Large Cap Stocks:

Large cap stocks are those stocks which have a market capitalization of $10 billion or above. Investors prefer to invest in large cap stocks, as these are the stocks of big companies and are stable in nature. It is less likely that these companies go out of business, owing to which investors feel safer to invest in large cap stocks. However, the challenge with these stocks is that their prices may not grow as fast as the small cap stocks. Large cap stocks pay a dividend. Conservative investors generally prefer to keep large cap stocks in their portfolio. Most of the large cap funds are blue chip stocks. These stocks not only pay a dividend, but also have less debt and a long history of stable earnings.

Healthcare in Australia:

In Australia, the central government along with state and territory governments fund the healthcare sector. Out of the total funding, the government contributes 67% in the healthcare sector in the form of Medicare and other programs.

Let us discuss three large cap healthcare companies operating on ASX along with their recent updates and stock performance.

ResMed Inc.

About the company:

ResMed Inc. (ASX: RMD) is a company operating in the healthcare sector, engaged in the development, manufacturing and marketing of medical equipment used for the treatment of sleep disordered breathing. ResMed team focuses on developing innovative solutions to help people stay healthier and live better life. The company is the world leader in the management of Sleep Apnea and COPD.

Sleep Apnea is a sleeping disorder in which the affected person repeatedly stops and starts breathing. The disorder is more commonly found in men than in women. Its symptoms are loud snoring and feeling tired even after sleeping the whole night.

A complex lung disease, Chronic Obstructive Pulmonary Disease (COPD) creates a blockage in the lung airflow. Its symptoms are cough, wheezing, mucus production and breathing difficulty.

Recent Updates:

In early May 2019, the company announced its Q3 FY2019 results ended 31 March 2019. The company reported an increase in the revenue by 12% to $662.2 million as compared to the previous corresponding period. The gross margin expanded to 59.2 percent. During the reported quarter, the companyâs net operating profit also registered an increase of 15%.

Q3 remained strong with top-line revenue growth across all the segmnets of the company. Q3 results were also the outcome of the recent acquisition of SaaS companies followed by progress in the international sales of devices. The company declared a cash dividend of US$0.037 per share, payable on Thursday, 13 June 2019.

According to the companyâs CEO Mick Farrell, RMD has a solid product pipeline, which in addition to the launch of the AirFit P30i, would aid the company in further growing its operations in the future. The company is on track to enhance the lives of 250 million people in out-of-hospital healthcare in 2025, stated Mick.

In the nine months ended 31 March 2019, the companyâs total assets stood at $4,098,526 from $3,063,923 in the same period a year ago, while its total liabilities reached $2,077,197 in 9M FY19 from $1,004,943 in 9M FY18. Its cash and cash equivalents stood at $146,513 at the end of the nine months to March 2019, compared with $704,281 pcp.

Stock Information:

The shares of RMD have given a positive YTD return of 9.60%. By the end of the trading session on 21 June 2019, the price of the shares of RMD was A$17.60, up by 0.114% as compared to its previous closing price. RMD holds a market capitalization of A$25.2 billion with approximately 1.43 billion outstanding shares and a PE ratio of 39.80x.

Cochlear Limited

About the company:

As a healthcare equipment and service provider, Cochlear Limited (ASX: COH) is engaged into offering a range of implantable hearing solutions. Through its segments, the company serves Americas, EMEA and Asia-Pacific markets. For more than three decades, Cochlear Limited has delivered several 'world firsts' in hearing technology. Incorporated in 1983, the company is headquartered in Sydney, Australia.

Cochlear implants:

A cochlear implant is a hearing aid device that helps individuals suffering from moderate to severe hearing loss. COH founded the implant technology and is still the industry leader in this segment.

Products:

Nucleus® 7 Sound Processor: This is the companyâs smallest and lightest behind-the-ear hearing solution, which helps the user to control his/her hearing and connect with the technology. Moreover, this solution enables individuals to connect directly using their smartphones.

Nucleus® Kanso® Sound Processor: This product is smart, and it does not compromise on hearing performance technology.

Nucleus® CP802 Sound Processor: The product is durable in nature and can be used for everyday hearing. It has a parental control as well at the touch of a button.

Recent Updates

On 17 June 2019, Cochlear publicized that it received approval from the Food and Drug Administration (FDA) for its Nucleus® Profile⢠Plus Series cochlear implant. The company will start an immediate launch of the product in the United States.

On 16 April 2019, Cochlear made an announcement regarding the launch of its Nucleus® Profile⢠Plus Series cochlear implant product. The new series is directed towards regular 1.5 Tesla as well as 3 Tesla magnetic resonance imaging scans. This Nucleus® Profile⢠Plus Series do not need the exclusion of the internal magnet. COH also made a statement in relation to the commercial availability of Nucleus® Profile⢠Plus Series in Germany. The implant series is due for availability in other parts of Europe in the next few months. Depending on the timing of securing approvals from regulatory bodies, the company is likely to launch the product in other developed markets as well.

The shares of COH have given a decent YTD return of 19.42%. By the end of the trading session on 21 June 2019, the price of the shares of COH was A$204.31, down by 2.178% as compared to its previous closing price. COH holds a market capitalization of A$12.05 billion with approximately 57.72 million outstanding shares and a PE ratio of 45.63x. Its EPS stands at A$4.577, while the company has an annual dividend yield of 1.51%.

Sonic Healthcare Limited

About the company:

Establishment in 1987, Sonic Healthcare Limited (ASX: SHL) is a global healthcare company, which provides high-quality medical and diagnostic services. The company delivers pathology/laboratory medicine services, along with radiology, general practice, occupational medicine and corporate medical services. The company is headquartered in Sydney, Australia. The company offers its services to hospitals, medical practitioners, community health services, in addition to their collective patients.

Services provided by the company:

Laboratory Medicine / Pathology:

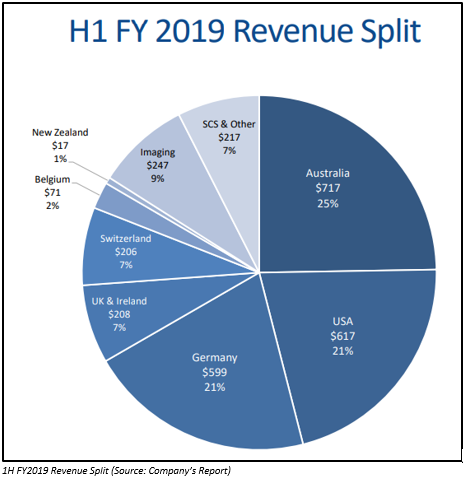

The company is the largest provider of laboratory medicine and pathology in Australia and Germany as well as Switzerland. The company has also made its presence in the United States, United Kingdom, Belgium, Ireland and New Zealand. The state-of-the-art laboratories of the company have over eight hundred specialist pathologists along with thousands of medical scientists and technicians who provide timely results that are accurate, helping clinicians in optimal patient management.

Radiology / Diagnostic Imaging:

The company ranks second in Australia as the diagnostic imaging provider and has over 100 radiology centres. The services of the company are being supervised by 200+ specialist radiologists as well as nuclear physicians.

Sonic Clinical Services:

This division is the primary care segment of the company, which brings together a broad range of health services such as general practice clinics and after hours GP services, and occupational health services.

Companyâs 1H FY2019 results:

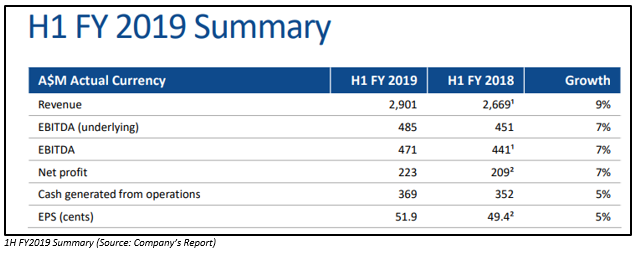

On 20 February 2019, the company released its 1H FY2019 results for the period ended 31 December 2019.

Below are the financial highlights for 1H FY2019.

- The company completed the strategic acquisition of Aurora Diagnostics in January 2019.

- The company is on track to achieve full year earnings guidance.

- The full year guidance of the company has been raised from the range of 3-5% underlying EBITDA growth to 6-8% underlying EBITDA growth, in order to include the Aurora Diagnostics acquisition.

- The underlying EBITDA growth for the period was up 7% to A$485 million.

- Revenue during the reported period grew by 9% to A$2.9 billion.

- The company reported a solid organic revenue growth of ~4.5 per cent.

- The company registered a net profit of A$223 million, up by 7%.

- Cash inflow from its operating activities grew by 5% to A$369 million.

- The company also reported a robust performance in its laboratory operations in the United States, Australia and Switzerland.

Stock Information:

The shares of SHL have given a decent YTD return of 27.75 percent. By the end of the trading session on 21 June 2019, the price of the shares of SHL was A$27.64, down by 0.754% as compared to its previous closing price. SHL holds a market capitalization of A$13.2 billion with approximately 473.89 million outstanding shares and a PE ratio of 25.23x. SHLâs 52-week high is A$28.030, while 52-week low stands at A$21.260. Its EPS stands at A$1.104, while its annual dividend yield is 2.94%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.