On 9 August 2019, the Australian Benchmark index S&P/ASX 200 closed at 6,584.4, up by 16.30 points or 0.25% from the previous close. The broader All Ordinaries Index edged up by 0.3%, settling at 6,663.4. Investors are carefully eyeing market updates by the companies amidst reporting season. Global trade concerns are also keeping the market players on their toes. Let us look at recent updates by four key players:

Australian Vanadium Limited (ASX: AVL)

On 9 August 2019, the company announced an update on the Vanadium Pilot Scale Study. Accordingly, it tested ~ six tonnes of oxide & transitional material for crushing, milling & beneficiation (CMB) at a laboratory based in Perth. Subsequently, the results indicated better than expected vanadium grades, and very low grades of silica & alumina in concentrate.

Reportedly, the companyâs target concentrate quality depicted SiO2 content <2% and V2O5 grade of 1.4% based on the companyâs pre-feasibility study. Also, the benchmark testwork has been ongoing, which would determine the optimal flowsheet to improve vanadium recovery. Besides, 550kg of magnetic concentrate generated from the initial pilot was delivered to a Brisbane laboratory to test condition prior to additional testing.

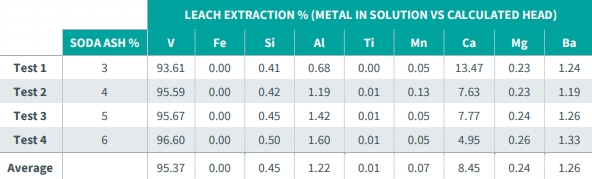

As per the release, some pelletised salt roast tests were performed on magnetic concentrate while preparing the roast leach benchwork, which depicted vanadium recoveries ranging from 93.7% with a 3% soda ash addition, to 96.6% with 6% soda ash addition.

Oxidative roast leach extraction results (Source: Companyâs Announcement)

The management commented that the company is focused on providing the final operating cost for the Project, which would be below the lowest quartile of vanadium producers. Admittedly, the company has been progressing with DFS, and possibilities for capital cost improvements, by-product sales and energy savings are being studied. Besides, it is advancing with testwork concurrently with obtaining financing, securing offtake agreements, and progress would be reported.

On 9 August 2019, AVL last traded at A$0.013, flat from the previous close.

Clancy Exploration Limited (ASX: CLY)

On 9 August 2019, the company announced an update on the Cummins Range Rare Earth Project. Accordingly, it was noted that the company completed due diligence on the RareX Pty Ltd, and Cummins Range Rare Earths Project. Additionally, the company intends to supply a notice of a general meeting to obtain approvals to complete the acquisition of RareX.

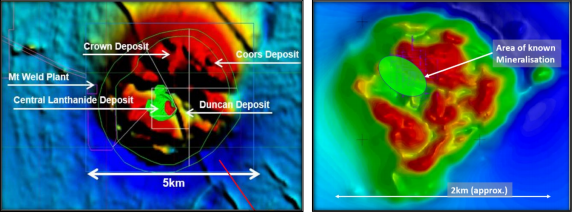

Reportedly, the company completed site visit at the Cummins Range, which confirmed access to the site. Also, the analysis of historical data suggested that known mineralisation remains open at depth, which is similar to the world class Mt Weld diatreme complex located in Western Australia.

Besides, the initial stage of the maiden drill program would start in the coming time, which would be dependent on permitting. Further, the program would include diameter PQ drill core to collect samples for test work for the determination of the grade of the mineralisation.

Mt Weld (Left) & Cummins Range (Right) (Source: Companyâs Announcement)

Rare Earths Market Update

Reportedly, the market is dominated by China, which produces ~80% of the global supply chain, and China also houses the majority of the refining and magnet fabrication facilities for rare earth. Besides, there have been signs predicting that China might leverage the dominance of rare earth in the trade war.

On 7 August 2019, the reports emerged that US Geological Survey scientists undertook a site visit of the Australian-based Rare Earth project. On 8 August 2019, the Shanghai Metals Market announced that the countryâs rare earth association would support actions by the government to counter US tariffs.

On 9 August 2019, CLY last traded at A$0.051, up by 155% or 0.031 from the previous close.

Mako Gold Limited (ASX: MKG)

On 9 August 2019, the company provided updates on Napié Project- Côte dâIvoire (Project). Accordingly, it received results from the final 11 holes from the twenty-seven-hole reverse circulation drill program at the project. Also, the company is entitled to earn up to seventy-five per cent in the project, which was agreed under the farm-in joint venture agreement with Occidental Gold SARL, a company of Perseus Mining Limited (ASX: PRU). Presently, the company operates the project and has a 51% stake in the permit.

Tchaga Prospect

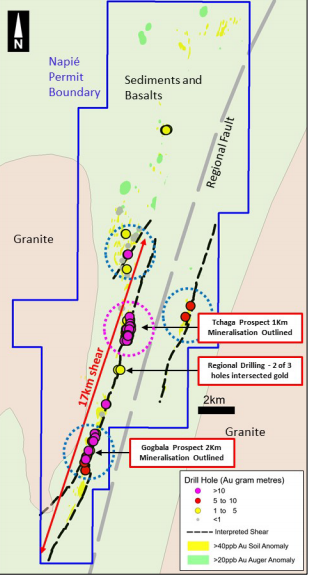

As per the release, the assays obtained from the eight holes depicted narrow gold intercepts, and the individual best was 1m assays up to 7.55g/t Au. Also, the high-grade gold intercepts from the drilling had identified area, which would be used in JORC compliant gold resource.

Regional Drilling

Reportedly, the assay from three RC drill holes depicted best intercepts of 1m at 1.48g/t Au (NARC099) and 1m at 1.27g/t Au (NARC098) in two holes. Also, there was no significant width of gold mineralisation had been intersected.

Planned Follow Up

The company would be progressing with additional follow-up drill campaigns post the wet season, which usually ends in November. Besides, it has identified various targets (in pink circle, below figure), and the current goal is to progress with the JORC compliant resource.

Napié Project - Prospects and drill targets (Source: Companyâs Announcement)

On 9 August 2019, MKG last traded at A$0.089, down by 7.292% from the previous close.

Impression Health Limited (ASX: IHL)

On 9 August 2019, the company announced a cannabis oil supply agreement. Accordingly, the company had launched its wholly owned novel cannabinoid drug discovery brand, Incannex PharmaceuticalsTM. Also, Incannex has engaged with Linnea SA â a global leader in custom cannabinoid drug design & formulations. Further, Incannex would be the supply partner of Linnea to provide cannabinoid materials for two novel cannabinoid formulations under design.

Reportedly, the company through Incannex had launched EU GMP-approved pharmaceutical grade CBD Oil product. Also, these new products by Incannex would be marketed by Cannvalate on a non-exclusive basis.

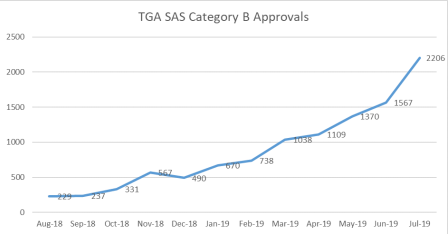

Growth in SAS Cat B Approvals (Source: Companyâs Announcement)

As per the release, the CBD supply agreements between Cannvalate Pty Ltd improve the current supply & distribution agreement, and equity relationship between the companies. Also, under the new products, Incannex would purchase up to 2k, 50 ml bottles of Incannex Oils over the rest of the calendar year. Besides, the new products have been designed to match with formulation mainly in demand on the Cannvalate business.

Further, Incannex, under the commercial strategy, would acquire 1k patients by the end of 2019 to become one of the largest licensed cannabis companies in Australia. Importantly, TGA Special Access Scheme (SAS-B) approvals for medicinal cannabis products have increased drastically over the calendar year.

On 9 August 2019, IHL last traded at A$0.091, up by 15.19% from the previous close.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.