Summary

- Amid the COVID-19 pandemic, sales of OTC products like medicines for cold and flu witnessed strong demand.

- AFT Pharma reported an increase of 24% in revenue in FY20 driven by strong growth in sales channels.

- Sales of lubricating eyecare products skyrocketed by 151% in April 2020.

- The Company announced capital raising to optimise capital structure and for providing support to liquidity.

- AFT Pharma had informed that its securities were placed in a trading halt pending the release of an announcement.

COVID-19 pandemic has impacted the global economy, with its effects ranging from severe consequences for people's health to businesses trying to acclimate to this new world order. Meanwhile, some major health care industry players are engaged in the research & development of a treatment/vaccine to combat this deadly viral infection. And some health care sector players are involved in the development of diagnostics for quick detection of COVID-19 to reduce the further spread of the virus.

DID YOU READ: Search for COVID-19 Vaccine; Top 10 Names Across the Globe

Moreover, the sale of over the counter (OTC) medicine, such as medicines for flu and cold, are observing robust demand amid the crisis.

Let us discuss one dual-listed healthcare sector company, AFT Pharmaceuticals.

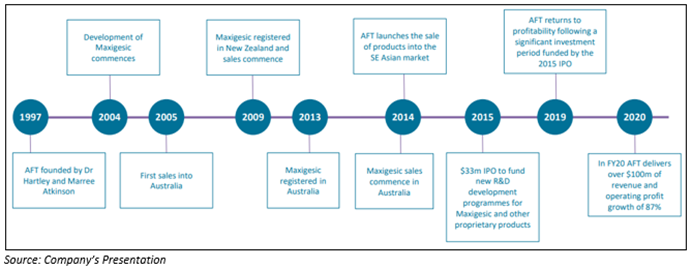

About the Company

Auckland, New Zealand-headquartered healthcare player AFT Pharmaceuticals Limited (ASX:AFP) is into the development, licensing along with sales of pharmaceuticals across Australia, New Zealand and worldwide. The products of AFT are for allergy, cold, flu, eye care, pain management and laxatives.

The product portfolio of AFT includes both proprietary as well as in-licensed therapeutic products, with over 125 prescription and non-prescription medicines. The Company has its offices in Sydney, Singapore, Kuala Lumpur, and Auckland.

AFT Pharmaceutical at a glance:

AFT Pharmaceuticals Announces Capital Raising

On 10 June 2020, the Company stated capital raising for providing support to liquidity and optimise capital structure.

AFT is undertaking an underwritten placement, comprised of:

- A primary placement to raise approximately NZD 10 million by issuing new shares in AFT.

- A secondary sale of nearly NZD 3.5 million worth of shares by AF Trust and almost 16 million existing shares by CRG.

AFT is looking to raise up to almost NZD 2 million through a non-underwritten share purchase plan (SPP) to its eligible shareholders.

The capital raising is anticipated to substantially increase the free float of AFT from almost 11% to 31% and is projected to offer a corresponding rise to trading liquidity.

The equity raised by the issue of new shares under the Placement and SPP would be utilised to retire one of working capital facilities of AFT, enhance free cash flow and offer more flexibility to fund future expected growth.

Pause in trading

Dated 10 June 2020, AFT Pharma informed the market that the securities of AFT are placed in a trading halt pending it releasing an announcement, and trading in AFT ordinary shares would resume on the commencement of normal trading on 12 June 2020 or when the statement is released to the market.

Financial Highlights, Reported Strong Growth in FY20

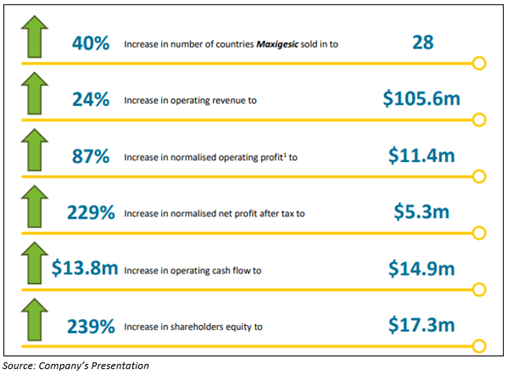

- In the financial year 2020, AFT recorded revenue of NZD 105.6 million increased by 24% on FY19.

- Strong cash flow generation with operating cash flow of NZD 14.9 million in FY20.

- This growth in revenue is being driven by registration and commencing sales in new nations, the launch of variants of existing products in Australasia as well as new countries along with in-licensing of new formulations developed by others for local Australasia market.

AFT Secures Maxigesic IV distribution in 4 European Countries

On 4 June 2020, AFT revealed that the Company secured an exclusive distribution agreement with Ever Valinject in Austria for the commercialisation of Maxigesic IV®, the intravenous (IV) formulations of its patented analgesic, in a substantial portion of Western Europe including Austria, Italy, Germany and France.

Moreover, the Company also disclosed substantial market share gains, including sales growth across a wide range of its Australasian OTC medicines as customers seek safety against coronavirus induced infection.

COVID-19 Response and Related Medicines

Since the COVID-19 outbreak, AFT has observed an increase in sales and market share in several of its over the counter (OTC) products, ranging from traditional medicines for cold and flu through to products for eye care.

Maxigesic Expands Market Share Across Australia

In Australia, Maxigesic® has risen its market share to achieve an 11.1% point lead on its nearest competitor based on the quarterly analysis. The Company disclosed that this rise is because of the robust demand for medicine in response to COVID-19 fears due to the perception the medicine could provide adequate relief to flu and cold symptoms.

Hand Sanitiser launch in AU and NZ

AFT launched its Hand Sanitiser under the name of Crystawash® across Australia and New Zealand in late May as an extension to its skin antiseptic Crystaderm® range- Crystaderm cream, Crystawash saline wound wash, Crystasoothe® for sunburn and burns.

Increase in Sales of Eyecare Products

During the lockdown induced by COVID-19, AFT has witnessed an unforeseen surge in sales of eyecare products as people spent more time in front of screens.

Sales of lubricating eyecare products of AFT pharma, including Hylo-Fresh®, NovaTears®, Hylo-Forte® and Optisoothe® skyrocketed by 151% in April 2020 as compared to the same month in last year.

Outlook

- Further drive International Sales, as the launch in new countries keeps accelerating and with launching new line extensions, for example, Maxigesic IV.

- AFT has plans to extend international licensing, finalise licensing agreement discussions in China, Japan, LATAM and USA.

- Progress commercialisation in additional new territories added during the fiscal year 2020- Canada, Columbia, Cyprus, Germany, Chile, Switzerland, Indonesia, Pakistan, and Peru.

- Drive Local ANZ Sales, Drive Maxigesic sales, new OTC launches, and new COVID-19 related product launches in Australian & New Zealand.

- AFT anticipates robust profit growth in the financial year 2021, with operating profit in a range of NZD 14-18 million, representing growth of nearly 23-58% over the fiscal year 2020.

- In the fiscal year 2021, AFT targets 11 new approvals and targets 38 new approvals in the financial year 2022 in AU & NZ.

Stock Performance

On 10 June 2020, there was a trading halt, and thus, the stock closed at AUD 4.570, the same price as on 9 June. AFP has a market capitalisation of nearly AUD 459.27 million, with ~100.5 million outstanding shares. The stock has delivered positive returns of 26.94% and 47.42% in the last three months and last six months, respectively.

Bottomline

AFT Pharmaceuticals Limited intends to further drive sales across the globe, extend international licensing, and drive improved direct payments and sales in the future. With the backing of its committed, faithful, and diverse team across Australia, New Zealand and other geographies, the Company is aiming to achieve positive cash flow as well as operating profit in the fiscal year 2021.