Choosing an appropriate stock for investment is undoubtedly not an easy task. Also, some investors eye for long term investment options while others look for a shorter span period. There are multiple strategies that can be adopted by an investor while choosing the right stock to put their hard-earned money. One of the most important strategy that is frequently used by investors for selecting stocks is âassessment of their past returnsâ. Considering this, let us discuss five small-cap stocks that have performed exceptionally well in September 2019 so far.

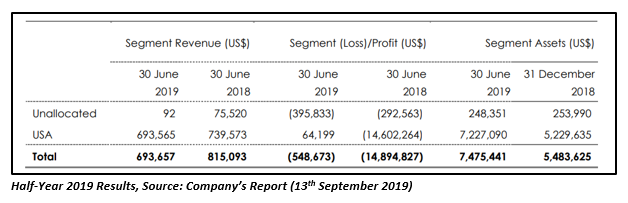

The below table summarises the list of five ASX-listed stocks that have delivered substantial returns so far in this month:

Let us take a look at each one of these small-cap stocks in some detail below:

Magmatic Resources Limited

A mineral exploration company based in Australia, Magmatic Resources Limited (ASX: MAG) holds six projects in two of the countryâs most prosperous mining jurisdictions. With this, the company has built a portfolio of advanced gold, copper and base metals in Australiaâs Leading Resources Regions.

Operational Update

On 11th September 2019, the company notified about the signing of a $3m funding agreement and $300k pre-production works agreement with Blue Cap Mining Pty Ltd. The agreement was signed to speed up the development of the North Iron Cap Gold project, situated in Western Australia.

Financial Update

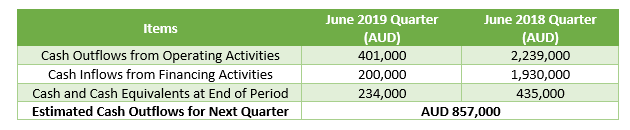

The companyâs June 2019 quarter results were out on 31st July 2019. The company reported a fall in the net cash used in operating activities from AUD 2.23 million in the June 2018 quarter to AUD 401k in the reporting quarter. The cash and cash equivalents of the company was noted at AUD 234k.

Stock Performance

MAG is trading flat at AUD 0.060 (As at 12:02 PM AEST on 17th September 2019). With around 164k shares in rotation, the stockâs market cap stands at AUD 7.03 million. The stock has delivered a YTD return of 130.77 per cent.

Winchester Energy Ltd

Australian-headquartered Winchester Energy Ltd (ASX: WEL) is engaged in the business of oil and gas production and exploration in Texas, USA. The company has established initial oil production on its 17,402 net acres leasehold position situated between proven significant oil fields on the largest oil producing basin in the USA.

Operational Update

Recently, the company provided an update about the recently completed and drilled Arledge 16#2 well at Winchesterâs Lightning Prospect. Considering the results of testing operations, the company notified that the well is presently flowing at a rate of 250 barrels of oil per day without assistance on a 32/64th inch choke.

Financial Update

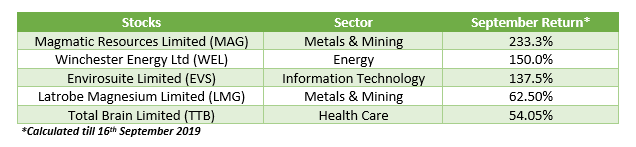

The company released its half-year financial report for the period ending 30 June 2019 on 13th September 2019. Winchester reported a fall in its revenue from continuing operations to USD 693.5k in the reported half-year from USD 739.5k in the prior corresponding period. The company also recorded a net loss before tax of USD 331.6k during the period.

Stock Performance

As at 12:02 PM AEST on 17th September 2019, WEL is trading at AUD 0.080, down by 5.88 per cent relative to the last closed price. With approximately 5.53 million shares in rotation, the stockâs market capitalisation stands at AUD 45.75 million. The stock has performed exceptionally well in the past, delivering a 6-month return of 325 per cent and 3-month return of 203.57 per cent.

Envirosuite Limited

An Australian-headquartered environmental management technology firm, Envirosuite Limited (ASX: EVS) has developed a major SaaS (Solution-as-a-Service) offering which converts data into action instantaneously. The Envirosuite platform uses proprietary algorithms that has been created on over thirty years of environmental consulting experience and offers an array of environmental management, supervising and investigative capabilities.

Operational Update

Recently, the company signed a transformational binding agreement, initiating the entry of Envirosuite into China. The company found an appropriate Chinese partner to mark its entry into the worldâs largest market for its solutions. Envirosuite partnered with Mr Zhigang Zhang, who is one of the most famous leaders in Chinaâs environmental protection sector.

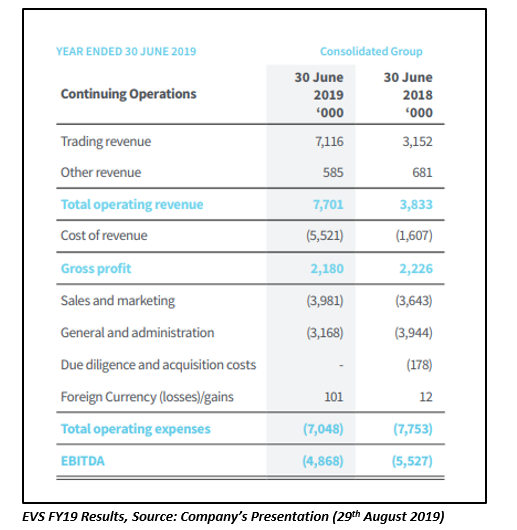

Financial Update

Envirosuite announced its FY19 financial results on 26th August 2019 via an ASX update. The company reported a rise of 126 per cent in its total trading revenue from AUD 3.15 million in FY18 to AUD 7.11 million in FY19. The company also posted a Net loss after tax of AUD 5.99 million from continuing operations.

Stock Performance

As at 12:02 PM AEST on 17th September 2019, EVS is trading flat at AUD 0.285. With ~437k shares of the company in rotation, the stockâs market cap stands at AUD 112.63 million. The stock has delivered a significant return of 352.38 per cent so far in 2019.

Latrobe Magnesium Limited

Latrobe Magnesium Limited (ASX: LMG) is engaged in the development of a magnesium production plant in Latrobe Valley utilising world-first combined hydromet/thermal reduction process. The company expects its Latrobe Project to convert 100 per cent of the treated Yallourn ash into sustainable products.

Operational Update

The company has recently completed the feasibility study and is currently negotiating access to ash to supply its planned $54 million 3,000 tonne pa magnesium plant. The initiation of the construction of the plant is expected to begin in December 2019. As per the company, up to 240 construction jobs will be required to construct the expanded plant and between 50-75 will be needed to build the initial plan.

Financial Update

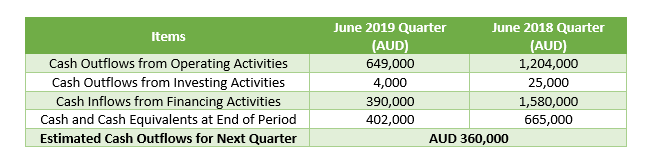

The companyâs June 2019 quarter results were out on 18th July 2019. The company reported a fall in the net cash used in operating activities from AUD 1.20 million in the June 2018 quarter to AUD 649k in the reporting quarter. The cash and cash equivalents of the company was noted at AUD 402k.

Stock Performance

LMG is trading lower at AUD 0.012 (As at 12:02 PM AEST on 17th September 2019), with a fall of 7.69 per cent relative to the previously closed price. With around 162k shares in rotation, the stockâs market cap stands at AUD 16.85 million. The stock has delivered a return of 62.5 per cent on a YTD basis.

Total Brain Limited

A Sydney and San Francisco based firm, Total Brain Limited (ASX: TTB) has developed and sells a mental health and fitness platform, Total Brain, powered by the worldâs largest standardized brain database. The companyâs SaaS platform enables people to optimise and scientifically measure their brain capacities whilst coping with the risk of common mental conditions.

Operational Update

The company notified about the partnership with IBM on 29th August 2019 via an ASX update. IBM and Total Brain have joined hands to unveil GRIT (Get Results in Transition) to help veterans in transition.

Financial Update

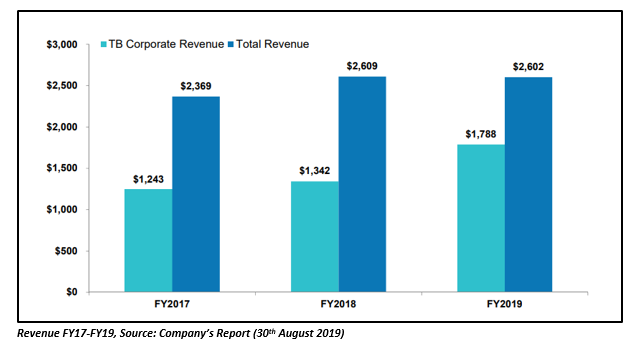

The company released its FY19 financial results on 30th August 2019. The company witnessed a drop of 5 per cent in its revenue from ordinary activities to AUD 2.6 million, and a fall of 62.9 per cent in its loss for the year attributable to the owners of Total Brain Limited to AUD 8.57 million.

Stock Performance

As at 12:02 PM AEST on 17th September 2019, TTB is trading higher at AUD 0.058 with a rise of 1.75 per cent. With approximately 709k shares in rotation, the market cap of the company stands at AUD 44.33 million. The stock has delivered a return of 73.39 per cent on a YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.