Diversification

Investing across multiple asset classes, sectors and geographies help an investor to manage their risks effectively. It supports in narrowing down an array of results between anticipated and the best return from an investment. It also aids in decreasing the reliance on any one investment. Diversified stocks are the combination of stocks, resulting as fixed income assets, containing different types of commodities. A typical diversified portfolio of investors may help them to yield a higher return with the least amount of risk.

In this article, the six stocks under discussion operates in various sectors. Letâs go through the recent updates on each one of them.

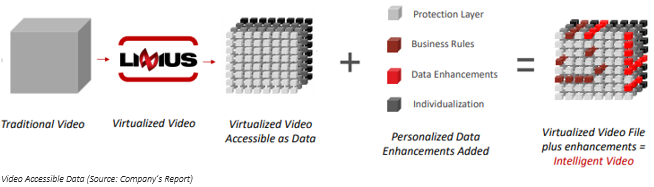

Linius Technologies Limited

Linius Technologies Limited (ASX: LNU) is an Australian-based, information technology player, which has developed a proprietary Video Virtualization Engine⢠(VVE), which is available on IBM Cloud, Microsoft Azure, and Amazon Web Services.

Options Expiry Notice

On 24 September 2019, the company declared that the options expiry notice had been sent to holders of a listed options exercisable at $0.16 each, related to their expiry date on 30 September 2019.

LNU Raised 4.5 Million

On 23 September 2019, the company notified the market that it had received commitments from sophisticated and professional investors to raise $4.5 million Placement.

The Placement comprises of $300,000 investment from Linius directors which is subject to shareholder approval. The placement will result in the issue of 136,363,60 fully paid ordinary shares at $0.033 per share to raise $4.5 million.

The company has decided to use the proceeds of the Placement to fund the continuous operations and deliver the companyâs vision of making all the worldâs video accessible as data.

The companyâs full year report for the year ending 30 June 2019 results can be accessed here.

Stock Performance

The stock of LNU was trading flat at $0.035 on ASX on 30 September 2019 (AEST 2:48 PM. The company has a market cap of $36.46 million and approx. $01.04 billion shares outstanding. The 52-week high and low of the stock was noted at $0.078 and $0.026, respectively. The LNU stock has given a negative return of 5.41 per cent in the last six months timeframe and a negative return of 32.69 per cent in YTD period.

Anteo Diagnostics Limited

Anteo Diagnostics Limited (ASX: ADO) is a nano technology company, engaged in the development and commercialisation of medical products, battery, energy, and material composites. It holds Intellectual Property in AnteoReleaseTM, AnteoCoatTM, AnteoBindTM , the companyâs 3 principal technology product group.

Axxin Collaboration

On 25 September 2019, the company announced the collaboration (non-binding) with Axxin, which leads in commercialising diagnostic delivery systems space.

The collaboration is expected to open up the prospects for Anteo and Axxin and their respective consumers. Anteo and Axxin are based in Australia and have a set of products that provide direct and uncompromised synergy with the companyâs PoC strategy.

Under the collaboration, the Axxin will provide its latest Gen 3 readers to Anteo, which will develop model assay using AnteoBind TM.

Financial Highlights for the year ending 30 June 2019

On 27 August 2019, the company has announced the financial result for FY 2019 for the period closed 30 June this year, a few points from the results are as follow:

- Sales revenue of the company was decreased by 72 per cent to $150,243 over the previous corresponding period.

- The loss before income tax for the period was decreased by 3 per cent to $3,296,840.

- Cash and cash equivalents of the company stood at $4,276,118.

- Net Assets of the company increased to $4,235,131.

Stock Performance

The stock of ADO was trading flat at $0.014 on ASX on 25 September 2019 (AEST 01:10 PM. ADO has a market cap of $20.92 million and approx. $01.49 billion shares outstanding. The 52 weeks high and low of the ADO stock was recorded at $0.023 and $0.011, respectively. The stock has generated a negative return of 18.61 per cent in the last six months and a negative return of 18.61 per cent on a year-to-date basis.

ApplyDirect Limited

ApplyDirect Limited (ASX: AD1) offers an online database platform that connects job seekers and employees.

ApplyDirect secures contract with Environment Protection Authority

On 25 September 2019, the company was pleased to announce that it had obtained at contract with the Environment Protection Authority Victoria (EPA). The services to be supplied as per the contract is for the integration of the EPAâs new human resource management system with the jobs portal Careers.Vic which is powered by ApplyDirectâs software. After inking of the contract, the company has a significant coverage of individual departments consisting of VicRoads, Department of Education, Development Victoria etc.

iGENO signed USS

On 17 September 2019, the company made an announcement that its fully owned subsidiary Utility Software Services (USS) had signed an agreement with iGENO â an embedded networks operator, with managed services solution for its customer service operations including the use of its SaaS platform.

Financial Highlights for the year ending 30 June 2019

On 30 August 2019, the company has announced the full year result for FY 2019, highlights from the same are as follows:

- Revenue from ordinary activities increased to 12.01 per cent to $2,421,110 compared to the previous yearâs corresponding period.

- Net loss attributable to members decreased by 7.71 per cent to $4,382,111.

- No dividend had been declared by the company.

- Cash and cash equivalents of the company stood at $838,987.

Stock Performance

The stock of AD1 was trading at $0.017 on ASX on 30 September 2019 (AEST 3:42 PM). AD1 has a market cap of $8.77 million and ~$548.06 mn shares outstanding. The 52-week high of AD1 stock was noted is $0.045. AD1 stock has provided a positive return of 23.08% in the past 6 months period, however, its YTD return stands at -34.62%.

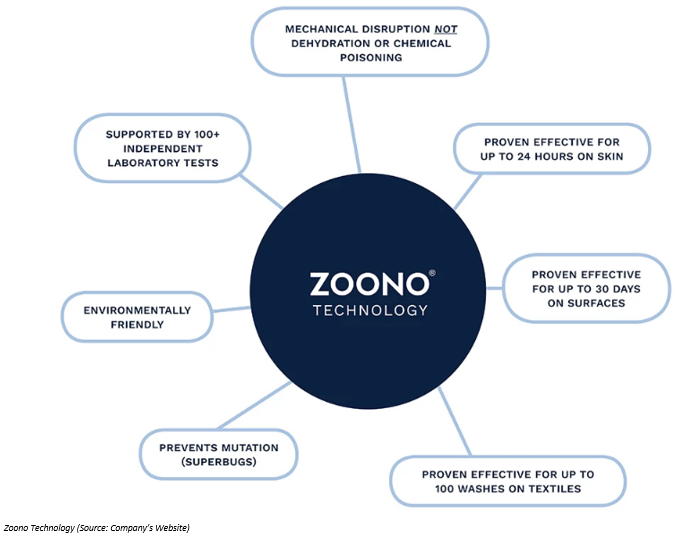

Zoono Group Limited

Zoono Group Limited (ASX: ZNO) deals in the development and global distribution of a unique range of antimicrobial solutions that are long-lasting and environmentally friendly. The company operates globally in ~42 countries and territories.

Signed China Distribution Agreement

The company has signed an agreement in China. The agreement is inked with Guangzhou Sanchengyun for selling the Zoono branded goods online in China region. The agreement is exclusively made for the online market in China.

Also, this deal is for the first five years period. The minimum yearly performance volumes consist of NZ$900,000 for the first year from the date of begninning, NZ$1.2 million for second year, NZ$1.6 million for third and subsequently, minimum sales requirement will rise by 10 per cent every year.

Financial Highlights for the year ending 30 June 2019

On 19 August 2019, the company has announced the results for FY 2019 closing 30 June this year, a few pointers from the results are as follows:

- Revenue from ordinary activities was decreased to 27 per cent to NZ$1,777,556 compared to the previous yearâs corresponding period.

- Net loss attributable to the owners decreased by 3,135 per cent to NZ$2,418,984.

- No dividend had been declared by the company.

- Cash and cash equivalents of the company stood at NZ$3,125,328.

Stock Performance

The stock of ZNO was trading higher at $0.090 on ASX on 30 September 2019 (AEST 3:59 PM). ZNOâs market cap stands at $13.23 million, with ~$163.31 mn outstanding shares. The 52-week high and low of the stock was noted at $0.220 and $0.063, respectively. The stock has generated a negative return of 10 per cent in the last six months and a negative return of 6.90 per cent on a year-to-date basis.

Esports Mogul Limited

Esports Mogul Limited (ASX: ESH) is listed on Australian securities exchange, and operates the gaming platform. The company functions through its platform esports fan to compete and organise tournaments. Also, Esports Mogul serves global consumers.

Mogul Partnered with Wizards of the coast

On 25 September 2019, the company announced a partnership with Wizards of the Coast. Through the partnership, both Mogul and Wizards are launching the MTG Arena Mogul Championship, which would begin from 7 October this year. The championship is open for an invitation of any player from Australia and New Zealand regions to participate for a reward pool of $50,000.

First Branded league Hosted on Mogul

On 10 September 2019, the company announced to host Alliance League DOTA 2, and it was to start in Southeast Asia and Europe from 13 September 2019. It is the foremost Branded League to be presented by the platform of Mogul.

Stock Performance

The stock of ESH last traded at $0.013 on ASX on 30 September 2019. ESH has a market cap of $19.57 mn and ~$1.63 billion shares outstanding. The 52-week high and low price is 0.029 and 0.010, respectively. In the last 12 months timeframe, ESH stock has given a return of 47.83 percent.

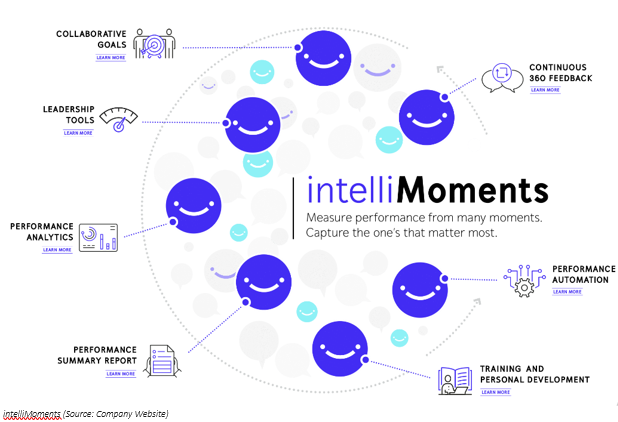

intelliHR Limited

intelliHR Limited (ASX: IHR) is a cloud-based people management and intuitive data analytics software.

Live in the Xero app marketplace

On 25 September 2019, the company announced that the IntelliHRâs payroll onboarding app was live in the Xero app marketplace, with access to Xeroâs Australian consumers. The integration in the Xero App marketplace leverages intelliHRâs new hire onboarding automation capabilities by adding new employee self-service functionality for Xero Payroll.

New Directorâs Appointment

On 9 September 2019, the company notified on the board appointment of Alan Bignell as a Non-Executive Director. He played an important role in developing simPRO and has been the its COO and CFO reporting to the Chief Executive Officer.

Stock Performance

The stock of IHR last quoted at $0.088 on 30 September 2019, up by 3.529 percent from the prior closing price. IHR has a market cap standing at $13.21 million and ~155.41 million shares outstanding. The 52-week high and low price is 0.205 and 0.050, respectively. IHR stock has given a return of -43.33 per cent in the last six months timeframe.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.