Leading publicly traded investment management firm, BlackRock has created a globally diverse technology and investment platform to meet the needs of its clients. The platform helps people build better portfolios that facilitate enhanced financial returns. The company assists a diverse mix of retail and institutional clients throughout the world.

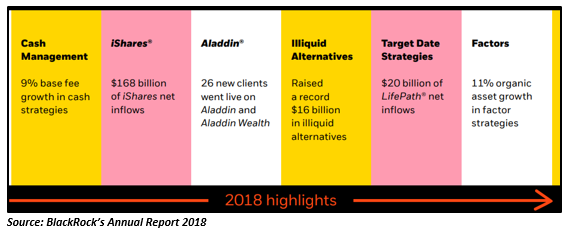

The BlackRockâs Annual Report 2018 mentioned that the diversity of the companyâs platform drove 1 trillion dollars of net inflows in the last five years. This demonstrates an average of 4 per cent organic base fee and organic asset growth.

Below figure depicts Blackrockâs unique offerings:

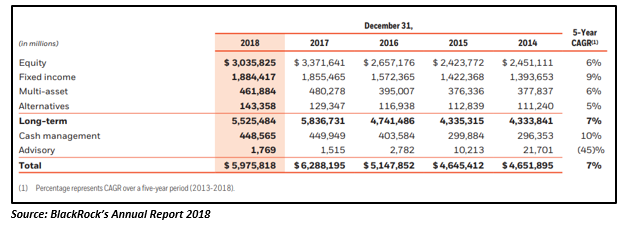

BlackRock had ~$5.98 trillion of Assets under Management (AUM) as at 31 December 2018, representing a CAGR of 7 per cent in the last five years. The assets under management are the wide range of financial assets managed by BlackRock on a discretionary basis. The company usually earns investment management fees as a percentage of AUM.

The Companyâs AUM (by product type) for the years 2014 - 2018 is given in the table below:

BlackRock is working towards becoming the most respected risk and investment manager in the Australian market. The company provides investment solutions to its clients to meet their challenges. The client base of the company includes asset managers, governments, SMSF clients, insurers, financial advisers and banks. BlackRock is currently working with almost all of the top 25 superannuation and investment entities in Australia in a certain way.

Opportunities of Growth for BlackRock

As individuals are living longer across the globe, the number of centenarians is anticipated to be more than twofold in the next decade. Also, people are working longer, but many of them have not saved enough for retirement. BlackRock stated in its 2018 Annual Report that nearly 50 per cent of the 26 trillion dollars wealth market in Europe consists of uninvested cash. This raises the need to invest early and consistently in order to support oneself financially later on. With the rising need for early investment, the requirement for proven and effective investment management is growing rapidly.

In its annual report, Blackrock mentioned that the global industry assets under management are likely to grow by 30 trillion dollars to 125 trillion dollars over the next four years. This growing need for asset management presents substantial growth opportunities for BlackRock.

BlackRock Solutions

BlackRock offers unbiased advice to its clients on complex capital market exposures that helps them in developing investment strategies. The companyâs risk and investment management services are generally provided through BlackRock Solutions® (BRS). The companyâs unique fully integrated investment management technology platform, Aladdin® is also offered through BRS. Besides this, the companyâs Financial Markets Advisory practice (FMA) provides guidance to governments and private institutions worldwide.

The company also offers a range of transition services including full fiduciary transition service management, comprehensive cost analysis to advisory services, proxy/corporate actions services, interim asset management and many others.

BlackRock is the second largest ETP manager in Australia with over $12 billion of the industry's total $45.8 FUM as on March end 2019.

Funds Offered by BlackRock

The company delivers extensive investment management services throughout the major asset classes. Also, the investment strategies of the company cover a broad spectrum of risk and return solutions. BlackRock offers a range of funds to its institutional investors classified under Alternatives, Australian Equities, Fixed Interest/Cash, International Equities, Multi Asset and Property.

Let us have a look at few of the funds consisting of International and Australian holdings:

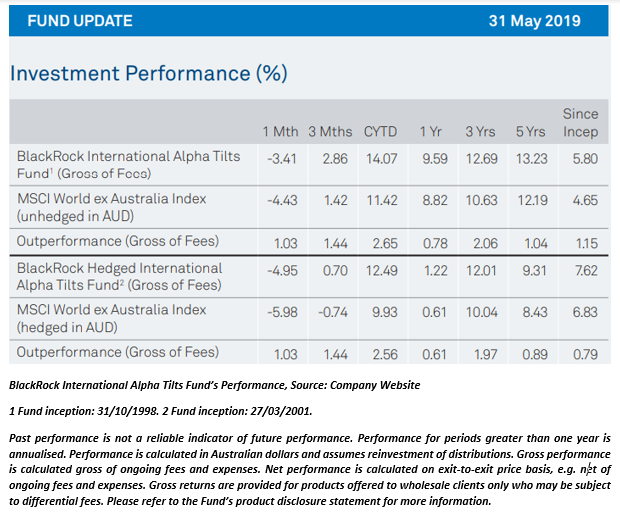

BlackRock International Alpha Tilts Fund

The BlackRock International Alpha Tilts Fund intends to outperform the MSCI World ex Australia Index before fees over rolling 3-year periods, retaining an identical risk level as its benchmark. The Index is hedged or unhedged in AUD with net dividends reinvested.

Fund Performance

The recent fund update released by the company indicates that the fund has been successfully outperforming the MSCI World ex Australia Index since inception (as on 31st May 2019).

Fund Strategy

The company uses local and global investment themes or insights to search for mispriced stocks and industries as its strategy to deliver better results.

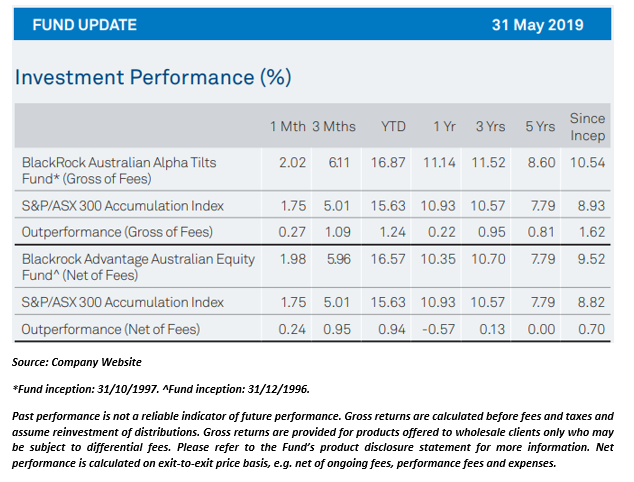

BlackRock Australian Alpha Tilts Fund

The BlackRock Australian Alpha Tilts Fund aims to surpass the S&P/ASX 300 Accumulation Index (while retaining an identical risk level as its benchmark) before fees over rolling 3-year periods.

Fund Performance

The fund has been successfully outperforming the S&P/ASX 300 Accumulation Index since its inception, indicates the recent fund update released by the company. Take a look at the investment performance on the fund up till 31st May 2019:

Fund Strategy

The company uses a highly risk-controlled strategy to identify mispriced stocks considering a range of fundamental investment insights. The insights are taken from the ongoing research by the companyâs global team of investment professionals.

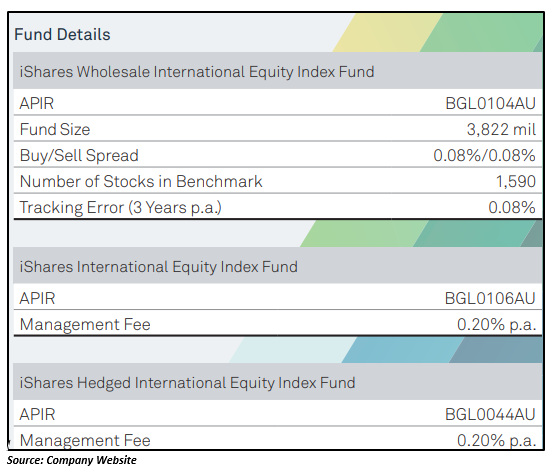

iShares Wholesale International Equity Index Fund       Â

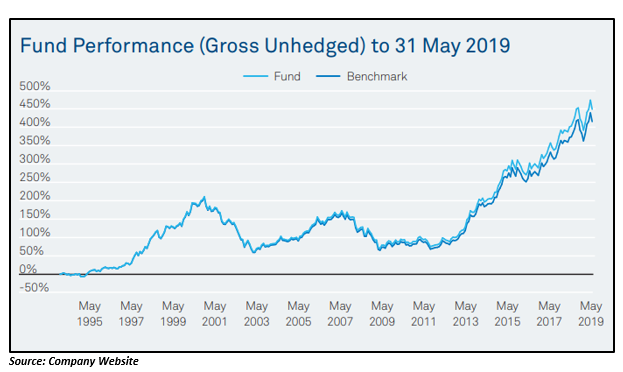

The iShares Wholesale International Equity Index Fund intends to match the MSCI World ex Australia Indexâs performance before fees. The Index is hedged or unhedged in AUD with net dividends reinvested.

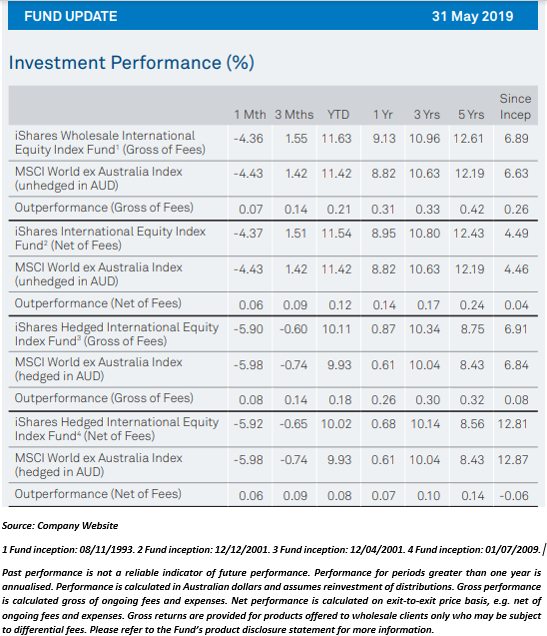

Fund Performance

The recently released figures on the investment performance of the fund suggest that the fund was able to outperform the MSCI World ex Australia Index in the last few years. The table below demonstrates the returns as on 31st May 2019:

Fund Strategy

The company uses a full-replication approach as its strategy to match the performance of the benchmark. The approach focusses on buying every security in the relevant index. The company takes into account the short-term transaction costs linked to the acquisition of a particular stock. The securities are then kept in the portfolio either at or close to its index weight. This is done to minimise the security-specific risk and security-level tracking error.

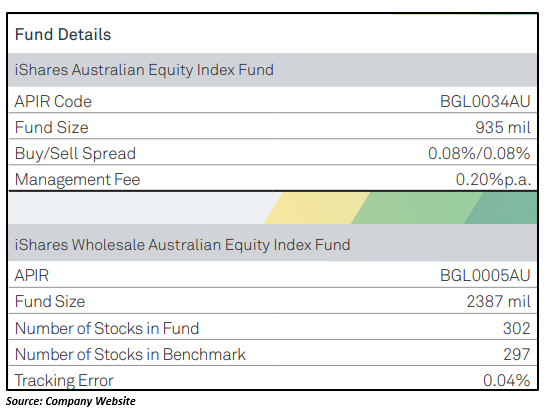

iShares Wholesale Australian Equity Index Fund

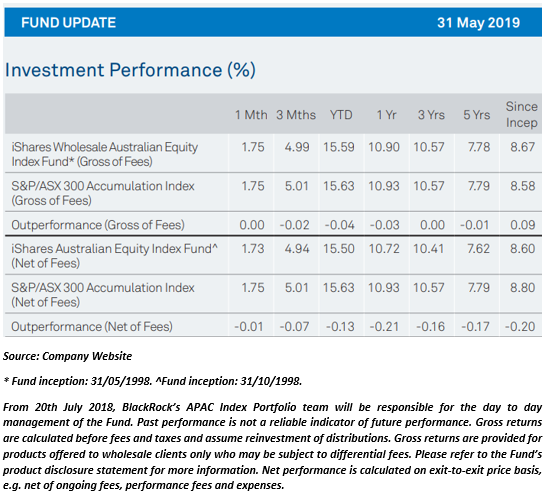

The objective of the iShares Wholesale Australian Equity Index Fund is to match the S&P/ASX 300 Accumulation Indexâs performance before fees.

Fund Performance

The figures of the fundâs investment performance declared by the company in its fund update shows that the fund was not able to outperform the S&P/ASX 300 Accumulation Index in the previous months. The table below shows the Investment Performance figures for the period till 31st May 2019:

Fund Strategy

The company used a full-replication approach in order to match the fundâs performance. The same approach was used by the company in iShares âWholesale International Equity Index Fundâ explained above.

BlackRock is making a positive impact on the communities as a global asset manager by understanding the unique financial needs of its clients. The company invests in diversified markets including fast developing markets around the world, focussing on those areas of the industry that have high growth potential. BlackRock has the opportunity and capability to shape up the future of the asset management industry.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.