The use of online property platforms has expanded in Australia in the past few years. These platforms offer online solutions and services for key property-related decisions. The platforms also help buyers find the perfect property for investment by providing them with the details of the major investment properties in Australia. The introduction of the real estate applications has also made dealing in property transactions simpler and convenient for the users.

The online real estate market has witnessed some developments in the last few days, including the introduction of an end to end marketing tool, Reach. Recently, an online property platform player, realestate.com.au. announced the launch of a digital marketing solution, Reach, for its agents and agencies. Reach has been designed to allow the agents and agencies to develop their online presence and develop advertising campaigns utilising realestate.com.auâs data to discover prospects that are appropriate to the local area. The key features of Reach incorporate continuous optimisation, self-service campaign set-up, reporting functionalities and ad creative generation.

In another update, a retail entrepreneur of Australia, Ruslan Kogan led a funding round worth $3.5 million for the online property platform, Landchecker. The platform is expanding its footprint from its Victorian roots into New South Wales, and the expansion has worked in favour of the platform as it has displayed over 8 million properties from May this year. The Landchecker platform that competes against realestate.com.au and Domain, contains information about the properties that can be searched through an online map.

Apart from the above-mentioned real estate platforms, Australians also use InvestmentRealEstate.biz to find their perfect investment property. The online property platform, InvestmentRealEstate.biz, advertises first-class investment Properties that saves the time of buyers and sellers in searching and filtering over all the other websites and irrelevant listings. The aim of the platform is to deliver the details on all the major Australian Investment property stock to the buyers and sellers.

A Glance At Few ASX-Listed Real Estate Stocks

Investment in the real estate stocks is also an option available to the investors besides direct investment in property via the online platforms.

Some investors also consider the investment in real estate stocks as a better option than purchasing a property. This is so because for purchasing a property, the investor needs more initial capital relative to the capital required for investing in stocks. Also, investment in real estate stock offers more liquidity as one can readily buy or sell a stock as per the requirement.

Let us have a look at few of the real-estate stocks listed on the Australian Stock Exchange with decent dividend payouts:

BWP Trust

Established in 1988, BWP Trust (ASX:BWP) is a real estate investment trust that is indulged in managing and investing in commercial properties across Australia. Most of the properties of Trust are large sized retailing properties. The Trust is managed by the BWP Management Limited which works under an Australian Financial Services (AFS) Licence.

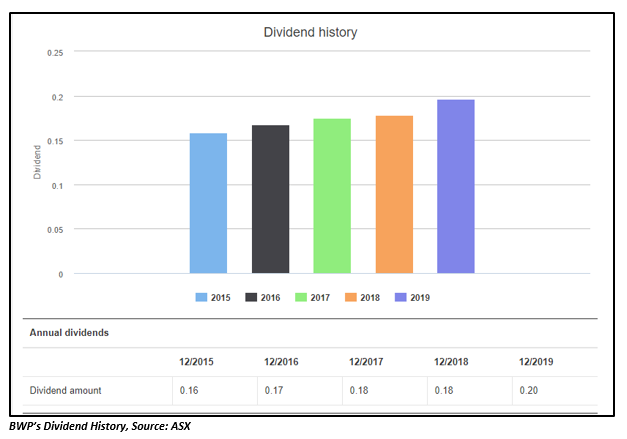

Dividend Update

The Trust recently announced the initial distribution estimate for the half-year period ending 30 June 2019. The Trust notified in an ASX announcement that the all distributable profit will be divided in accordance with the Trustâs constitution. The total distribution amount disclosed was 10.74 cents per unit out of which the estimated ordinary distribution is 9.18 cents per unit that included ~0.8 cents of capital profits. The Directors of the Trust offered a special distribution of 1.56 cpu (cents per unit). The dividend carried an ex-distribution date of 27th June 2019 and the record date of 28 June 2019; to be payable on 23rd August 2019.

The Trust has decided to suspend the Distribution Reinvestment Plan in respect of the special distribution and final distribution for the year ending 30th June 2019. The actual distributions will be examined on 6th August 2019 at a Board of Directors meeting of the BWP Management Limited.

The annual dividend yield of the Trust was at 5.11 per cent on 12th July 2019.

Stock Performance

BWP closed lower on the ASX on 11th July 2019 at AUD 3.850, down by 0.25 per cent relative to the last closed price. The stock reported a market cap of AUD 2.48 billion at the time of writing the report. The stock has delivered a return of 9.79 per cent on a YTD basis and 17.80 per cent in the last one year.

Charter Hall Group

One of Australia's leading fully integrated property groups, Charter Hall Group (ASX:CHC) has over 28 years of experience in funds management and property investment. The Group use its property expertise to manage, deploy, access and invest equity in core real estate sectors. The purpose of the Group is to generate superior returns and create value for its customers.

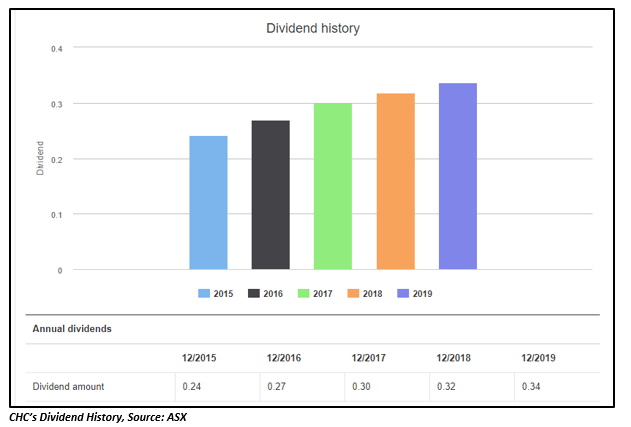

Dividend Update

Charter Hall Funds Management Limited recently announced a distribution of 17.2 cps (cents per security) for the half year ending 30 June 2019. The Charter Hall Funds Management Limited is a responsible entity for Charter Hall Limited. The declared distribution is for its Stapled Securities US Prohibited. With the recent update, the total distribution per security will be 33.7 cps for the year ending 30 June 2019, 6 per cent higher than FY18 distribution.

The distribution will be paid from both Charter Hall Property Trust (10.7 cents per security distribution) and Charter Hall Limited (6.5 cents per security fully franked dividend). The distribution to be payable on 30th August 2019, carried a record date and ex-date of 28th June 2019 and 27th June 2019, respectively. The group notified in the announcement that 37.79 per cent of the distribution is franked with 30 per cent corporate tax rate applicable on it for franking credit.

The annual dividend yield of the Group was at 2.94 per cent on 11th July 2019.

Stock Performance

The stock of the group closed the trading session higher on ASX at AUD 11.750 on 11th July 2019. The stock witnessed a rise of 2.53 per cent in comparison to its last closed price of AUD 11.460. Around 1.8 million shares of the group were in trade against the annual average volume of 1.66 million. The 52-week high and low value of the stock was recorded at AUD 11.840 and AUD 6.50, respectively. The performance of the stock has been extremely well in the past as it has generated a huge return of 55.92 per cent on a YTD basis.

Dexus

One of the Australiaâs leading real estate groups, Dexus (ASX:DXS) directs a high-end Australian property portfolio worth 28.9 billion dollars. Dexus directly owns 13.9 billion dollars of office and industrial properties in Australia and manages a further 15.0 billion dollars of retail, healthcare, office and industrial properties for third-party clients.

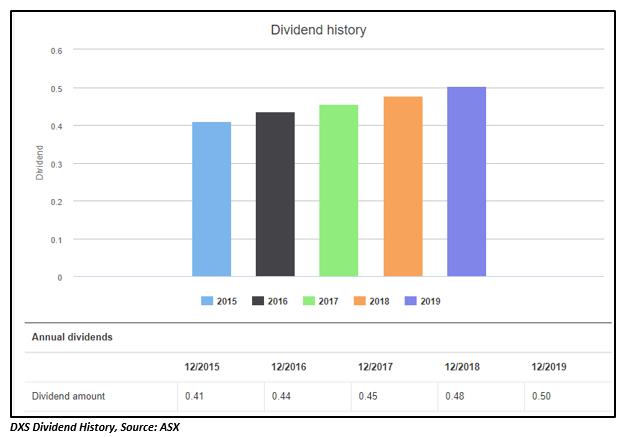

Dividend Update

The Group announced the details of its distribution for the half-year ending 30 June 2019 in June this year. The estimated distribution amount stands at 23.0 cents per stapled security. With the announcement of this distribution, the total distribution amount reached 50.2 cents per stapled security for the financial year 2019 (including distribution of 27.2 cents per stapled security for the half-year ending 31st December 2018), representing an increase of 5 per cent on the prior year.

The declared distribution is for Fully Paid Units Stapled Securities and is payable on 29th August 2019. The record date and the ex-date of the distribution were 28th and 27th June 2019, respectively. Out of the estimated distribution amount, 19.8195 per cent is franked with 30 per cent franking credit applicable on it, and the remaining 80.1805 per cent is unfranked. Dexus confirmed that the distribution reinvestment plan will be suspended for the declared distribution payment. Also, the group will announce the actual distribution rate on Wednesday, 14 August 2019, when it will release its 2019 annual results.

The annual dividend yield of the Group was at 3.74 per cent on 11th July 2019.

Stock Performance

DXS closed higher on the ASX at AUD 13.580, with a rise of 1.19 per cent on 11th July 2019. The group had a market capitalisation of AUD 14.72 billion at the time of writing the report. The stock opened at AUD 13.43, fluctuating between a dayâs high and low value of AUD 13.61 and AUD 13.43, respectively. The stock has delivered a return of 27.57 per cent on a YTD basis, and 24.37 per cent during the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.