The benchmark Index S&P/ASX 200 settled at 6,604.2 on 30 August 2019, up 96.8 points or 1.47% from its previous close, while S&P/ASX 200 Health Care (Sector) inched up 674 points or 1.83% to settle at 36,822.2. Below discussed are three companies that are catering to the health care sector. Let us have a look at their business overview, recent updates and performance on the ASX.

Starpharma Holdings Limited (ASX: SPL)

Company Profile: Starpharma Holdings Limited, listed on ASX in 2000, is an Australian biotechnology company with its registered office in Melbourne, Australia. The company leads globally in the progression of dendrimer products, targeted towards the pharma sector, life sciences sector, and various other applications. The company's underlying technology is built around a type of artificial nanoscale polymer- dendrimers. DEP® drug delivery and VivaGel® portfolio â the companyâs main development programs.

Encouraging Outcomes with Targeted DEP®: On 29 August 2019, SPL unveiled positive findings with targeted DEP®, utilising antibody fragment in a preclinical human ovarian cancer model. According to the announcement, the study achieved tumour regression, in addition to complete survival in a preclinical human ovarian cancer model.

Promising Efficacy Signals: On 28 August 2019, SPL announced that encouraging efficacy signals have been noticed in the trials of DEP® cabazitaxel and DEP® docetaxel, two out of three presently running clinical stage products from SPLâs DEP® platform, along with DEP® irinotecan. Both DEP® cabazitaxel and DEP® docetaxel trials showed promising efficacy signals and a noticeable lack of bone marrow toxicity.

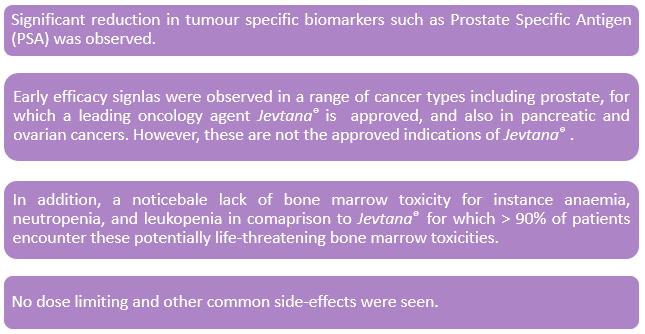

DEP® cabazitaxel trial: Let's dig into some critical observations on these efficacy signals.

Source: Companyâs Report

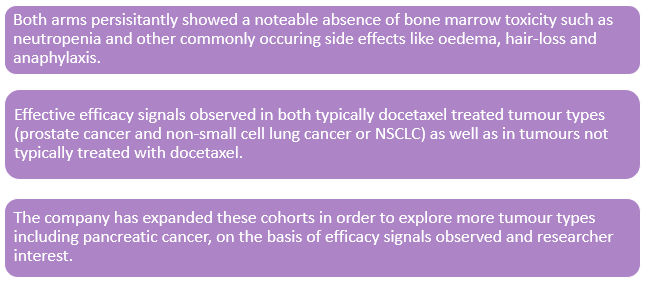

DEP® docetaxel trial: This ongoing phase 2 trial program includes two arms; product use in combination with Nintedanib and a monotherapy arm. The main observations of this trail are:

Source: Companyâs Report

Novel combinations are now being explored. Moreover, due to the lack of need for steroid pre-treatment combinations with IO agents are also being discussed. Starpharma CEO, Dr. Jackie Fairley was extremely happy with these early-stage observations and commented on the commercial utility of the DEP® platform, evidenced by the company's partnerships including with AstraZeneca, bringing their first DEP® candidate, AZD0466, into the clinic later in 2019.

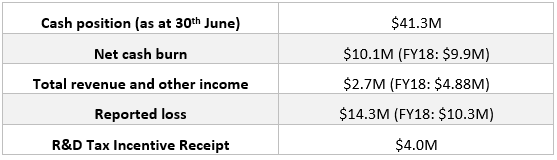

Starpharma also released its annual report and full-year financial results on 28th August 2019. The snapshot of key highlights is given below:

FY19 Highlights (Companyâs Report)

Stock Performance: The stock closed the dayâs trading at A$1.095 on 30 August 2019. The companyâs 6-month return stands at 4.27%, while YTD return is 3.77%. SPL has a market capitalisation of A$408.89 million and approximately 371.72 million outstanding shares.

Telix Pharmaceuticals Limited (ASX: TLX)

Company Profile: Telix Pharmaceuticals, a clinical-stage company, headquartered in Melbourne, develops therapeutic and diagnostic products based on Molecularly Targeted Radiation (MTR) or targeted radiopharmaceuticals. On 30 August 2019, the company announced that its wholly owned Japanese subsidiary concluded lodging the Clinical Trial Notification (CTN) to the Japanese Pharmaceutical and Medical Devices Agency (PMDA) for TLX250-CDx (89Zr-girentuximab). The Japanese unt can now start a Phase I/II trial, designed to bridge to the companyâs international ZIRCON Phase III study.

FDA Pre-NDA Meeting Outcomes: On 28 August 2019, TLX announced the outcomes of the Food and Drug Administration (FDA) pre-NDA (New Drug Application) meeting held in the US on 24 July, highlighting the progress of its TLX591-CDx prostate cancer imaging product (68Ga-PSMA preparation kit), trademarked as illumetTM in the US. The FDA provided valuable and clear clinical and manufacturing guidance to Telix regarding its planned NDA submission in the US.

Regarding the manufacturing package (CMC or Chemistry, Manufacturing, and Control), both the FDA and Telix agreed that NDA would primarily depend on the Drug Master File (DMF), submitted by the company in July 2018. Telixâs DMF has been used as a reference in many Investigational New Drug (IND) applications. FDA agreed on the sterility and final release specifications for the drug substance precursor and other Kit components finding these specifications logical, and also on Telixâs recommended manufacturing validation plan. Further, the FDA made some clarifications about the essential product stability data (compatible with Telixâs present data capture activity) to support an NDA, under Telixâs transition plans from a small scale to a large-scale product manufacturing US-based company. Besides, FDA mentioned that Telixâs proposed plan to include manufacturing validation data, generated with GE Healthcare, supporting the use 68Ga produced by cyclotron was acceptable and would be reviewed in future, which, if cleared, lead to expansion of product deployment flexibility.

Regarding the clinical aspects, both the FDA and Telix mutually agreed that the New Drug Application, where some information is not acquired from a validated study such as public domain literature or from the studies either not done by or for the sponsors or for which the correct reference is not provided, would be regulated under the 505(b)(2) pathway, suitable for the above mentioned information sources. Furthermore, the FDA and Telix collectively agreed on the basic guidelines to support NDA submissions that include published clinical studies for 68Ga-PSMA-11. Telixâs rationale for the proposed clinical dose was also found acceptable. However, a few recommendations were given regarding the data requirements for supporting the safety and efficacy of the product.

Currently, Telix is working on filing a DMF amendment to incorporate its new US-based manufacturer of record, followed by the NDA submission.

Stock Performance: On 30 August 2019, TLX closed the dayâs trading at A$1.365, down 1.444% from its previous close. It has generated an excellent YTD return of 113.08%. The company has a market cap of A$350.38 million and approximately 252.98 million outstanding shares.

Probiotec Limited (ASX:PBP)Company Profile: Probiotec is a leading pharmaceutical company that manufactures, markets and distributes innovative, high-quality range health care products including prescription and OTC pharmaceuticals, nutraceuticals and cosmeceuticals. Other products of the company deal in human nutrition and other high purity functional ingredients. PBP, which has prime focus on innovation, quality and customer service, believes in growing both organically and via accretive acquisitions.

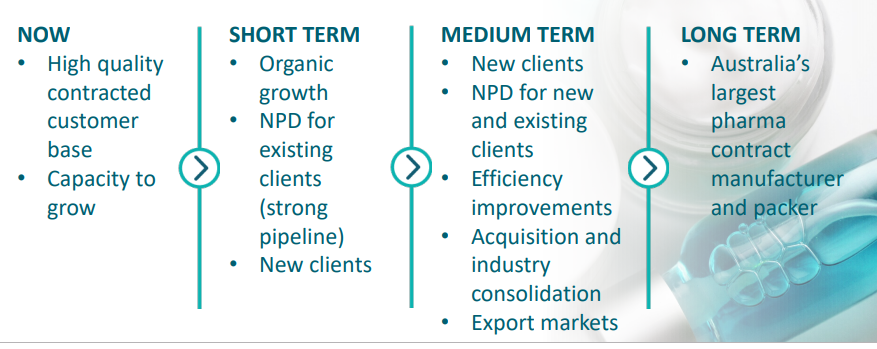

PBP Strategic Plan (Source: Company investor presentation)

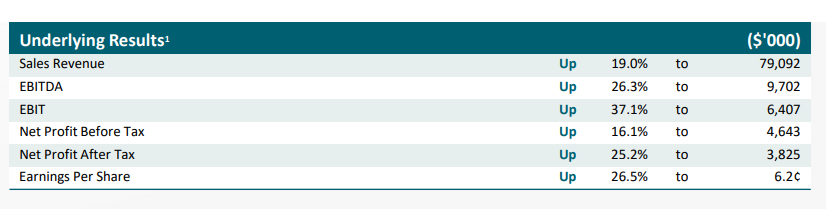

FY19 Resultsâ Investor Presentation: The company released investor presentation for the financial year 2019 ended 30 June 2019, on 29 August 2019, highlighting major financial facts and latest achievements. Moreover, for FY2020, PBP is expecting to generate a revenue of $ 100 million +, with an increase of 26% and EBITDA in the range of $ 16 million to $17 million. FY20 growth drivers are expected to be full year impact of newly contracted work, organic and new product growth from existing customers, ABS acquisition and cost savings from the development of 85 Cherry Lane.

FY19 Highlights (Source: Company Investor Presentation)

Sale of Celebrity Slim Brand: PBP and Global Brands Australia Pty Ltd (GBA) have signed a contract for the sale of Celebrity Slim brand, a leading health and weight loss program, and all intellectual property and business assets at $ 6.75 million in cash. Of the total consideration, GBA initially paid $ 1.5 million as a deposit and the balance amount will be paid after completion of sale, according to the companyâs announcement on 28 August 2019. Anticipated date of sale to occur is 30 September 2019, provided GBAâs satisfactory financial position regarding its current off-market equity raising process completion. Probiotec will now focus exclusively on its core manufacturing business and ABS recently acquired in July, as per Wes Stringe, Probiotecâs Managing Director. PwC and Arnold Bloch Leibler were the two advisors.

Stock Performance: On 30 August 2019, the stock of Probiotec Limited closed trading at A$1.570, down 0.633% from its previous close. It has a market capitalisation of A$94.85 million and approximately 60.03 million outstanding shares. The stock provided returns of 5.33%, in the last six months period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.