Financials sector player, A1 Investments & Resources Ltd (ASX:AYI) is an investment firm that focuses on projects in Australia and Asian countries including Korea, China, Taiwan and Japan. AYI primarily targets food industry related investments, while also exploring other sectors such as tourism, property and financials. The Company, founded in June 2004, operates with a vision of maintaining and developing a diversified investments portfolio, globally.

The Company recently released its Quarterly Activity Statement for the three-month period ended 31 March 2020, highlighting activities directed towards further developing its primary new business of sea cucumbers and improving overall financial position.

Let us look at the recently finalised project of the Company. But before reading this article, remember these three abbreviations -

AYI- A1 Investments & Resources Ltd

TM- Tidal Moon Pty Limited

TMA- Tidal Moon Australia Pty Limited

Sea Cucumber Business Deal - AYI entered into an agreement with Tidal Moon Pty Limited or TM in September 2019 to collectively develop a new sea cucumber business based in Western Australia. As part of the deal, TM has access to harvest sea cucumbers along 1,200km of Western Australian coastline waters from Shark Bay to Onslow, with its primary operations at Denham.

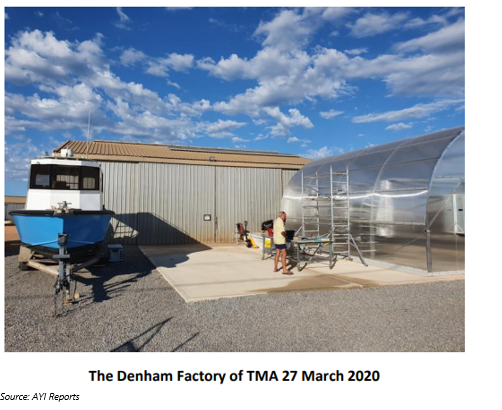

Also, the two companies agreed to form a new entity that would be responsible for the handling of sea cucumbers from a new factory at Denham on the shores of Shark Bay in Western Australia. The new entity, namely Tidal Moon Australia Pty Limited (TMA) would be owned 51% by TM and 49% by AYI, although AYI will have the rights of veto.

As per the agreement between the three companies:

- TM will sell 100% of harvested sea cucumbers to TMA at cost plus 20%

- TMA will sell 80% of processed sea cucumber to Blue Ocean Health, which is an operating division of AYI, at cost plus 20%.

AYI will control the project cost, with TM and TMA required to provide AYI with an open accounting book and driving their own operating costs down.

- By way of payments for product in advance of its delivery, the Company paid $374,170 to TM or TMA till 31st March 2020.

- AYI expects to pay an additional amount of $300-400,000 to TMA over the next 3-4-month period to finalise the project operational objectives and allow the continuous dried sea cucumber supply over the long term.

New Business Activities in March Quarter - During the March 2020 quarter, TM started survey operations in Shark Bay, hired experienced divers, tested its primary fishing vessel and acquired the required equipment to support the operation.

TMA and TM continued to finalise the factory in Denham that would handle sea cucumbers and comprise of a new state-of-the art solar-powered drying room. Meanwhile, AYI and TMA worked on all the pre-requisite requirements during the March quarter, targeted towards securing the required export authorities for the product.

The Company was also looking to obtain the best possible logistics solution for the export of the product, given the significant constraints due to COVID-19.

What is Next?

- The facility is expected to receive final operational approval as a food processing factory in May 2020.

- AYI expects to receive the required authority in May or early June 2020 to permit the export of product in late-June.

- Harvesting of sea cucumbers would start by the third or fourth week of May, with processing expected to start at the same time.

- Final processing operations will be refined during the June quarter, and approximately 100kg of product for export is anticipated on or about 30 June 2020.

Further Project Development

Blue Lagoon Pearls Pty Limited - A1 Investments & Resources has also decided to join hands with TM to acquire the operations and assets of Blue Lagoon. As per the plan, the two companies will have no funding obligations in the proposal. However, at the same time, they have agreed that TMA will lease the pearling processing platform and sub-license the pearling license area for sea cucumber breeding, in case they have success with the TM proposal.

Bundybunna - The Company continues to pursue the resolution of the termination of the liquidation of Bundybunna Aboriginal Corporation Limited (in liquidation). Owing to the coronavirus pandemic, further delay is expected in finalisation.

Corporate Activities

Acquisition of Blue Ocean Japan – AYI settled the purchase of Blue Ocean Japan for a sum of $200,000 in January 2020. Four hundred million shares in the Company at a notional $0.0005 per share were issued to the shareholders of Blue Ocean Japan in full satisfaction of the purchase price.

The new addition is expected to serve as the sales and marketing vehicle for the Company’s products into Asian countries including Japan and China. The primary focus of the Company’s marketing is China and Japan. Blue Ocean Japan is positioned to take advantage of these difficult trading conditions.

Capital Raising - On 17 February 2020, the Company announced to have successfully raised approximately $627,460 and issued ~4.48 billion ordinary shares at an issue price of $0.00014 per share.

Proceeds planned to be directed towards developing the sea cucumber business and used as further working capital. It has also issued further 1 billion shares to its sea cucumber partners and contractors in Western Australia at a notional issue price of $0.0004 per share.

Loan Facility - AYI entered a loan facility with WIN Properties Australia Pty Limited in a principal sum of $2 million.

Plans with respect to the new sea cucumber business of AYI seem to progress well. Moreover, the Company intends to position its sea cucumber products as high-end products at high-end market prices.

Stock Information - The stock of AYI last traded at $0.001 per share on 29 April 2020. The Company has a market capitalisation of $30.61 million.