Australian Agriculture Industry

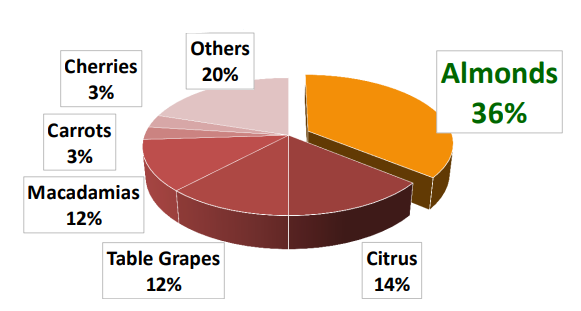

Australian companies are a major agriculture producer and exporter across the globe. According to the Australian agriculture government, almonds are Australiaâs most valuable horticultural export with 36% of the total sales. Australia is the second-highest producer of almonds across the world and largest southern hemisphere producer.

As per the available data from the Australian agriculture government, in 2015 Australia produced 80,500 metric tonnes of almond kernels, and it is reported that in the last 10 years almond production has grown considerably. The export sales were 59,000 tonnes, which generated $747 million. In Australia, there are nearly 200 growers in four states.

The Australian agriculture industry is investing $3 million per annum in research and development and expects to boost to $7 million to develop production systems best adapted to Australian conditions.

Australian Horticultural Exports; Source: Australian Agriculture Report

Letâs now have a look at one of the biggest almond producers in the Australian region:

Select Harvests Limited (ASX:SHV)

An ASX listed and one of Australiaâs largest almond companies, Select Harvests Limited (ASX:SHV) is a fully integrated almond business consisting of orchards, primary processing, secondary processing, trading and consumer products. The company is headquartered in Melbourne, Australia and it supplies almonds in domestic as well as in international markets.

Opportunities & Challenges in China

- Capabilities to meet the increasing demand- Being one of the largest almond growers globally, Select Harvests is capable of exporting almonds and nuts to China as per the growing requirement. The company is capable of supplying bulk and value-added almonds to growing consumers and industrial markets in China.

- Increasing demand for âbetter for you plant-based foodsâ in China- In China, there is a growing demand of almonds, snacking nuts and oats and muesli-based breakfast cereals by the consumers. Besides, the industrial manufacturers are also increasing the use of almonds and other tree nuts in China.

- Evolving food market- In China, the consumer food market keeps constantly changing as they are adopting new trends from other countries and developing its characteristics. In China, E-commerce is growing continuously, so it is important to have a âswitched onâ social media presence on the Chinese platform.

- Employees with China market knowledge- The updated understanding of changing market trends in the local market of China is mandatory for growing business in the Chinese market.

- Strong in market competition in China- The major challenge in the Chinese market is the growing competition between the domestic and foreign food companies.

- For a medium-sized company like Select Harvests, it is crucial to have trusted in-country business partners for growth.

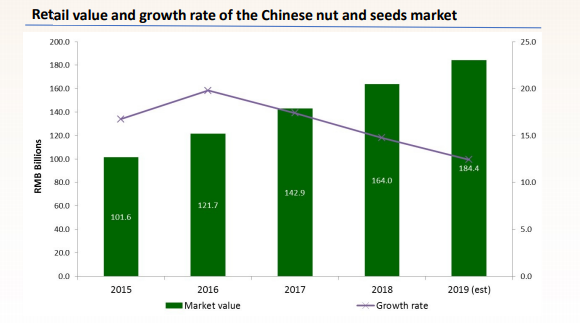

Chinese market (nuts and seeds)

The estimated value of the Chinese seeds and nuts are about to reach RMB 280 billion by 2024. According to forecasts by Mintel, an 8.7% CAGR is expected for the Chinese nuts and seeds market over 2019-24.

Source: Companyâs Report

Select Harvests growth strategy in the Chinese market

Select Harvests is committed to a long-term growth strategy in China, and it is extending its business in China by multiple distribution channels-

- Bricks & Mortar Distribution

- Direct to Retail- âBig boxâ stores are growing in China with Costco most recently entering China. Select Harvests has a supply agreement for Sunsol brand in Samâs Club China stores.

- E-commerce Footprint- The e-commerce strategy is increasingly important to support brand presence in solid bricks and mortar distribution. Select Harvests has an e-commerce presence on T-Mall.

- Industrial Sales- The industrial market for almonds is continuously growing in China with Fast-Moving Consumer Goods (FMCG) majors demanding more almonds for product inclusions.

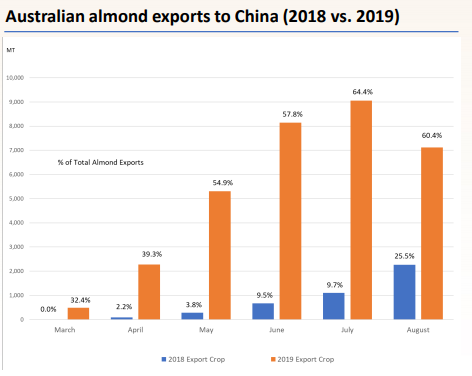

China bulk almond market update

The tariffs being levied on the United States almonds into China, provides excellent opportunities for the Australian almonds to enter the Chinese market.

- In the 2019 year to date, nearly 57.2% of Australiaâs almond exports have gone to China, which was ~10.9% in 2018.

- Chinese market is growing rapidly with the Australian and US almond export sales to China more than doubling in the current Australian crop season.

Source: Companyâs Report

Victorian Export Award Winner-

Select Harvests received the Governor of Victoriaâs Export award for 2019 in the Agribusiness Food & beverages category, and it is a national finalist in the 57th Australian Export Awards. The company awarded for the recent success of both the industrial and consumer divisions in South East Asia and China.

Sunsol SKUâs in China market-

Select Harvests four new Sunsol have received the Chinese government certification, and the company is planning to launch the products in China in the first half of the financial year 2020.

Source: Companyâs Report

According to the 2019 crop update, the companyâs managing director announced that the 2019 crop yields were above the industry standard and exceeded the previous forecast. He further added that in the year 2019, there had been a strong demand from domestic as well as traditional export markets and the demand from the Chinese market, which was relatively new market for Australian almonds had almost shown significant growth.

Stock Performance

The companyâs stock was trading at $7.23 (at AEST 1:47 PM), down by 0.823% on 04 November 2019, with a daily volume of nearly 229,962 and a market capitalisation of approximately $697.92 million. The stock has a 52 weeks high price of $8.100 and a 52 weeks low price of $5.130. The company has delivered a return of 18.54% on a year to date basis and 13.20% in the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.