NEXTDC Limited (ASX:NXT)

NEXTDC Limited (ASX: NXT) is engaged in the development and operation of independent data centres in Australia. The company is involved in enabling business transformation through infrastructure management software, connectivity services and data centre outsourcing solutions.

The company lately announced that it has agreed to a syndicate allocation and received commitment letter to refinance its existing $300 million senior debt facilities and is seeking to raise additional senior unsecured debt as an additional tranche of its existing $200 million Floating Rate Notes IV, due 9th June 2022.

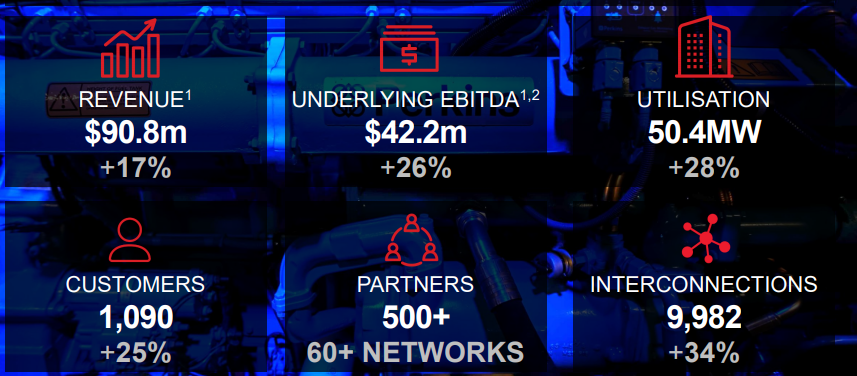

1H19 Highlights (Source: Company Reports)

1H19 Highlights (Source: Company Reports)

The revenue of the company was up by 17% to $90.8 million in H1 FY19 as compared to $77.5 million in H1 FY18, driven by higher contracted utilisation and an increase in the interconnections. The company reported a net loss of $3.1 million in H1 FY19 as compared to the net profit of $8.4 million in H1 FY18, primarily impacted by a significant rise in finance costs. The underlying EBITDA stood at $42.2 million in H1 FY19, up by 26% as compared to $33.6 million in H1 FY18.

On the price-performance front, at market close on May 24, 2019, the stock of NEXTDC Limited was trading at $6.700. The stock has yielded a YTD return of 10.03% and exhibited returns of 16.35%, -7.08% and 7.73% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $8.190 and a 52-week low price at $5.610, with an average trading volume of ~2,128,235.

WiseTech Global Limited (ASX:WTC)

WiseTech Global Limited (ASX: WTC) provides software to the logistics services industry across the globe. The software of WTC is used across 130 countries and helps logistics service providers to smoothen the movement and storage of goods and information domestically and beyond borders.

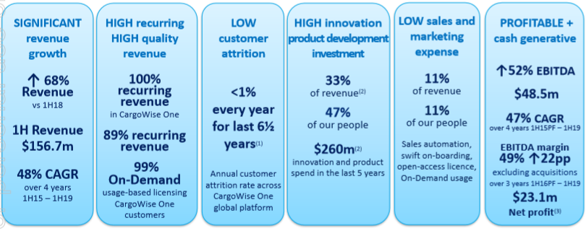

1H19 Financial Highlights (Source: Company Reports)

WiseTech continued to deliver high-quality growth in 1H FY19. WTCâs revenues for the period stood at $156.7 million, an increase of 68% and the EBITDA was up by 52% to $48.5 million, reflecting the strategy of the company to fast-track its global growth and penetration of the industry, driven by the geographic expansion, relentless innovation and deepening product capability. Additionally, WiseTech made 11 strategic acquisitions in key geographic locations to add to the innovation pipeline to grow at a global scale.

WTC is primarily focused on innovation during the period and intended to maximise the opportunities available from building out its global platform so that it can access new addressable markets.

On the price-performance front, at market close on May 24, 2019, the stock of WiseTech Global Limited was trading at $22.630. The stock has yielded a YTD return of 36.82% and exhibited returns of 45.72%, 22.31% and 9.18% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $25.00 and the 52-week low price at $13.655, with an average trading volume of ~925,059.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.