Utility industry in Australia is an essential part of the Australian economy, and utility sector in Australia basically made up of five following industries;

- Electric utilities industry- Electric utility industry comprises of electricity generator, retailer and metering providers.

- Gas utilities industry- This industry includes transmission of gas, storage, processing, compression and gas-powered generation companies.

- Multi-utilities industry- Multi-utility industry includes companies providing a broad range of utility services.

- Water utilities industry- In this industry, the companies are involved in water supply and water & wastewater technology.

- Independent power and renewable energy producers industry- Energy industry comprises of independent companies that are involved in the generation of energy through renewable and non-renewable sources.

Energy industry in Australia-

The Energy industry in Australia is an essential part of the Australian economy, and is accountable for activities concerning the production, distribution and supply of electricity and gas to end-users in the country.

There are various responsibilities for a person who is working in the energy industry, which are laying pipes and maintaining water infrastructure to reading meters as well as providing customer service. The work of energy industry workers could be categorised in three major categories- Generation, transmission and distribution of energy, Natural gas distribution and Water, sewerage and other systems.

As per the growing demand, many specialists in the energy industry are engaged in efforts for creating cheaper and more sustainable sources of energy, water and gas.

In this article, we are highlighting five ASX listed utility stocks which are engaged in the production of energy-

Infigen Energy Ltd (ASX:IFN)

A largest ASX listed owner of wind power generators Infigen Energy Ltd (ASX:IFN) is engaged in providing energy solutions to large retailers and Australian businesses. The company is a licensed energy retailer and have installed capacity of 557 megawatts, in addition to 113 megawatts which is under construction in NSW. Infigen provides clean energy from a combination of renewable energy generation and firming solutions available from the wide energy market to Australian business customers.

Distribution for first half FY2020-

On 16 December 2019, Infigen announced that the company would pay a distribution of 1 cent per stapled security for the half year ending 31 December 2019 and for security holders a distribution reinvestment plan would be available. The valuing of stapled securities assigned under the Distribution Reinvestment Plan would be a discount of 2 per cent to the average of the daily weighted average price of stapled securities during the 10 trading days ending 3 days before the allotment date of distribution reinvestment plan. The notification regarding the participation in a distribution reinvestment plan (DRP) must be received by the companyâs security registry, Link Market Services, by 2 January 2020.

Stock Performance-

IFNâs stock settled the dayâs trade at $0.620 on 16 December 2019. The stock has a market cap of approximately $596.53 million with 962.15 million outstanding shares on ASX. IFNâs stock has delivered a positive return of 40.91% on year to date basis.

Genesis Energy Limited (ASX:GNE)

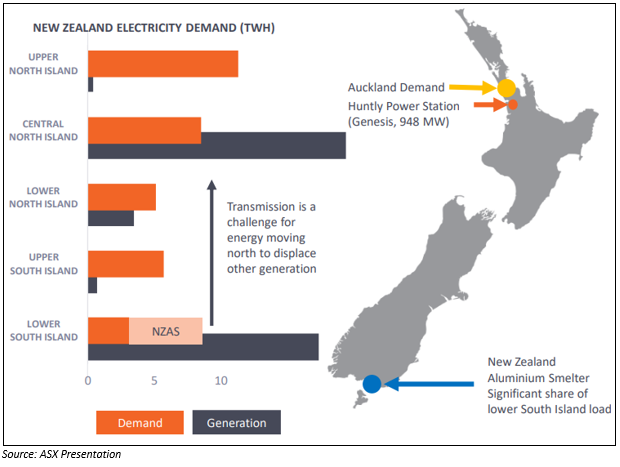

A dual listed energy company Genesis Energy Limited (ASX:GNE) is engaged in selling electricity, LPG and reticulated natural gas through its retail brands of Genesis Energy and Energy Online. The company is largest energy retailer of New Zealand with nearly 500k customers. Genesis Energy produces electricity from a varied portfolio of thermal and renewable generation assets located in various regions of the country.

Investor presentation

The company updated the market with its investorâs presentation on ASX in November. The quick highlights from investors presentation are-

- New Zealand Aluminium Smelter (NZAS) has announced a strategic review. In October 2019, the company initiated a Strategic review in order to determine the ongoing feasibility of the operation. The essential points relevant to the review are-

- The outcomes to be announced by the end of the first quarter of the fiscal year 2020.

- A twelve monthsâ notice period for cessation of electricity supply contract of Meridian.

- Approximately NZ$260 million in closure costs.

- The effect of New Zealand Aluminium Smelter exit on Genesis is anticipated to be limited. Net short generation position in South Island benefits from lower prices while a variable portfolio in the north offers opportunities to adjust in response to market changes.

Stock Performance-

GNEâs stock settled the day at $2.83 on 16 December 2019, down by 0.702% from its previous close. The stock has a market cap of approximately $2.93 billion, with 1.03 billion outstanding shares on ASX. GNEâs stock has delivered a positive return of 16.33% on year to date basis.

Tilt Renewables Limited (ASX:TLT)

An ASX listed energy industry player Tilt Renewables Limited (ASX:TLT) has an aim to become a leader as well as owner and manager of renewable energy generation assets in Australia and New Zealand. In Australia, some major assets of the company are Blayney Wind Farm in NSW, Tararua Wind Farm in Manawatu, Snowtown Wind Farm in South Australia and more.

Sale of Snowtown 2 Wind Farm-

On 5 December 2019, Tilt Renewables announced that the company has entered in an agreement which is in relation to selling the 270-megawatt Snowtown 2 wind farm to an entity wholly owned by funds managed by Palisade Investment Partners Limited and First State Super, for an enterprise price of approximately $1,073 million.

This transaction would take place via the sale of shares in Snowtown 2 Wind Farm Holdings Pty Ltd for nearly $472 million, and the transaction is expected to close before the end of 2019. Snowtown 2 Wind Farm Holdings is being sold with Snowtown 2âs existing project finance facility, which has an anticipated balance of approximately $611 million at the closing of the transaction.

Stock Performance-

TLTâs stock settled the day at $3.10 on 16 December 2019 with a market cap of approximately $1.46 billion. The stock has nearly 470.06 million outstanding shares on ASX. TLTâs stock has delivered a positive return of 56.78 % on YTD basis.

New Energy Solar (ASX:NEW)

New South Wales headquartered company New Energy Solar (ASX:NEW) is focused on renewable energy and acquires large-scale solar power plants for generating attractive returns from the generation of renewable energy sold under long-term agreements. The company might invest in other renewable energy assets which include geothermal, hybrid solutions, wind and other associated investments like battery and other storage, smart metering and other potential future technologies.

In an announcement dated 16 December 2019, New Energy Solar announced that its weekly estimated unaudited net asset value as at 13 December 2019 was approximately $1.57 per stapled security. The applicable AUD: USD foreign exchange rate applied for calculation of the estimated unaudited net asset value as at 13 December was 0.6876.

In addition, the company also notified that this would be the final weekly net tangible asset (NTA) estimate for the CY2019. The next weekly net tangible asset estimate would be published on Monday 6 January 2020.

Stock Information-

NEWâs stock settled the day at $1.310 on 16 December 2019, up by 3.15% from its previous close. The stock has a market capitalisation of nearly $445.85 million, with approximately 351.06 million outstanding shares on ASX.

Energy World Corporation Ltd (ASX:EWC)

A utility sector player Energy World Corporation Ltd (ASX:EWC) is engaged in the manufacturing and distribution of liquefied natural gas (LNG) and independent power projects development. The company operates in three countries- Australia, the Philippines and Indonesia.

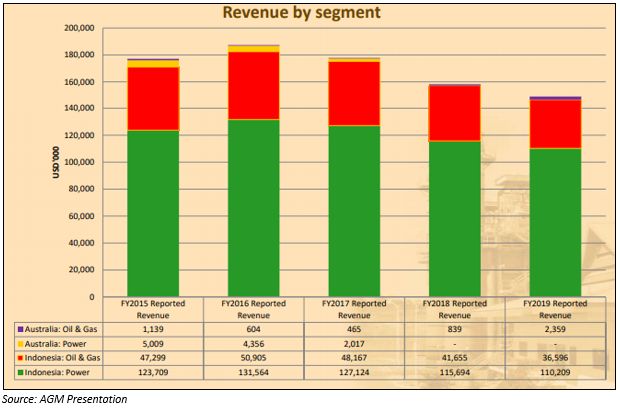

2019 AGM Presentation Highlights- The company updated the market with its AGM presentation on ASX. The quick highlights are-

- Energy World Corporation continued its robust financial support advancing a further US$17 million of operating capital facilities during the year. The company also decided to extend the maturity date of its existing US$45 million in loan funds to 1 January 2022.

- The EPC contractor of EWC contracts- Slipform Engineering International Ltd and PT Slipform Indonesia, have concurrently agreed to defer repayment of the loan with first instalments not due until 1 January 2022.

Stock Information-

EWCâs stock settled the day at $0.075 on 16 December 2019, up by 2.74% from its previous close. The stock has a market capitalisation of nearly $131.08 million, with approximately 1.8 billion outstanding shares on ASX.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.