On ASX, Metals and Mining sector is being represented as S&P/ASX 300 Metals & Mining Index. The metal and mining industry include those companies, which are classified by the Global Industry Classification Standard as belonging to the Metals & Mining industry. It generally includes producers of metals like aluminium, gold, steel, precious metals and minerals etc. Letâs have a look at three Metal and Mining stocks with their recent updates:

Rafaella Resources Ltd

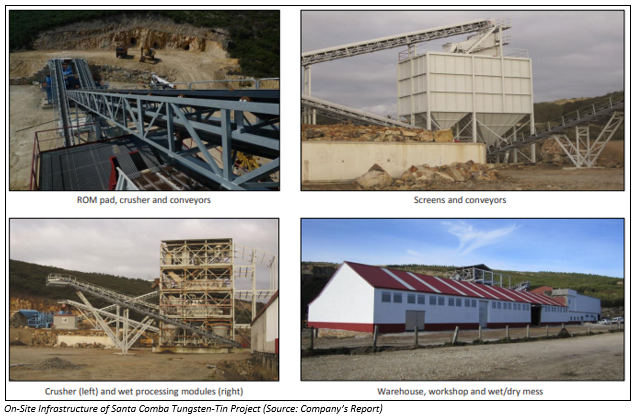

Rafaella Resources Ltd (ASX: RFR) is involved in exploration and development of minerals with the ownership of Santa Comba tin and tungsten project in Spain. Recently, the company through a release dated 3rd September 2019 updated the market that it has entered into agreement Spanish drilling contractor Geonor Sondeos y Peforaciones, S.L in order to commence its drilling campaign though its through its Spanish subsidiary Galicia Tin and Tungsten SL, which is the 100% owner of the Santa Comba tungsten project. The company further stated that the drilling programme had been scheduled to begin within two weeks and it would look to upgrade as well as expand the near-surface JORC Inferred MRE.

Initial and Change in Directorâs Interest

Rafaella announced that Robert Wrixon had been appointed as director in the company with securities 100,000 Fully paid ordinary shares, 250,000 Milestone 1 Performance rights, 250,000 Milestone 2 Performance rights and 750,000 Unlisted $0.20 options, which are expiring 27 August 2022. The director was appointed on 27th August 2019. In another updates, the company announced that Graham Durtanovich has made a change to his indirect interest in the company by acquiring 250,000 fully paid ordinary shares on 27th August 2019.

Completion of Capital Raising

As per the release dated 9th August 2019, the company announced that it has successfully wrapped up the capital raising amounting to $2.8 million for supporting the acquisition of Galicia Tin & Tungsten SL as well as the development of the Santa Comba tungsten project. For the raising of funds, the company had issued 14 million shares at an issue price of $0.20 to sophisticated and strategic investors. When it comes to using of proceeds, it stated that RFR is now well placed to finalise the acquisition of Galicia Tin & Tungsten SL. From the raised funds, it will expand the near-surface JORC Inferred MRE and to feed into the planned pit design optimization.

Moving to price performance, the stock of Rafaella Resources Ltd last traded at A$0.155 per share with a fall of 13.89% in the trading session on 3rd September 2019. In the time frame of three months and six months, it witnessed a rise of 28.57% and 125.00%, respectively. When it comes to the time period of one month, RFR indicated a decline of 7.69%.

Oakdale Resources Limited

Oakdale Resources Limited (ASX: OAR) is into exploration and development of viable graphite mining operations. As per the release dated 3rd September 2019, the company updated the market about its gold projects in Nevada and Peru. The company has three projects in Nevada district, which include Tonopah North, Douglas Canyon and Lambarson Canyon. While in Peru, it is in the development of Chimu gold processing plant and Burpar project.

Nevada Prospective Gold Area

The company stated that 74% of US gold mined in this jurisdiction and has been rated as 3rd best mining district in the world. Moving forward to the projects of Nevada. Douglas Canyon, which is in the Camp Douglas area is an important gold-silver mining area. Tonopah North is in the Tonopah area an epithermal gold-silver mining district

Peru Gold Processing Framework

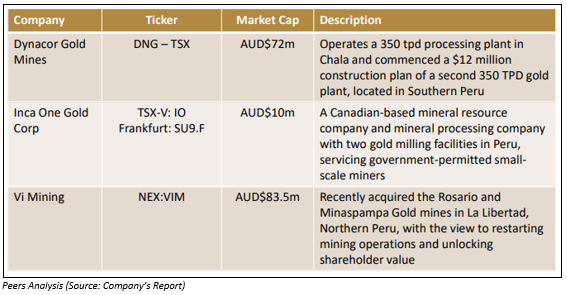

The company stated that Peru is the first country in South America, which is having a formalised small scale mining resulting in a boom of small-scale mining activity. When it comes to the project of area, the company added that Chimu processing plant is near Burpar Project which could provide high-grade ore. The following picture provides an idea of peersâ analysis in Peru:

Strategic Rationale

The company has existing plant and operation for near term positive cash flow with low capital expenditure in order to increase the volume and efficiency initially to 40 tpd and after that 120tpd to 200tpd. The company further stated that it is further planning to have three 200tpd plants strategically placed across Peru in the upcoming 5 years.

Share Purchase Plan

As per the release dated 28th August 2019, the company has successfully wrapped up the share purchase plan, wherein it raised an amount of $497,233. OAR has received $218,000 from eligible shareholders for new fully paid ordinary shares under the Share Purchase Plan. The company will utilize the funds for Chimu Gold Plant in Peru and in Alpine Gold Project, which is located in Nevada.

Moving to price performance, the stock of Oakdale Resources Limited last traded at A$0.009 per share on the trading session of 3rd September 2019. In the time frame of three months and six months, it witnessed a fall of 30.77% and 25.00%, respectively. When it comes to the time period of one month, OAR declined by 25.00%.

Apollo Minerals Limited

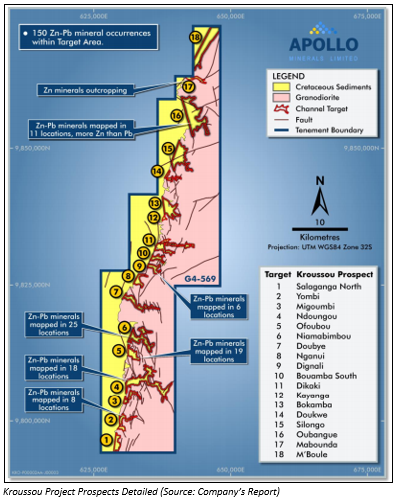

Apollo Minerals Limited (ASX: AON) is engaged exploration and development activity at its Aurenere Project in Spain and Couflens Project in southern France. Recently, the company, through a release dated 3rd September 2019, announced an update on a large scale near surface zinc-lead project. The company added that it has executed Earn-in Agreement for earn-in an interest of up to 80% in the Kroussou zinc-lead project with Trek Metals Limited. The company will be spending g A$2,000,000 on the Project within 3 years, by this the company will earn 70% interest and remaining 10 % interest will be earned by the company by making an expense amounting to A$2,000,000 on the Project within five years.

Entitlement Issue

The company further stated that in order to finance its new and existing activities, it would be undertaking a 1 for 1 pro rata non-renounceable entitlements issue at $0.025 per share in lieu of raising up to $4.2 million before costs

Overview of Kroussou Project

It was mentioned in the release that the project is having one Prospecting License, G4-569, which covers an area of 986.5 square km situated in Ngounié Province. The company stated that Trek Metals Limited has recently performed two small drilling programs at the Kroussou Project for primarily confirming historical results, soil surveying, mapping etc. Trek Performed first drill at Dikaki area, wherein reported following results:

- 8 metres @ 4.2% Zn+Pb (DKDD010, from 2.4 metres)

- 7 metres @ 4.6% Zn+Pb (DKDD012, from 25.1 metres)

- 1 metres @ 6.1% Zn+Pb (DKDD013, from 0.7 metres)

- 0 metres @ 15.2% Zn+Pb (DKDD029, from 8.1 metres)

- 8 metres @ 6.0% Zn+Pb (DKDD028, from 8.9 metres)

- 0 metres @ 4.5% Zn+Pb (DKDD033, from 37 metres)

When it comes to second drilling, Trek Performed at Niambokamba area and reported result;

- 0 metres @ 4.8% Zn+Pb (NKDD001, from 45.0 metres)

For the quarter ended 30 June 2019, net cash outflow from the operating activities stood at A$1.148 million as reported by Apollo Minerals Limited after settling for major payments of A$0.857 million and A$0.146 million for exploration & evaluation and staff costs, respectively.

Moving to the stock price performance, the stock of Apollo Minerals Limited last traded at A$0.028 per share on the trading session of 3rd September 2019. In the time frame of three months and six months, it witnessed a fall of 70.00% and 75.00%, respectively. When it comes to the time period of one month, AON indicated a decline of 16.67%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.