More than 100 ASX-listed companies have released their earnings during the corporate earnings season in August. It was a crucial and exhausting month for companies releasing their financial results. The intensifying US-China trade tensions and the historic low interest rates prevailing in Australia were among the key challenges faced by the companies during 2019 financial year.

Gainers and Losers of August Reporting Season

The August earnings season was not so impressive, as most of the companies were not able to stand with the expectations. The impact was seen on the Australian share marketâs benchmark index S&P/ASX 200 that delivered a negative return of approximately 4.14 per cent during August (calculated till 29th August 2019), while it generated a positive return of 2.47 per cent in the previous month.

Though several companies reported weaker results, there were some that surprised on the upside on earnings. As the 2019 August reporting season concludes this week, it is time to look at some of the gainers and losers of the earnings season. The below table includes the list of some of the gainers and losers of the reporting season:

*YTD Return Calculated Till 29th August 2019

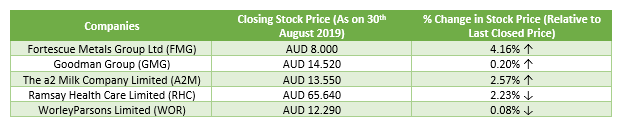

Gainers of Reporting Season

Let us now take a quick look at the financials of the gainers of reporting season in some detail below:

Fortescue Metals Group Ltd

Australia-headquartered company leading the iron ore industry, Fortescue Metals Group Ltd (ASX: FMG) reported robust financial results for the financial year closed on 30th June 2019. The company reported a record rise of 263 per cent in its NPAT from US$878 million to ~US$3.2 billion. The companyâs revenue was also 45 per cent up on the prior corresponding period (pcp) to ~US$10 billion. In terms of safety performance, the company announced a 24 per cent improvement in the Total Recordable Injury Frequency Rate to 2.8.

Goodman Group

Sydney-headquartered integrated property group, Goodman Group (ASX: GMG) published its full-year FY19 financial results on 23rd August 2019. The real estate playerâs statutory profit was 48 per cent up on pcp to $1,628 million. The operating profit and operating earnings per share of the Group also improved by 11.4 per cent and 10.5 per cent on FY18, to $942 million and 51.6 cents, respectively. Goodman also declared a significant distribution of 15 cents for the half-year ended 30th June 2019. The Group expects its operating profit to witness a rise of 10.4 per cent in FY20 to $1,040 million.

The a2 Milk Company Limited

Founded in 2000 in New Zealand by scientist Dr Corrie McLaughlan, The a2 Milk Company Limited (ASX: A2M) reported record financial results and market shares for the year ended 30th June 2019. The year saw the company step-change its investments in consumer understanding, brand and capability. The total revenue and NPAT of the company experienced a rise of 41.4 per cent and 47 per cent on pcp, to $1.3 billion and $287.7 million, respectively. The share of the infant nutrition market got reinforced to 6.4 per cent in China, with a rise of 46.9 per cent in its infant formula revenue to $1.1 billion. The company expects its FY20 EBITDA as a percentage of sales to be largely consistent with the 2H19 EBITDA margin of 28.2 per cent.

Ramsay Health Care Limited

The global health operator, Ramsay Health Care Limited (ASX: RHC) posted an increase of 40.5 per cent in its âStatutory reported net profit after tax and after noncore itemsâ to $545.5 million for the financial year 2019. The companyâs Core NPAT and Core EPS were also 2 per cent and 2.1 per cent up on pcp, to $590.9 million and 285.8 cents, respectively. The companyâs Revenue and EBITDA from the Australian market saw a rise of 4.1 per cent and 6 per cent to $5.2 billion and $950.5 million, respectively. The company is targeting for a Core EPS growth of 4 per cent in FY20.

WorleyParsons Limited

Australiaâs professional services company, WorleyParsons Limited (ASX: WOR) delivered an improved financial performance in FY19, with an underlying NPATA growth of 43 per cent to $259.8 million. The aggregate revenue of the company also improved by 36 per cent from FY18 to $6,439.1 million. The company notified that it completed the acquisition of ECR during the period for a total consideration of US$3.2 billion. The company expects to deliver the benefits of ECR acquisition in FY20.

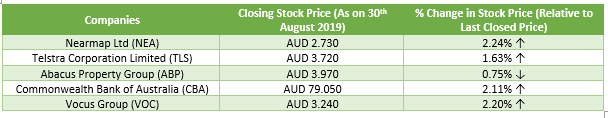

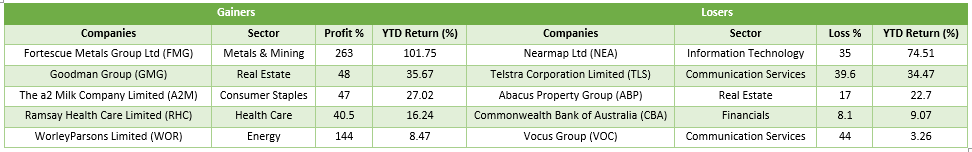

Losers of Reporting Season

Now, let us take a quick look at the financials of the losers of reporting season in some detail below:

Nearmap Ltd

A next-gen digital content leader, Nearmap Ltd (ASX: NEA) released its FY19 financial results on 21st August 2019. The results demonstrated a rise of 35 per cent in its âloss after taxâ from AUD 11.02 million in FY18 to AUD 14.93 million in FY19. The loss delivered by the company was higher than the loss expected by the market analysts. The company also reported a statutory revenue of AUD 77.6 million for the period.

Telstra Corporation Limited

Australia-headquartered telecommunications company, Telstra Corporation Limited (ASX: TLS) published its FY19 results in mid-August. The company mentioned that its total income on a reported and guidance basis declined by 3.6 per cent and 2.6 per cent, respectively. The NPAT of the company observed a fall of 39.6 per cent to $2.1 billion during the period. The disappointing results indicated the companyâs ongoing struggle with the effect of the National Broadband Network.

Abacus Property Group

Australiaâs leading diversified property group, Abacus Property Group (ASX: ABP) reported a fall of 7 per cent in its revenue from $292.3 million in FY18 to $270.4 million in FY19. The Groupâs NPAT also declined by 21 per cent from $246.95 million to $194.4 million. The Groupâs underlying profit observed a fall of 24 per cent to $139.4 million. Weaker residential development results during the period contributed to the Groupâs unsatisfactory financial results.

Commonwealth Bank of Australia

One of Australiaâs big four banks, Commonwealth Bank of Australia (ASX: CBA) recorded a fall of 8.1 per cent and 4.7 per cent in its Statutory NPAT and Cash NPAT, respectively. The revenue of the bank was 3 per cent down on pcp to $24,337 million. The bankâs operating expenses were 13.1 per cent up due to customer remediation costs, risk and compliance increases.

Vocus Group Limited

Australiaâs specialist fibre and network solutions provider, Vocus Group Limited (ASX: VOC) published its FY19 financial results on 22nd August 2019. The company reported a fall of 2 per cent in its underlying EBITDA from AUD 366.7 million in FY18 to AUD 360.1 million in FY19. The underlying NPAT of the company was also 17 per cent down on pcp, to AUD 105.5 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.