Giving shoppers credits to spend online is not a very safe option yet there are some strategies of Buy Now Pay Later (BNPL) mode of operations which are gaining traction. This is more or less like a credit card but is comparatively simple. A few checks are done for a buyer and then the facility is given. These facilities also enable the customers to return the products within a specific time period. Within the same time span, no interest or fees are levied.

What is sounding so good is not that beneficial though. You cannot expect a free lunch Afterall! These easy credit facility results in the shoppers buying more than required and risk their repaying ability. A default on these credit lines serve to lift the interest amount.

Let’s take a look at how BNPL industry is growing and how the stocks are performing!

Afterpay Limited (ASX: APT)

Regulatory Update - California, US: Afterpay Limited (ASX:APT) provides technology-driven payments solutions for consumers and businesses through its Afterpay and Pay Now services and businesses. As on January 03, 2020, the market capitalization of the company stood at $7.98 billion. The company responded to questions on the subject of regulatory and credit licensing arrangements. The company confirmed that the license was issued by DBO in November 2019 and hence it is valid.

Afterpay US - Equity Incentive Plan: The company updated its shareholders with regards to 2018 Equity Incentive Plan of Afterpay US, Inc. Under the Plan, the company’s US subsidiary, Afterpay US, Inc. may offer options which will give a right to acquire common stock to eligible participants. The company confirmed that currently it has a total of 7,788,243 US options on issue.

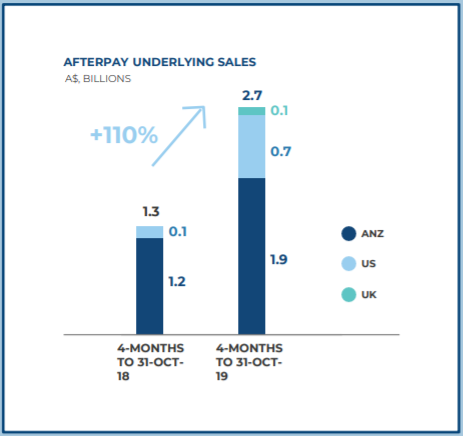

Group YTD Performance: For the 4 months ending 31 October 2019, Underlying sales of the company stood at $2.7 billion, up by 110% on the prior corresponding period. Sales in October 2019 represented a record month of underlying sales with an annualized run rate in excess of $8.5 billion globally.

Underlying Sales (Source: Company Reports)

Stock Performance: The stock of APT closed the day’s trading at $30,270 per share on 3rd January 2020, down by 1.175% from its previous closing price. The total outstanding shares of the company stood at 260.66 million. The stock has given a negative return of 13.38% in the span of 3 months but a positive return of 17.40% in the time period of 6 months.

Zip Co Limited (ASX:Z1P)

Update on Share Purchase Plan: Zip Co Limited (ASX:Z1P) is offering point-of-sale payment and credit solutions to customers. It also provides integrated Retail Financing solutions to merchants across numerous industries. These are both online and in-store. The company has recently announced that SPP (Share Purchase Plan) closed on 20 December 2019. The plan followed the oversubscribed and upsized placement of $60 million to new and existing institutional, sophisticated and professional investors.

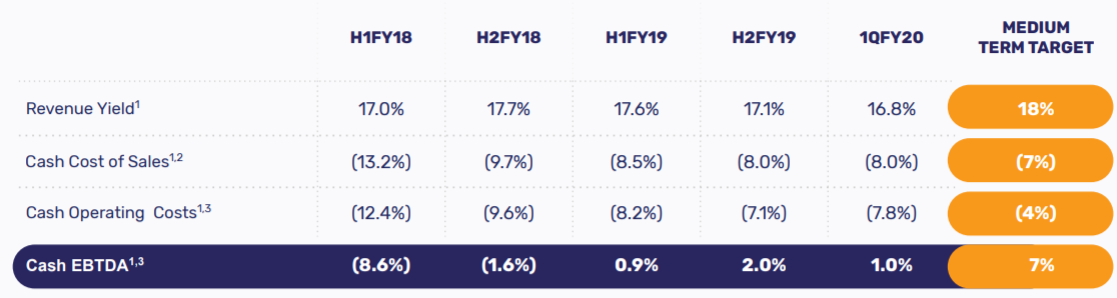

Decent Rise in Receivables: In the recently held Annual General Meeting, the top management of the company addressed its shareholders and stated that the company has a high-quality interest base and has a strong demand for interest free terms of purchases. During the First quarter of FY20, receivables of the company went up to $784 million, up from $683 million in 4Q FY19. The company’s cash cost of sales was almost in line with H219 at stood at 8% in 1QFY20.

FY20 Outlook: In FY20, the company is focusing on 3 core areas involving-Core, product expansion and global expansion. The company also remains confident in its ability to drive growth, achieve targets and expand globally with a deliberate lift, shift and scale strategy.

Stock Performance: The stock of Z1P closed the day’s trading at $3.530 per share on 3rd January 2020, down by 0.282% from its previous closing price. The company has a market capitalization of $1.38 billion as on 3rd January 2020. The total outstanding shares of the company stood at 390.39 million. The stock has given a total return of 13.83% in the span of 6 months.

Flexigroup Limited (ASX:FXL)

Addition of New Customers: Flexigroup Limited (ASX:FXL) is a point of sale lease and rental finance for the IT equipment, electrical appliance and other retail markets. As on 3rd January 2020, the market capitalization of the company stood at $735.54 million. The company has recently announced the pricing of $265 million asset-backed securities. The company has recently added new customers of over 132k to the humm platform and experienced a rise of 35% in the total transactions in comparison to that in the prior corresponding period.

Future Opportunities: The company has experienced significant growth in the past year and has presented three clear propositions that are supported by unique and identifiable brands. Under the BNPL strategy, the company has Humm, which is the only product in its market to extend up to $30k interest free credit.

Stock Performance: The stock of FXL closed the day’s trading at $1.855 per share on 3rd January 2020, down by 0.536% from its previous closing price. The total outstanding shares of the company stood at 394.39 million. The stock has given a total return of 13.03% in the span of 6 months.

Sezzle Inc. (ASX:SZL)

Update on California Financing Law License: Sezzle Inc. (ASX:SZL) is operator of payment platform, the market capitalization of which stood at $294.67 million. The company in response to DBO statement of “illegal unlicensed lending” stated that it does not operate as a lender but under a different financing model as a sales finance company.

Sezzle Inc. reports exceptional Black Friday event: The company has reported a strong Year on Year sales growth and have added 36,000 new Active Customers during the period of Black Friday and Cyber Monday, representing a marked acceleration versus the 8,000 new Active Customers acquired in the corresponding period of previous year. The company also stated that cash payments have witnessed a decline from 39.3% to 36.3%, owing to the declining use of credit cards for online purchases.

Sezzle Secures US$100M Funding Facility: The company has recently announced that it has secured debt funding facility of US$100 million in order to support growth. The company said that it sees substantial growth opportunities in the BNPL sector on the global front including North America and has also executed the New Facility agreement with three U.S. credit providers.

Stock Performance: As per ASX, the stock of SZL gave a negative return of 34.33% in the past 30 days. The stock closed at $1.395, down by 15.71% on January 3, 2020, owing to the recent update concerning Financing Law License.

Splitit Payments Ltd (ASX:SPT)

Strong Black Friday Sales: Splitit Payments Ltd (ASX:SPT) offers a credit card-based instalment resolution to companies and retailers. As on 3 January 2020, the market capitalization of the company stood at $207.17 million. The company has recently announced that it witnessed record underlying sales over Black Friday and Cyber Monday of more than US$3 million. In the same span, the Average Order Value (AOV) went up to US$820, representing a spectacular increase from the company’s YTD AOV of US$644.

In the recently held Annual General Meeting, the top management of the company addressed its shareholders and stated that FY19 was a very strong foundational year for the company and it has witnessed significant growth in Merchants, Customers, Transaction Volume and Merchant Fees.

Stock Performance: The stock of SPT closed the day’s trading at $0.670 per share on 3rd January 2020, up by 0.752% from its previous closing price. The total outstanding shares of the company stood at 311.53 million. The stock has given a total return of 31.68% in the span of 6 months.

Openpay Group Ltd (ASX:OPY)

Openpay Group Ltd (ASX:OPY) provides payments technology that offers a Buy Now, Pay Later suite of products. The company has recently raised $50 million through the fully underwritten issue of new shares totaling 31.25 million at a consideration of $1.60 per share. The proceeds will be used to support the company’s growth strategies, including working capital to achieve the targeted business plans of the company. The company has reported 1,834 Active Merchants on 30 November 2019, up from 1,510 as at 30 June 2019, representing year on year growth to 30 November 2019 of 74.8%.

Stock Performance: The stock of OPY closed the day’s trading at $1.245 per share on 3rd January 2020, up by 0.403% from its previous closing price. As on 3 January 2020, the market capitalization of the company stood at $116.31 million. The total outstanding shares of the company stood at 93.8 million. The stock has given a return of 2.48% in the past 5 days.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.