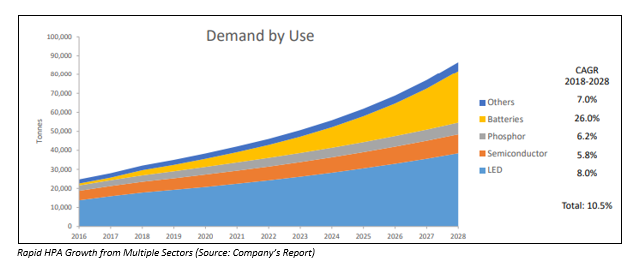

High Purity Alumina or HPA is a specialty product of at least 99.99% pure Al2O3. It is a bad conductor of electricity and has a very high melting point. HPA finds its application in LED lighting, semiconductors, lithium-ion battery separators, scratchproof artificial sapphire glass, fingerprint readers and many more. Demand for high purity alumina stood at nearly 25,315tpa in 2016. During the period of 2016-2024, global HPA market is forecast to exhibit a CAGR of 16.7%, on account of rapid adoption of HPA in these applications.

High purity alumina (HPA) is emerging as the major material used in lithium-ion batteries, backed to its features. HPA is expected to the next major battery metal. Some of HPA benefits in lithium-ion batteries are as follows:

- HPA is a bad conductor of heat. Since lithium-ion batteries generate a lot of heat, they can catch fire. However, HPA use makes them safe.

- Separators coated with HPA boosts the thermal stability and efficiency of the batteries. According to some sources, high purity alumina of 38,000tpa would be needed for coating the separators in lithium-ion batteries by 2025.

- HPA also enhances battery life cycle and reduces self-discharge.

Several companies are getting engaged in the business of HPA, banking on growing demand for the material in the coming years. Some of the major stocks listed on ASX that are dealing in the HPA market are:

- Altech Chemicals Ltd (ASX:ATC)

- Pure Alumina Limited (ASX: PUA)

- FYI Resources Limited (ASX:FYI)

- Platina Resources Limited (ASX:PGM)

- Nova Minerals Limited (ASX:NVA)

Let us have a look at recent updates from three of these ASX-listed stocks and see how their stocks are performing.

Pure Alumina Limited (ASX: PUA)

Sydney-based Pure Alumina Limited is a producer of HPA and gold in Australia. Based on its partnerships and product quality, the company intends to become a premier supplier of high purity alumina. The company is working on Yendon HPA and Hill End Gold projects. After completing the acquisition of Polar Sapphire, a Canada-based high purity alumina producer of high-quality 5N HPA, PUA plans to use Polar's patented technology to build a commercial-scale factory for high purity alumina.

Recent Update:

On 17 June 2019, Pure Alumina Limited released its revised investor presentation with changes suggested by the Australian Securities Exchange in its Investor Presentation made on 14 June 2019. Under the presentation, the company gave investment highlights, according to which it is one of the high-quality, low-cost HPA suppliers in the globe. Its capital expenditure is substantially lower than other potential HPA suppliers. Moreover, its near-term cash flow is positive.

PUA is currently in the process of raising capital to fund the acquisition of Polar Sapphire and development of its planned facility. Polar can use lower cost feedstock to produce 3N and 4N HPA and its innovative process produces the highest commercial grade of HPA, 99.999% (5N) HPA (Al2O3). The higher-grade boules produced by Polar have lesser defects, while the market produces boules with color, clarity and bubble defects. The pilot plant of Polar in Toronto, Canada, has an annual production capacity of 145 tonnes of high purity alumina. HPA demand registered an eight-fold growth since 2003 and is projected to triple by 2030.

Key Acquisition Terms:

Under the terms of the deal, PUA will acquire the equity in Polar Sapphire, which will receive C$13.75 million in PUA shares, C$12 million in cash and 3 board seats in PUA. The deal covers conditions precedent such as completion of due diligence, progress on sale of PUA gold assets, raising a minimum equity of A$30 million, Polar management and employees continuing with the combined entity and other standard conditions precedent. The transaction is likely to be completed in August 2019.

Stock Performance: The shares of PUA have delivered a negative return of 50.00 percent in the past one year. PUA returns for the past six months stand at -7.32 per cent.

The Stock closed the dayâs trade at A$0.040 up by 5.2%, with a market capitalisation of A$8.43 million. The 52-week high stands at A$0.096 and the 52-week low of A$0.026 (as on 21 June 2019).

Altech Chemicals Ltd (ASX:ATC)

Founded in 2010, Altech Chemicals Ltd (ASX:ATC) is operating in the metals and mining sector. The company intends to become one of the leading suppliers of high purity alumina across the world. The company is headquartered at Rokeby Road, Subiaco, Australia. ATC is working on an HPA plant project. The company has completed a Final Investment Decision Study (FIDS) related to the plant, which to be constructed at the Tanjung Langsat Industrial Complex in the Malaysian state of Johor will have an annual production capacity of 4,500 tonnes of high purity alumina.

Recent Update:

ATC gave an update related to its Johor plant project on 18 June 2019. The company announced that the first stage of construction work at the project is progressing as per the plan. It has progressed considerably with structural steel erection for the maintenance workshop building, with the building frame erection and roof structure placement nearing completion. Team working at the construction site is set to soon start roof and wall cladding activities. Retaining wall construction work is almost 75% complete, while work on internal site retaining wall is advancing as per the schedule. Additionally, work on excavation of the on-site detention storm water tanks has started along the plant siteâs southern boundary. Construction work is being carried out on the first of four underground tanks. The tanks will serve as intermediate storage for all site storm water in line with the planning regulations and stormwater management practices adopted in Malaysia. The four tanks will have a total volume of 2,000 cubic metres.

In another statement on 14 June 2019, ATC announced the issue of 18,433,180 fully paid ordinary shares at a price of $0.1085 each share to SMS Investments SA. The development, which will result in a total consideration of $2.0 million, secured shareholder approval on 6 June 2019.

Stock Performance: The shares of ATC have delivered a negative return of 42.86 percent in the past one year. ATC returns for the past six months stand at 19.05 per cent.

The Stock closed the dayâs trade flat at A$0.100, with a market capitalisation of A$72.21 million. The 52-week high stands at A$0.215 and the 52-week low of A$0.082. (as on 21 June 2019)

Nova Minerals Limited (ASX:NVA)

Melbourne-based Nova Minerals Limited (ASX: NVA) is a mineral exploration company, majorly focused on gold exploration. The company operates the Estelle Gold project in Tintina Gold Province in Alaska and the Officer Hill project in the Tanami desert in Northern Territory in Australia. In addition to these two highly prospective projects, NVA owns a substantial stake in Snow Lake Resources Ltd, via which it holds an indirect interest in the Canadian Thompson Brothers Lithium Project. NVA holds a 26.3% interest in a high purity alumina project, namely, Halcyon Resources Pty Ltd. The company is also engaged in exploration projects for nickel, copper, cobalt, gold, silver, platinum and rare earth elements in Alaska. The company is listed on the Australian Stock Exchange with a ticker name NVA and on the Frankfurt Stock Exchange with a symbol QM3.

Recent update:

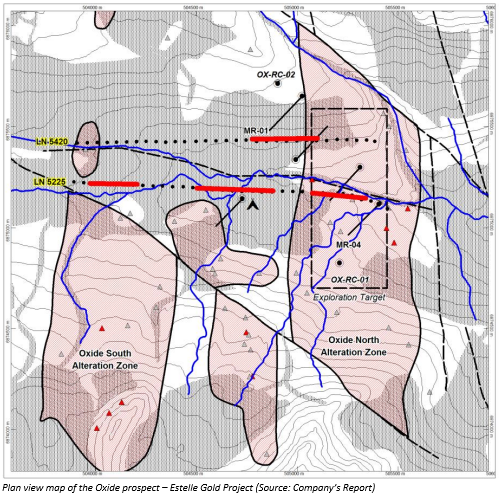

In an ASX announcement on 19 June 2019, the company confirmed a considerable larger gold target at the Oxide prospect on the Estelle Gold project. According to NVA, Induced Polarisation (IP) geophysical survey at the prospect has recognised the volume of prospective mineralisation on only two of the 15 targets areas, with the mineralised system expected to be larger than previously envisaged.

Gold Veins from the Estelle Gold Project, Alaska (Source: Companyâs Report)

The company has mobilised drill crew and rig on the first spotted hole location and is set to start drilling program in the next few days. After the completion of IP and Magnetic geophysical surveys, the company will start surface sampling and geologic mapping program at RPM and Shoeshine prospects in early July 2019.

Pacific Rim Geological Consulting of Fairbanks Alaska carried out the 2018 mapping campaign at the project of Estelle Oxide. The campaign demonstrated that higher gold values are related to bismuth telluride and arsenopyrite mineral phases. The campaign also highlighted that sheeted quartz veins containing narrow alteration selvages hosts the mineralogy.

The project area of Estelle covers several alterations zones and structures, in addition to identified mineral occurrences within a huge tenure. The IP survey will focus the drilling down to the key areas that would result in tonnes for the companyâs maiden Inferred Resource, said NVA Managing Director, Avi Kimelman.

Stock Performance: The shares of NVA have delivered a negative return of 29.03 per cent in the past one year. NVA returns for the past six months stand at 10.00 per cent.

The Stock closed the dayâs trade flat at A$0.022, with a market capitalisation of A$17.03 million. The 52-week high stands at A$0.035 and the 52-week low of A$0.013. (as on 21 June 2019)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.