Metals and Mining Sector

Australian region generates approximately 19 useful minerals from 350 mines. Australia is one of the major producers of gold, bauxite, lead, diamond, lithium and such. Metals

and mining sector has added approximately $148 billion to Australia’s economic growth. The metals and mining sector has generated thousands of job in Australia and has a bunch of opportunities to exploit over the forthcoming years to meet the growing and changing expectations of the market.

On 30 December 2019, S&P/ASX 300 Metals and Mining sector last traded at 4537.3 points, with a fall of 0.41 per cent compared to the last close. Also, S&P/ASX 200 index last traded at 6,804.9 points, with a decline of 0.2 per cent from its previous close.

Let us have a look at the three stocks from the Metals and Mining sector and their recent updates.

AuStar Gold Limited (ASX: AUL)

AuStar Gold Limited is engaged with the gold production. The main purpose of the company is to generate sustainable gold production from its high-grade gold projects. The company’s vision is to turn into a mid-tier gold producer in Australia.

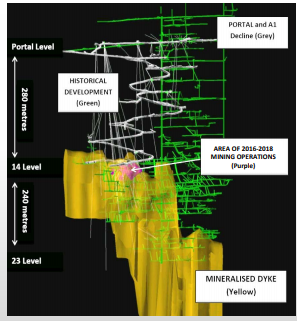

Company Presentation

On 24 December 2019, the company released the presentation showing their recent updates in the last quarter. A few highlights from the presentation are as follows:

Ø The company has approved the acquisition of Centennial Mining, which offers a wealth of opportunities in the highly prospective Victorian goldfields.

Ø AuStar continued mining of high-grade ore sourced from the A1 and Morning Star Gold Mine.

Ø The company has two fully permitted and operational Gold Processing Facilities:

· Morning Star Mill

· Porcupine Flat Mill

Ø The A1 Gold Mine has historically produced in excess of 660koz, and Maldon Goldfield’s historical production was 1.47M oz.

Source: Company’s Report

AuStar Appoints Company Secretary

On 18 December 2019, the company announced the appointment of Sue-Ann Higgins as Company Secretary. Ms Higgins is an experienced legal practitioner and director with diversified skills and corporate experience from over 25 years as an in-house counsel and legal consultant.

The company’s board also announced the resignation of Mr Stephen Kelly as Company Secretary. AuStar’s board thanked Mr Kelly for his service and contribution during the year and wished him well for his future endeavours.

Notice of Annual General Meeting

On 13 December 2019, the company released a notice for Annual General Meeting of shareholders to be held on 13 January 2020. The resolutions mentioned below to be considered during the meeting are as follows:

Ø Resolution 1 - Approval to issue Shares and Options to Amery Partners Pty Ltd

Ø Resolution 2 - Approval to issue Shares and Options to McNally Clan Super

Ø Resolution 3 - Approval to issue Shares and Options to M&C Gill SMSF

Ø Resolution 4 - Ratification of prior agreement to issue Placement Shares

Ø Resolution 5 - Approval to issue Placement Options

Ø Resolution 6 - Approval to issue underwriter Options

Ø Resolution 7 - Approval to issue Shares and Options to Avior Consulting

Ø Resolution 8 - Approval to issue Shares and Options to Gandel Metals

Ø Resolution 9 - Approval to issue Additional Consideration Shares to Centennial Vendors

Ø Resolution 10 - Amendment to the Constitution

Stock Performance of Austar Gold Limited

The stock of AUL settled at $0.325 on ASX, as on 30 December 2019, rise by 8.333 per cent from its previous close. The company has approximately 33.9 million outstanding shares and a market cap of $10.17 million. AUL’s 52 weeks low and high value of the stock is at $0.500 and $0.200, respectively. The stock has generated a negative return of 25.0 per cent in the last six months and a negative return of 25.0 per cent on year to date basis.

Venus Metals Corporation Limited (ASX:VMC)

Venus Metals Corporation Limited is a metals and mining company. The company is engaged in the exploration activities of its diverse portfolio of projects focussed on vanadium, gold and base metals.

Rox Resources and Venus Metals Confirm New Zone of Mineralisation

On 24 December 2019, Rox Resources Limited (ASX: RXL) and Venus Metals Corporation Limited announced the new zone of mineralisation. The joint venture has shown an exceptionally high-grade result. The company conducted the drilling campaign at the OYG JV, a part of the broader Youanmi Gold Project.

The Joint Venture recently conducted a series of RC holes to the north drill hole MLRC020 to test the continuity of new zone of mineralisation intersected in that hole (as announced on 19 November 2019).

Both the companies were highly encouraged by the tenor of these intercepts and the JV will be undertaking follow on drilling during CY2020 period.

Change of Interest of Substantial Holder

On 10 December 2019, the company notified on the changed of interests of substantial holder - Christopher Ian Wallin with effect from 9 December 2019. The number of shares held by the substantial holder after the change was 26,064,128 person’s votes or 17.25 per cent of the voting power.

Stock Performance of Venus Meta Corporation Limited

The stock of VMC settled at $0.185 on ASX on 30 December 2019, falling by 2.632 per cent from its previous close. The company has approximately 151.08 million outstanding shares and a market cap of $28.7 million. VMC stock’s 52 weeks low and high value was at $0.110 and $0.280, respectively. The stock has generated a positive return of 35.71 per cent in the last six months and a positive return of 11.76 per cent on year to date basis.

Rox Resources Limited (ASX: RXL)

Rox Resources Limited is an ASX listed metals and mining company. The company is engaged with the exploration of gold and nickel projects in Australia.

Change of Director’s Interest

On 16 December 2019, the company announced the change in one of its directors’ interest- Mr Alexander Passmore with effect from 12 December 2019. The number of securities held of the director after the change was 32,000,000 – fully paid shares, 20,000,000 options exercisable at $0.015, expires 31 January 2022 and 40,000,000 options exercisable at $0.033 (expiring on 30 November 2022).

Results of Annual General Meeting

The company released the results for Annual General Meeting of shareholders, which was held on 26 November 2019. The resolutions mentioned below were considered during the meeting and are as follows:

Ø Resolution 1 - Adoption of Remuneration Report

Ø Resolution 2 - Re-election of Mr Stephen Dennis as a Director

Ø Resolution 3 - Election of Dr John Mair as a Director

Ø Resolution 4 - Ratification of prior issue - 25,000,000 Shares

Ø Resolution 5 - Ratification of prior issue - 7,500,000 Shares

Ø Resolution 6 - Ratification of prior issue - 166,666,667 Share

Ø Resolution 7 - Approval of Additional 10 per cent Placement Capacity

Ø Resolution 8 - Adoption of Employee Share Option Plan

Ø Resolution 9 - Approve issue Options - Mr Alex Passmore

Ø Resolution 10 - Approve issue Options - Mr Brett Dickson

Ø Resolution 11 - Approve issue Options - Mr Stephen Dennis

Ø Resolution 12 - Approve issue Options - Dr John Mair

Ø Resolution 13 - Appointment of Auditor

Stock Performance of Rox Resources Limited

The stock of RXL settled at $0.027 on ASX on 30 December 2019, rising by 8 per cent from its previous close. The company has approximately 1.46 billion outstanding shares and a market cap of $36.45 million. RXL’s 52 weeks low and high value of the stock is at $0.007 and $0.035, respectively. The stock has generated a positive return of 78.57 per cent in the last six months and a positive return of 212.50 per cent on year to date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.