When it comes to making investments, ânever put all your eggs in a single basketâ, which means that do not invest your whole money in a single basket. In order to hedge risk and speculation of market, diversification of portfolio is a necessity.

Let us have a deep look at 5 diversified stocks with their recent updates.

Qube Holdings Limited

Qube Holdings Limited (ASX: QUB) provides comprehensive logistics solutions across several aspects of the import-export (IE) supply chain. The company recently announced the appointment of Mr Stephen Mann as a non-executive director, effective from 1st September 2019. Mr Stephen holds experience in handling extensive strategy, transformation and business development projects across various industries as well as geographies.

FY19 Results:

During the financial year ended 30 June 2019, QUB achieved solid earnings growth, backed by strong market positions as well as diversification strategy. With the completion or roll out of acquisitions and growth capex during FY19, the company expects further diversification and support to its future earnings growth.

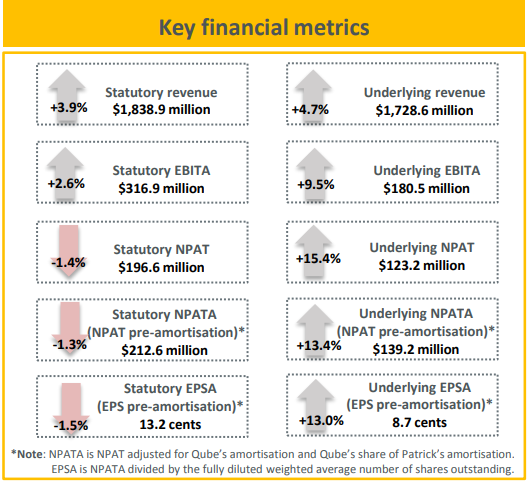

Its statutory and underlying revenue amounted to $ 1,838.9 million and $ 1,728.6 million during FY19, reflecting a rise of 3.9% and 4.7%, respectively, when compared with the same period a year ago. Meanwhile, statutory EBITA and underlying EBITA grew 2.6% and 9.5% to $ 316.9 million and $ 180.5 million, respectively.

Source: Companyâs Report

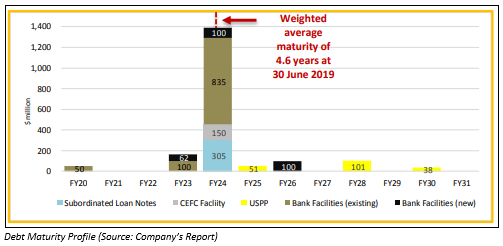

The net assets attributable to Qube stood at $ 2,814.6 million with net debt amounted to $ 1,356.4 million and a leverage ratio of 32.5%. The company further reported $ 537.1 million in cash and undrawn debt facilities.

For FY19, the company unveiled total dividend of 6.7 cents, including the special interim dividend amounting to 1.0 cent per share paid in April 2019. Its final fully franked ordinary dividend for the period witnessed an increase of 3.6% to 2.9 cps.

FY20 Outlook:

During the financial year 2020, QUB is expecting broadly similar economic and competitive conditions to FY19. The company is hoping to witness subdued trends in the volume of containers, grains, vehicles and general cargoes in FY20. Moreover, bulk commodities, forestry products, oil & gas related activities and other important markets of the company are unlikely to observe a significant change in conditions.

Additionally, the company expects to register solid increase in underlying net profit after tax (before amortisation) and improvement in underlying earnings per share (before amortisation) during FY20; however, this guidance depends on no material adverse change in economic or market conditions.

Stock Performance:

The stock of Qube Holdings Limited closed the dayâs trading at A$ 3.270 per share on 23 August 2019, up 2.83% from its previous close. It has a market cap of A$ 5.11 billion and approximately 1.61 billion outstanding shares, with an annual dividend yield of 1.79% and a PE multiple of 23.56x. In the last three months and six months, the stock has delivered returns of 12.77% and 11.60%, respectively, while YTD return stands at 27.16%.

Reece Limited

Reece Limited (ASX: REH) is engaged into supplying plumbing and bathroom products with operations in Australia and New Zealand (ANZ). According to a company announcement, Perpetual Limited and its related bodies corporate have ceased to become a substantial holder in the company from 4th March 2019.

FY19 Half Year Results:

In 1H FY19, the company reported normalised EBITDA amounting to A$ 260 million as compared to A$ 179 million, reflecting a rise of 45% year-on-year. The company witnessed a fall of 8% in net profit after tax, owing to one off acquisition costs. Its sales revenue for 1H FY19 stood at A$ 2,718 million, reflecting a rise of 104% year-on-year.

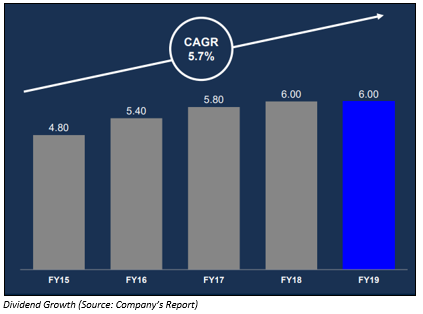

In the first half of FY19, the company declared an interim dividend amounting to 6 cps, fully franked, which was paid to shareholders on 28th March 2019. The dividend of the company witnessed a CAGR of 5.7% in the time frame of the financial year 2015 to the first half of the financial year 2019.

Stock Performance:

The stock of Reece Limited closed the dayâs traded at A$ 10.250 per share on 23 August 2019, up 0.196% from its previous close. In the last three months and six months, the stock has delivered negative returns of 1.54% and 1.73%, respectively. It also produced negative returns of 2.39% in the time period of one month. REH has a market cap of $ 5.74 billion and approximately 560.82 million outstanding shares.

Atlas Arteria

Atlas Arteria (ASX: ALX) makes investments into infrastructure assets in the Organisation for Economic Co-Operation and Development and its equivalent countries. On 16 August 2019, the company announced that Graeme Bevans, Director of Atlas Arteria Limited, has made a change to his holdings in the company by acquiring 76,214 fully paid ordinary stapled securities on 16 August 2019.

Moreover, Yarra Funds Management Limited; Yarra Capital Management Holdings Pty Ltd; Yarra Management Nominees Pty Ltd; AA Australia Finco Pty Ltd; TA SP Australia Topco Pty Ltd; TA Universal Investment Holdings Ltd have become an initial substantial holder in the company, with a voting power of 5.8285% on 7th Aug 2019.

ALX is scheduled to release its financial results for the half year ended 30th June 2019 on 29th August 2019.

Q219 Toll Revenue and Traffic Statistics

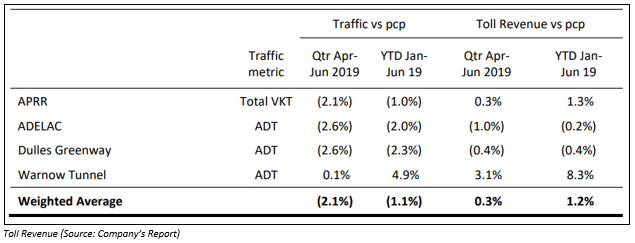

Atlas Arteria updated the market with Q2 toll revenue and traffic statistics via a release dated 24th July 2019. It stated that the weighted average traffic for Q2 2019 was 2.1% lower in comparison to Q2 2018. The following picture provides a broader overview of toll revenue and statistics:

Stock Performance:

The stock of Atlas Arteria closed the dayâs trading at A$ 8.140 per share on 23 August 2019, up 1.37% from its previous closing price. It has a market cap of $ 5.49 billion and approximately 683.37 million outstanding shares with an annual dividend yield of 3.36% and a PE multiple of 90.84x. In the last three months and six months, the stock has witnessed a rise of 10.76% and 11.07%, respectively. It also produced returns of 2.03% in the time period of one month.

Downer EDI Limited

Downer EDI Limited (ASX: DOW) is into designing, building and sustaining assets. The company is a leading provider of integrated services in ANZ. On 23 August 2019, the company updated the market about its selection as the preferred contractor for providing overhaul and capital works services at the Callide and Kogan Creek power stations of CS Energy in Queensland. The contract is for a five-year period.

FY19 Results:

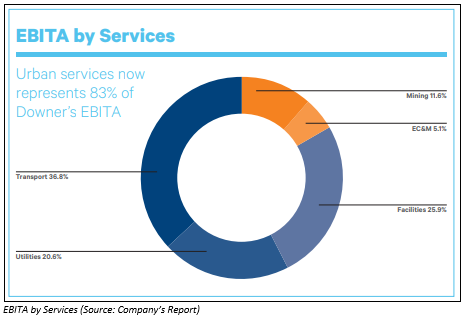

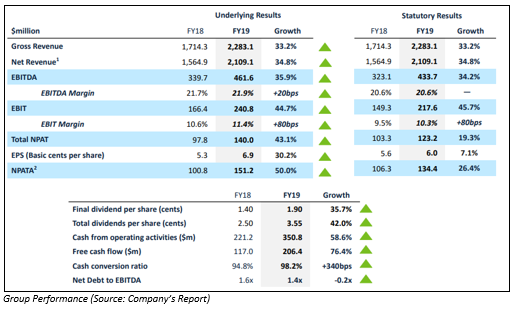

On 22 August 2019, DOW released results for the year ended 30 June 2019, unveiling good revenue growth, improved group margin and strong increase in earnings. Its statutory NPATA grew to $ 325.6 million from $ 117.9 million, while underlying NPATA stood at $ 340.1 million in FY19, reflecting a rise of 14.7% on prior corresponding period. The company posted operating cash flow of $ 630.2 million, up 8.0% year-on-year.

The company unveiled dividend per share of 14.0 cents per share, with a franked amount per share of 7.0 cents. Record date of the dividend is 4 September 2019 and payable date of 2 October 2019.

In other update, Downer EDI announced that Grant Anthony Fenn has made a change to his holdings in the company by acquiring 418,015 shares, which were allocated after provisionally qualified performance rights granted under the 2016 LTI plan met the remaining conditions and vested as well as disposing 418,015 performance rights vested which were exercised to 418,015 ordinary shares on 16th August 2019. Previously, Chorus Limited had selected the company for a field services agreement.

Stock Performance:

The stock of Downer EDI Limited settled at a price of A$ 7.890 per share on 23 August 2019, up 2.868% from previous closing price. The market cap of DOW stands at A$ 4.56 billion with approximately 594.7 million outstanding shares and an annual dividend yield of 3.65%. In the last three months and six months, the stock has witnessed returns of -3.40% and 6.38%, respectively.

Cleanaway Waste Management Limited

Cleanaway Waste Management Limited (ASX: CWY) is into collection services for all types of solid waste streams, which include general waste. The company has recently announced that it has acquired the senior secured debt amounting to around $ 60 million from Commonwealth Bank of Australia (ASX: CBA) in the SKM Recycling group. It added that the debt is secured against all assets of the SKM Recycling group excluding its Glass Recovery Services business.

FY19 Full Year Results:

CWY released its full year results for the financial year 2019 on 15 August 2019, reporting total recordable injury frequency rate of 5.7 in FY19 as compared to 6.2 in FY18. The company witnessed a rise of 58.6% in net cash from operating activities as compared to previous corresponding period, while cash conversion ratio for FY19 stood at 98.2% and free cash flow grew 76.4% year-on-year to $ 206.4 million. Cash capital expenditure of the company stood at $ 192.5 million in FY19 and finance leasing utilised amounted to $ 47.9 million for government related contracts in FY19.

Stock Performance:

The stock of Cleanaway Waste Management Limited closed trading at A$ 2.060 per share on 23 August 2019, down 0.483% from its pervious close. In the last three months and six months, the stock delivered negative returns of 7.59% and -0.96%, respectively. The stock has a market cap of A$ 4.23 billion and approx. 2.05 billion outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.