Carbonxt Group Limited (ASX: CG1), established in 2001 and headquartered in Gainesville, Florida, develops and commercialises specialised and advanced Activated Carbon products, including Powdered Activated Carbon (PACs) and Activated Carbon pellets for the removal of pollutants and toxins in industrial processes principally in the United States.

The products are used in a range of applications like industrial air purification, waste-water treatment and other liquid and gas phase markets, to capture mercury and sulphur and reduce harmful emissions into the atmosphere, as required by global regulations. Moreover, Carbonxtâs key competitive advantage is that the products are non-brominated, which eliminates the corrosion and damage caused to plant equipment when using brominated products.

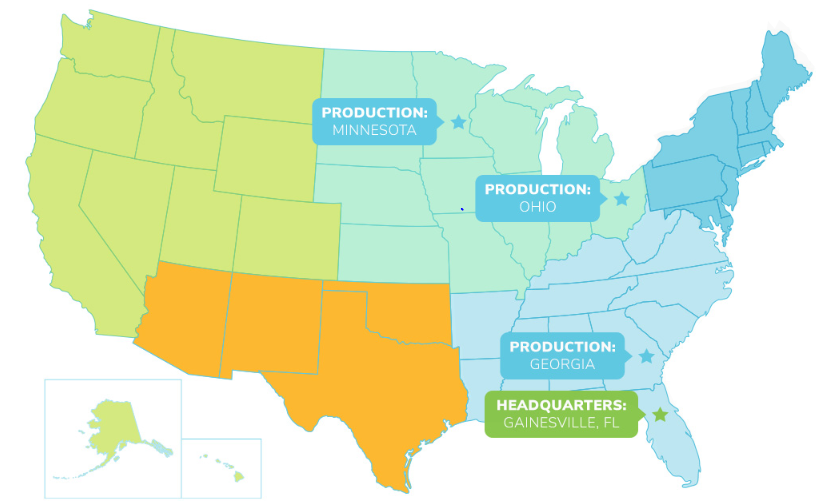

The companyâs manufacturing facilities are located at separate geographical locations to mitigate potential weather-related interruptions and gain access to multiple sources of raw materials.

Source: Companyâs Website

Carbonxt Group conducts extensive research and development (R&D) and leverages on its technical know-how to engineer innovative novel sorbents for pollutant absorption, working with an array of partners across industries including cement plants, industrial boilers and incinerators, facilities in the potable water industry, and more.

The companyâs product line features two broad categories:

Powdered Activated Carbon (PACs)

Impregnated PACs are produced from coal or domestic sustainable materials, designed with distinctive physical features and a unique pore structure that allows for the rapid adsorption and removal of mercury from combustion gases originating in various environments.

PACs are customizable according to individual clientâs unique needs in the most cost-effective manner.

Activated Carbon pellets

Carbonxt develops another high-efficiency product called, Carbon Pellets to remove Volatile Organic Compounds (VOCs) and Hydrogen Sulfide (H2S) from different kinds of gas streams. Carbonxt develops distinct activated carbon pellets in a catalogue of sizes and properties, by working closely with the clients and end users to fully understand the application.

The manufacturing of pellets is primarily undertaken in the United States, which provides various benefits including reduced turnaround time and freight costs, and increased process transparency. The applications range from simple VOC removal to exotic applications which require high adsorption capacity.

Depending upon the industrial usage, the related products are listed as below:

- Coal-Fired Power Plants- MATS-PAC, MATS-PAC PLUS, MATS-PAC HG0, CXT-WETJECTâ¢, CXT-NAQ-ACP

- Cement Plants- CEM-PAC, CEM-PAC PLUS

- Waste to Energy: Industrial Boilers and Incinerators- MACT- PAC

- Portable Water- CXT-BB500, CXT-BB600, CXT-AQUA+

- VOC & Hydrogen Sulfide (H2S) Removal- CXT-ACP60, CXT-ACP80

Market size for the Products

On the basis of product type, the activated carbon market is segmented into powdered, granular, and others. Of these, powdered form is the extensively and widely used variety that finds application in a wide array of industry, ranging from the new age pharmaceutical and medical sectors to the well-established automotive industry; as well as food and beverage processing. The product acceptance is attributed to its unique pore structure (structural properties) and high adsorption capacity (surface property).

The governments across the globe have imposed stringent air and water pollution control and waste treatment norms; focus on clean portable water is witnessed globally. Further, China has taken an aggressive stance on curbing the pollution menace. According to the United States Environmental Protection Agency (EPA) and other government regulatory agencies in North America, activated carbon has been recommended as the best available material for removing particulate matter and chemical impurities such as mercury.

The global activated carbon market size is estimated to expand at a decent rate in the coming decade, aided by the demand from developing nations across Asia and Africa, not just on back of the economic growth but also the need to tackle pollution concerns. The recent technological advancements and improvements in efficiencies is further expected to fuel the growth.

Asia Pacific continued to be the dominant region, accounting for over a third of the overall market share. Increasing usage in air and water purification and emergence of novel applications such as pharmaceutical and food and beverage industry in the region is expected to drive the product demand.

China is known to be the second largest consumer of activated carbon products after the United States. On account of continued increase in the different industry applications, the countryâs demand for activated carbon is forecasted to grow steadily in the near future. Meanwhile, it also one of the largest producers of activated carbon.

The recent global developments suggest that the US average tariff rate is climbing on the Chinese goods and vice-versa.

Amidst the ongoing US-China trade war, Carbonxt Group is closely monitoring the future of the changes in domestic demand as well as exports to China.

Raising funds to meet the rising demand in the US and Australia

Recently on 30 May 2019, Carbonxt Group announced to have entered into a new finance facility with PURE Asset Management Pty Ltd and Skye Equity Pty Ltd to provide additional expansion funding and to redeem the existing Convertible Note facility. The key terms of the facility are:

- Redemption of the existing $ 2.5 million Convertible Note facility (interest rate of 8.0% pa).

- A new facility agreement for $ 5.5 million, representing $ 3 million of additional funds.

- Interest rate on the new facility being 9.5% pa with a term of four years.

- Warrant shares are to be issued at 60 cents per share to the Lenders.

Quarterly update

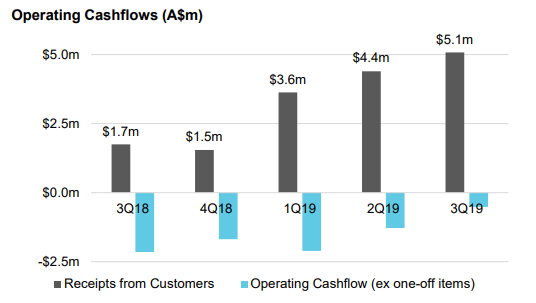

Carbonxt witnessed an outstanding operating performance during the quarter ended 31 March 2019 (3Q19) recording revenues of $ 5.1 million, up 191% on $ 1.7 million the prior corresponding period.

The Arden Hills (pellets) and Black Birch (powdered) facilities, both delivered a decently good performance during the quarter. A fire related manufacturing outage was witnessed at the Black Birch facility with production expected back online in a short span.

As per company, the supply to customers would be maintained from inventory and alternate sources. Going forth, the company Board forecasts the cashflow to be positive. As of 31 March 2019, the cash balance stood at ~ $ 1.11 million.

Source: Companyâsâ March 2019 Quarterly Update

Stock Performance

Carbonxt Groupâs market capitalisation stands around $ 30.64 million with 88.8 million shares outstanding. Today, on 21 June 2019, the CG1 stock closed the market trading at $ 0.330, over last one month the stock has soared by 23.21%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.