leaves an investor in oblivion to choose the mining stock, which would serve the financial goal of an individual.

However, there are plenty of parameters, which an investor could use to screen a few stocks from the vast options.

The foundation of picking up a mining stock lies in the understanding of an individual about the mining sector and its interaction and relation with other sectors of an economy.

Mining sector typically produces raw material for the other sectors of an economy, and it usually exhibits negative or inverse correlation with the other sectors; however, the extent of the relationship shows variance depending upon the certain economic factors, but the general relationship holds true in the normal economic scenario.

To clear out the basics of the mining stocks and the discipline of investing in them, Do read: Smart Ways To Invest In A Commodity Stock

There are plenty of mining stocks on the Australian Securities Exchange (or ASX), and one can easily observe the different valuations assigned for them or say we see a wide range in their market value.

So, what are the major parameters to be considered while valuing a mining stock?

The answer to this question could be easily derived in terms of financial metrics when it comes to the stocks of other sectors; however, with the mining stocks, it is not just the financial metrics, which leads to the valuation.

A mining company typically lease the mineral rights of a real asset such as land and capitalise on it to produce the raw material, which is then shipped to the market in exchange for money. Lands which hold minerals are typically assessed by geographical surveys, which gives a land with larger mineral exposure a higher value as compared to the one, which holds lesser minerals.

Thus, a type of land, where the company conducts its digging activities contributes significantly towards the valuation of the company.

Parameters to Help Screening A Mining Stocks

Selecting the Commodity

Not every commodity is in demand all the time and understanding the cyclical nature of the demand for any commodity could help an investor in picking up the right commodity over the desired investment horizon.

For example, natural gas prices witness a spike in prices during the winter session in the northern hemisphere amid an increase in demand for heating fuel, which supports the prices.

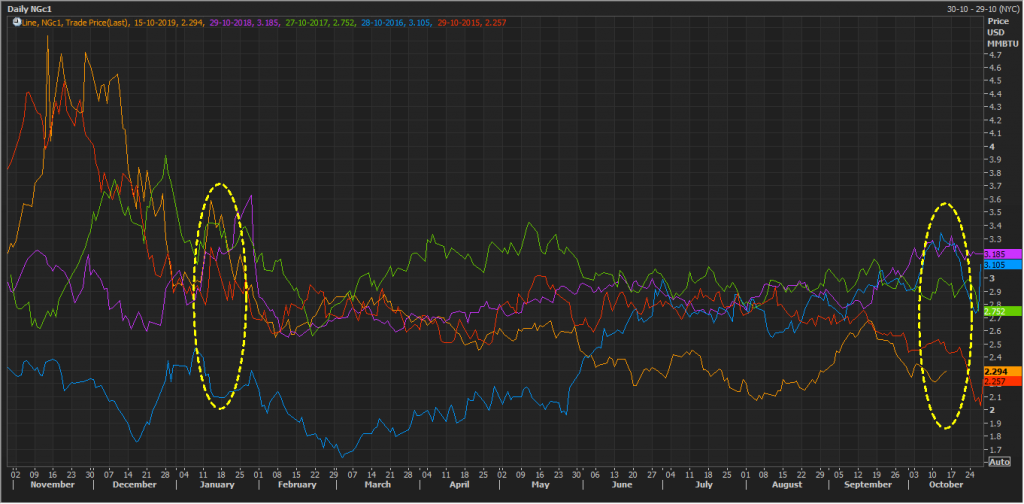

NYMEX NG Futures Seasonality Chart (Source: Thomson Reuters) (Henry Hub)

Note the spike in prices of natural gas in January and in October.

Getting familiar with the cyclical nature of a commodity is an import aspect of selecting the appropriate commodity for the decided investment horizon. Investors usually have a view on the underlying commodities price projections before they venture into investing in individual companies. For example, investors with the view that gold prices are set to rise in the near term could consider investing in gold mining companies.

Understand the Future Prospects of the Selected Commodity

Commodity valuation is very different from the valuation of the traditional assets and understanding the prospects of the selected commodity is pivotal for the investment in the mining stocks.

The pricing of a commodity incorporates four major components, i.e. the storage cost, convenience yields, the mathematical constant âeâ aka Euler's number and the spot price.

It is always helpful to get acquitted with the technical terms and their application. To Know More about these technical words and their respective applications, Do Read: Things to Be Familiar With Before Fishing for Mining Stocks.

Once investors zero in on the commodity, the next logical step would be the analysis of the future curves over their investment time horizons, which would make our next parameter to help in screening the right mining stock.

Understanding the Future Curve

The future curve of a commodity is the function of its storage cost and the convenience yields, and understanding it becomes crucial to estimate the demand and supply dynamics of a commodity in future.

The future or the forward curve is drawn by taking the difference of future or forward contract prices of different expiry with the spot price of the commodity. In a broader sense, and upward slope represents dominancy of demand over the supply in future, and a downward slope represents the dominancy of supply over the demand in the future.

However, this relationship does not always hold true, and investors should utilise other valuation methods to measure the scope of discrepancies between the estimated price and the observed price.

Once investors spot the discrepancies, they can take various approaches to take advantage of it.

To Know More, Do Read: Gold-Backed ETFs Vs Gold; A look At Direct And Indirect Investment Approach

Spotting the Potential Miner

Different miners could face different phase of development, and it would always be necessary to spot the miner, who can take the maximum advantage of the rise in commodity price.

For example, if the commodity price starts rising in the market, the miner with an immediate supply could be well placed to take the advantage; however, it is not always true, and understanding the future prospect of the commodity becomes crucial here.

Once investors are confident about the future prospect of the commodity, they can bet on the miners who are still in the development phase, and would supply the commodity, when the prices reach even higher, and could recognise higher sale price, which in turn would eventually boost the revenue and the financial status of the miner.

However, if the estimation of the investors about the underlying commodity goes wrong, it would cost the investors not only in investment loss but also an opportunity cost, for the very same reason, the convenience yields of miners with immediate inventory are high at the starting of the rally in the underlying commodity.

The other parameters of selecting the right or potential miner are equity-based such as checking on debt and debt-related ratio, estimating leverage ratios, financial valuations, cash flow and income statement analysis.

In case of mining stock, few ratios work better than the other, apart from that higher reliance on cash flow could also be problematic, and investors should be familiar with all such nuances.

To Know More, Do Read: Is P/E Ratio A Good Valuation Metric To Value A Resource Stock?

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.